Kim & Crypto review

Introduction to Kim & Crypto

Kim & Crypto is a prominent crypto asset signal provider renowned for its substantial following on its Telegram channel. The name alone may lead some to assume that it represents a female-led initiative, which is a rarity in the predominantly male-dominated landscape of cryptocurrency trading. This intriguing aspect piques curiosity about the platform's offerings and outcomes in the vibrant world of digital assets. Let's take a closer look at what sets Kim & Crypto apart and explore the potential implications of its unique perspective within the industry.

Kim & Crypto's Website

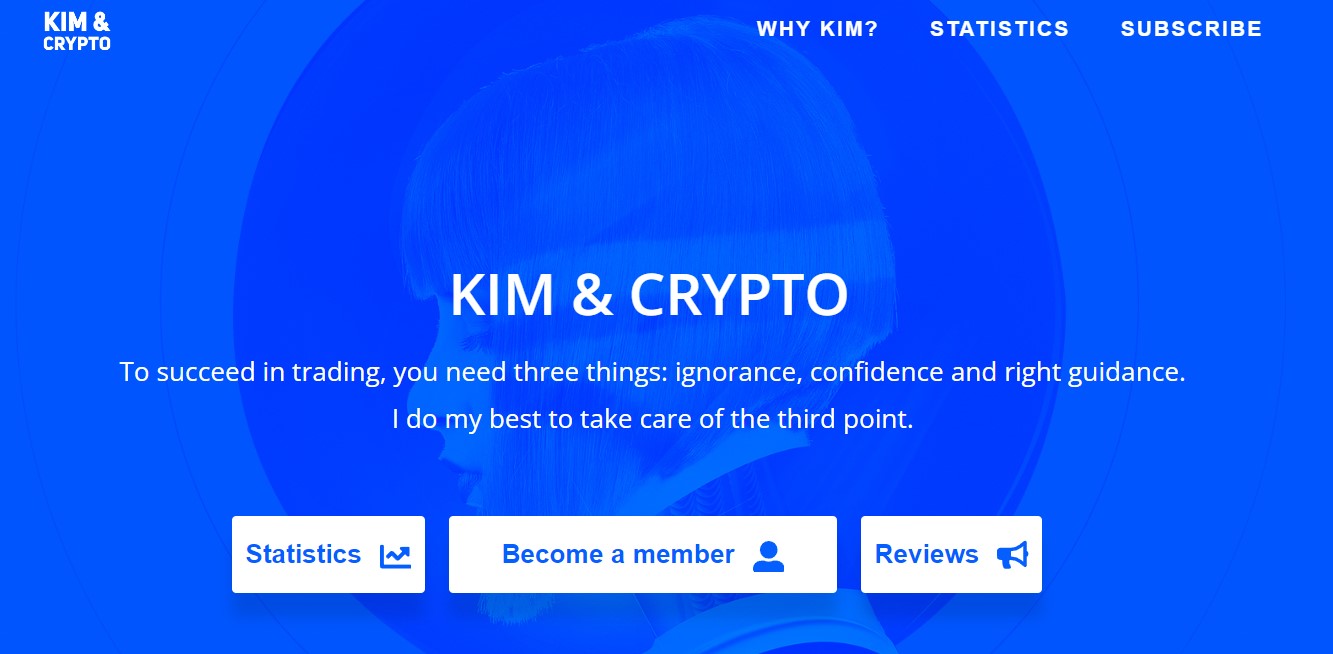

The provider’s website boasts a polished and professional appearance, instantly capturing visitors’ attention with a thought-provoking declaration on its homepage: “To succeed in trading, you need three things: ignorance, confidence, and the right guidance. I do my best to take care of the third point.” This statement underscores the provider's commitment to educating its audience, indicating a recognition of the complexities involved in trading. Immediately upon entering the site, visitors are presented with an array of purported statistics, testimonials, and an invitation to become a member.

The provider presents four compelling arguments for why customers should consider joining Kim Premium, each highlighting a distinct advantage of their service.

The first argument, “Trade everything,” emphasizes the comprehensive nature of the signals offered. Subscribers can expect insights covering the entire spectrum of the crypto market, from Bitcoin to a diverse array of altcoins. While this broad approach is enticing, it may also raise the question of whether the provider would benefit from specializing in specific instruments to deliver even more informed and targeted signals.

