Ideas

Want to trade with the best? Start winning your trades.

-

Check free traders' forecasts

-

Check profit per trade

-

Analyze general statistics

-

Publish traders' forecasts here

- We not only publish only good traders, but we do NOT publish forecasts for instruments they poorly analyze.

- 94% accuracy of our program for testing forecasts.

- We only publish traders, who have checked more than 85% of deals.

- Many traders make their forecasts without SL. That's why we use standard TP:SL ratio 2:1.

- Not all predictions can be checked because some forecasts are hard to write (some TP, unclear entry point etc.).

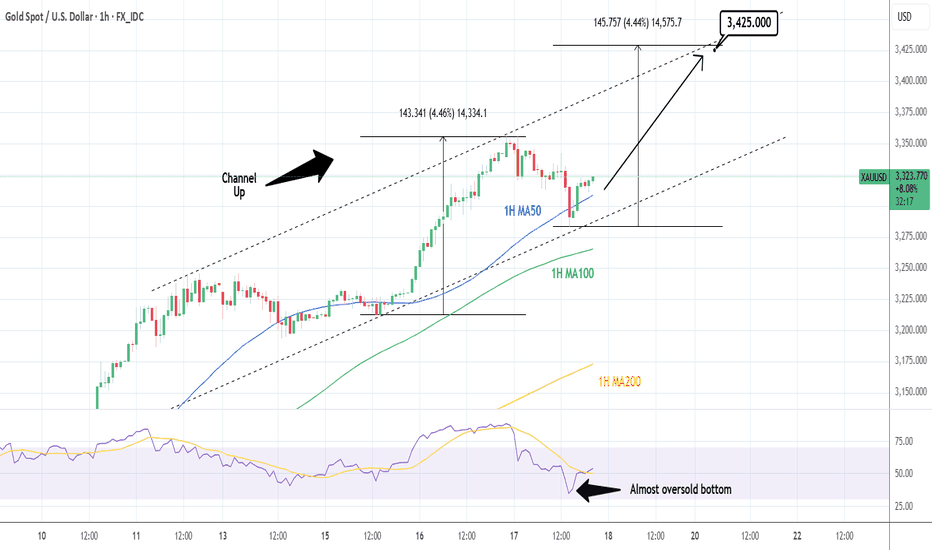

XAUUSD, 60

Short-Term

17 April 2025

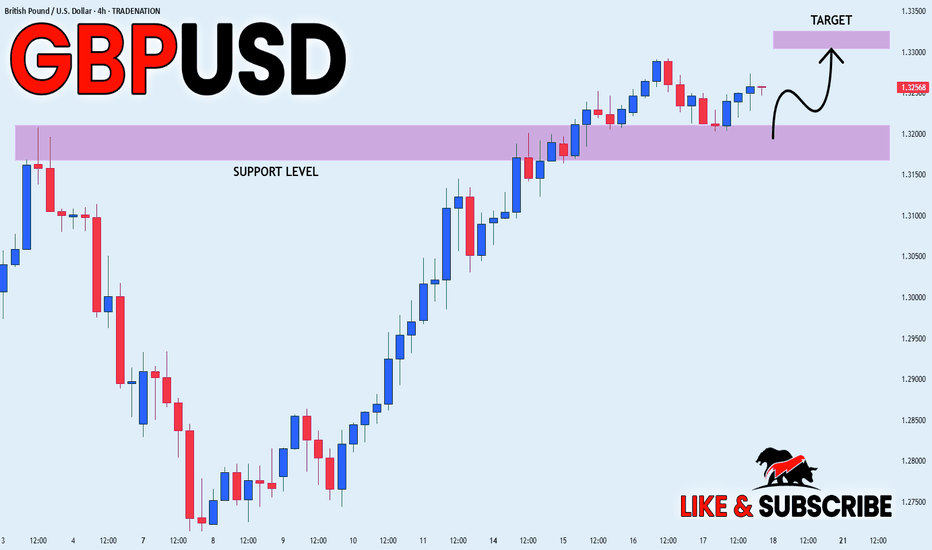

GBPUSD, 240

Long-Term

17 April 2025

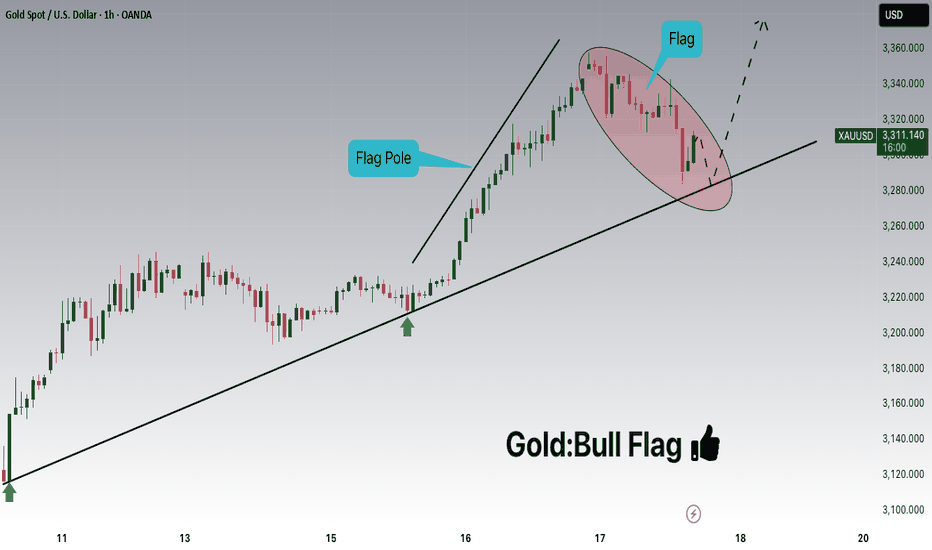

XAUUSD, 60

Short-Term

17 April 2025