The second argument, “High quality,” asserts that the provider's accuracy, results, and user feedback speak volumes about the reliability of the service. However, there is a notable caveat: the provider acknowledges the challenges of relying on unverified third-party track records. This transparency reflects an understanding of the importance of trust in the realm of crypto trading, where mere suggestions can often be insufficient for building confidence among users.

The third argument, “Auto following,” introduces a feature designed to ensure that subscribers never miss a signal. However, the specifics of this offering remain unclear. Whether it involves automated trading, signal alerts, or some other mechanism, potential users might find value in further clarification on how this feature functions in practice.

Finally, the argument for “education” highlights the provider's commitment to empowering its users. By offering detailed analyses of charts with accompanying explanations, the provider seeks to share its insights and rationale behind each signal. In addition, subscribers can look forward to educational articles that will deepen their understanding of the market dynamics at play. Ultimately, the question remains: Are these arguments persuasive enough to convince you to join Kim Premium? That decision rests entirely with you, as you weigh the potential benefits against your own trading goals and strategies.

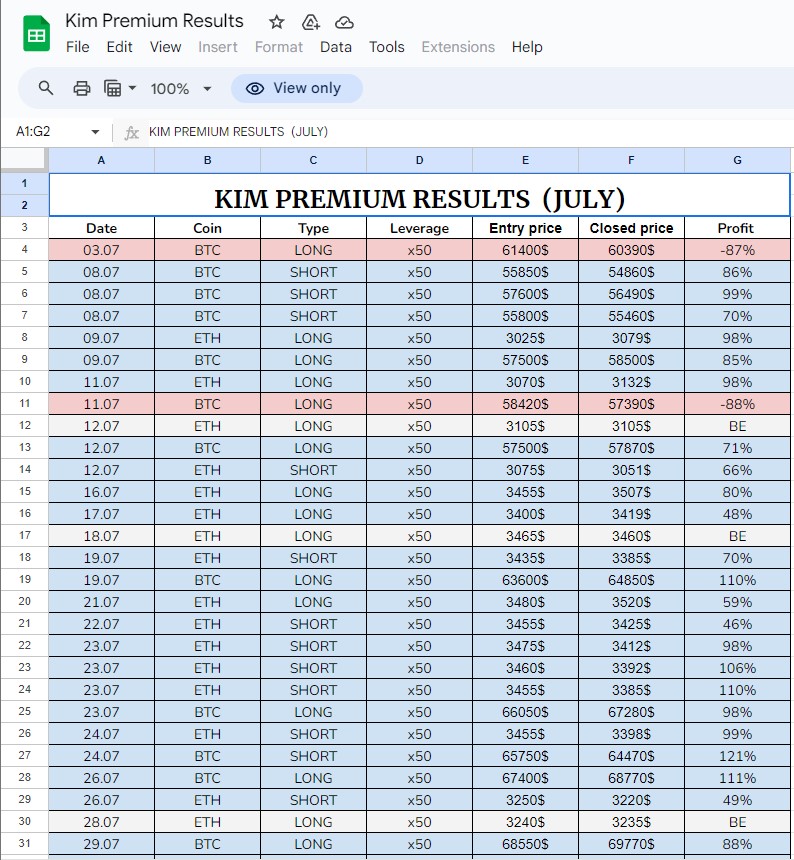

Next, let’s delve into the statistics presented. To be candid, the current data does little to instill confidence. The figures stretch from April to July, despite the fact that we are now in October, raising questions about their relevance and reliability. One notable trend observed is the impressive growth in the win rate of the provider, which surged to an astonishing 95%, culminating in a remarkable total profit of 2,272%. That certainly sounds impressive, doesn't it?

However, when we click on “VIEW TRADE,” we are merely redirected to a Google Sheets document. Here, the provider showcases the results of what are claimed to be profitable trades. Yet, these figures are presented in isolation, lacking any robust platform or independent verification to substantiate the authenticity of the trades. Without a comprehensive context or credible evidence, these statistics, though eye-catching, may not carry the weight of genuine performance claims.

In evaluating the premium services offered by the provider outlined below, we’ve identified some subscription options. For those interested in a short-term commitment, a three-month subscription is available for $200. Alternatively, a more cost-effective yearly subscription can be secured for $350. It’s important to note that both subscriptions grant access to the same comprehensive suite of services, making either option a valuable choice for users seeking quality and flexibility.

Kim & Crypto's Social Media

The provider currently has a presence on only one social network: Twitter. They have amassed a total of 4,026 subscribers. However, activity on the platform appears to be lacking, as the last post by Kim & Crypto was made around four months ago, and there have been no updates since then. This prolonged period of inactivity may affect engagement with their audience and hinder their ability to connect with subscribers effectively.

Kim & Crypto (@Crypto_Kimmy) / X

The provider uses Twitter as a platform to share insights, providing followers with thoughts, technical analysis, and detailed charts. In these posts, they offer general targets and entry for trades, aiming to guide their audience through market movements. This type of content can be valuable for those interested in trading or investing, as it combines analysis with actionable information. However, the effectiveness of this approach may be diminished due to the recent inactivity, as followers might be looking for regular updates and new insights to inform their trading decisions. Engaging consistently and providing fresh content could enhance their presence and connection with subscribers.

Telegram

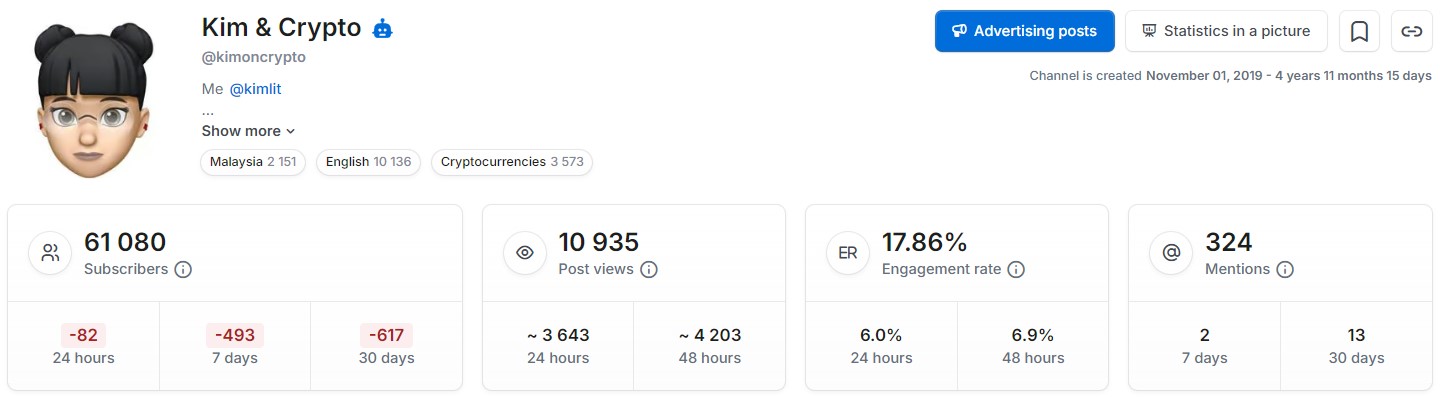

The provider's primary source of signals comes from their Telegram channel, where they have a substantial following of over 61,000 members. Audience engagement on this platform is encouraging, with an engagement rate of 17.86%. This translates to approximately 10,000 individuals actively viewing and interacting with the provider's posts. Given this level of engagement, the Telegram channel serves as an effective platform for delivering trading signals and insights, allowing the provider to reach a significant number of interested and engaged followers. Maintaining and enhancing this engagement through regular posting and interaction can further solidify the provider's reputation and effectiveness in conveying valuable information.

The growth trajectory of the provider’s Telegram channel raises some red flags. One year ago, the channel had around 27,000 subscribers, but on June 20 of this year, there was a sudden surge of over 20,000 new subscribers in just one day. This unusual spike suggests that the provider may have taken measures to artificially inflate their subscriber count, which can undermine trust and confidence among followers.

Such rapid growth in a short period, especially when it doesn't align with steady organic growth trends, can lead to skepticism regarding the authenticity of the engagement and the value of the content being provided. Potential subscribers and current followers may question the quality of the signals and analysis shared, as well as the motives behind such aggressive subscriber growth tactics. To foster trust and credibility, it's essential for the provider to focus on delivering consistent, high-quality content, engaging genuinely with their audience, and being transparent about their growth strategies. This might help mitigate concerns and reinforce their standing in the trading community.

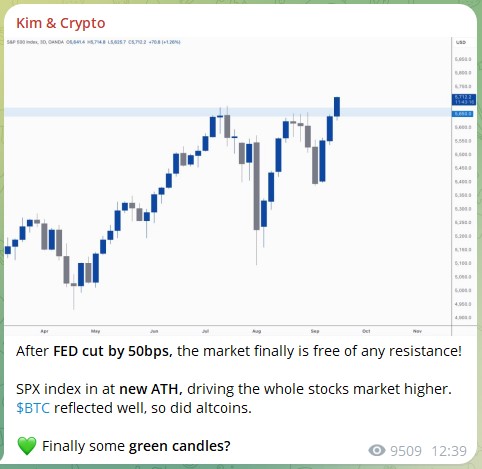

In her Telegram channel, the provider offers additional market overviews and crucial news updates. This information can be particularly valuable for traders looking to stay informed about market trends and developments. By sharing insights and analyses, the provider helps traders make more informed decisions, enhancing their overall trading strategies. These updates can also provide context for market movements and potential opportunities, making the channel a useful resource for both seasoned and novice traders.

The anonymity of the provider's admin further compounds the concerns regarding credibility and trustworthiness. When followers cannot identify or verify the individuals behind a service, it raises questions about accountability, expertise, and the integrity of the signals being provided. An anonymous admin might lead to skepticism among subscribers, as followers often prefer to know who they are relying on for trading advice or market insights. Transparency is crucial in financial contexts, where users need assurance that they are making informed decisions based on reliable information.

Kim & Crypto Signals

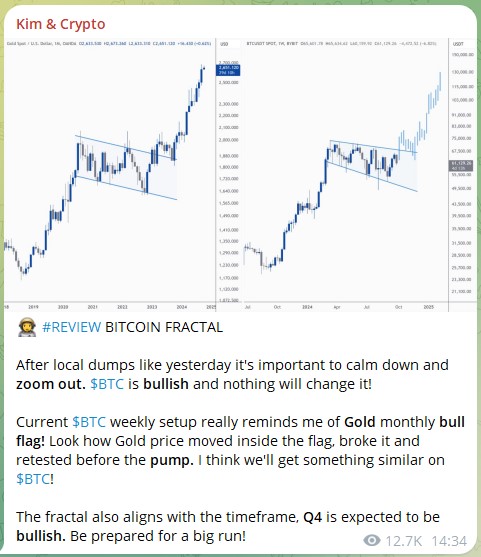

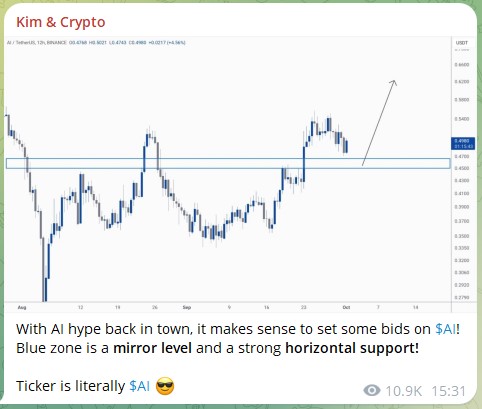

The provider does not give specific signals with precise enter and TP/SL levels. Instead, it offers a general analysis along with an overall price direction. A few weeks ago, they issued a forecast for the crypto asset AIUSDT, highlighting in their post, "The blue zone is a mirror level and a strong horizontal support!" They suggested that this zone would hold the price due to its strength.

However, as illustrated in the chart, the price remained within this zone but eventually experienced significant momentum and declined. There were no further comments regarding this development.

Another illustration of this trend can be found in the DOGEUSDT pairing. The provider initially anticipated that the price would rise from its current level. However, as demonstrated in the accompanying graph, the price unexpectedly declined instead. Interestingly, despite this initial downturn, the price began to recover and move upward after a span of two weeks.

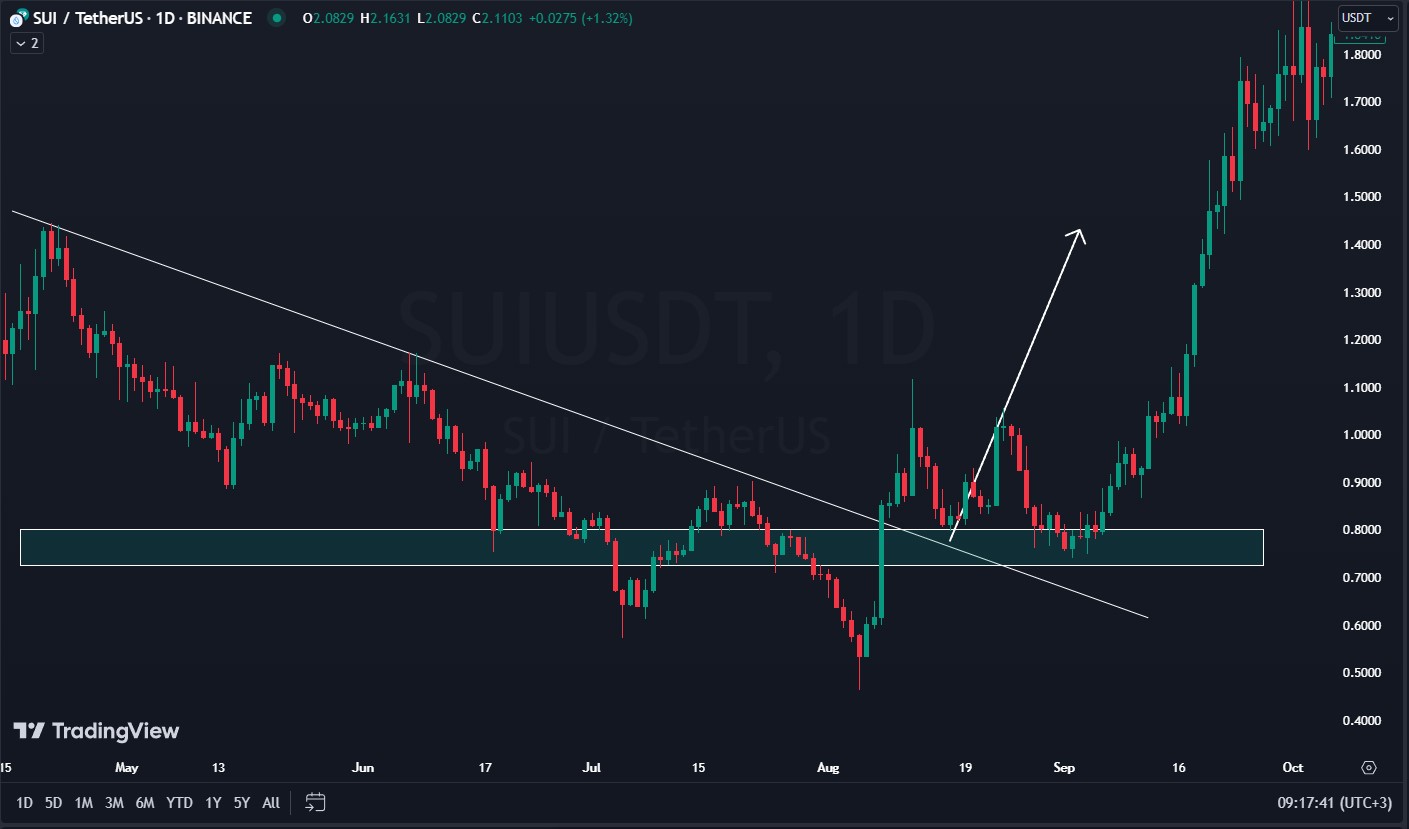

A recent example involving SUIUSDT presents a compelling case for investment. As illustrated in the chart, Kim predicted that the price would increase following a retest of the support level.

Observing the graph, it is clear that the price indeed experienced an upward movement after this pivotal point. The provider later remarked that the price had already surged by an impressive 20%. This upward momentum continued, leading to even higher price levels in the following days.

Feedbacks

When evaluating the credibility of any financial service or product, client feedback often serves as a vital indicator of reliability and performance. However, Kim & Crypto, a prominent cryptocurrency provider, presents a concerning lack of reviews on established platforms such as Trustpilot. This absence of third-party evaluations raises questions about the transparency and authenticity of the feedback showcased on their official website.

On Kim & Crypto’s site, one can find a selection of reviews purportedly from premium clients. While these testimonials may seem positive at first glance, they warrant further scrutiny. The absence of independent verification means there is an inherent risk of bias; the provider could easily curate or fabricate these comments to enhance its reputation. Therefore, one must approach such reviews with caution, as they may not accurately reflect the experiences of a broader clientele.

In an industry where trust is paramount, potential customers are advised to conduct thorough research before committing to any service. The lack of diverse feedback on reputable platforms coupled with potentially manipulated testimonials could indeed be considered concerning red flags.

Conclusion

Kim & Crypto raises several red flags that warrant caution. Notably, there are indications of artificially inflated subscriber numbers, a lack of credible reviews, and an absence of a proven track record. Furthermore, the provider demands a substantial fee of $250 for premium services, yet we have no clarity regarding the legitimacy of their offerings. Given these concerns, it’s essential to proceed with vigilance before engaging with this service provider.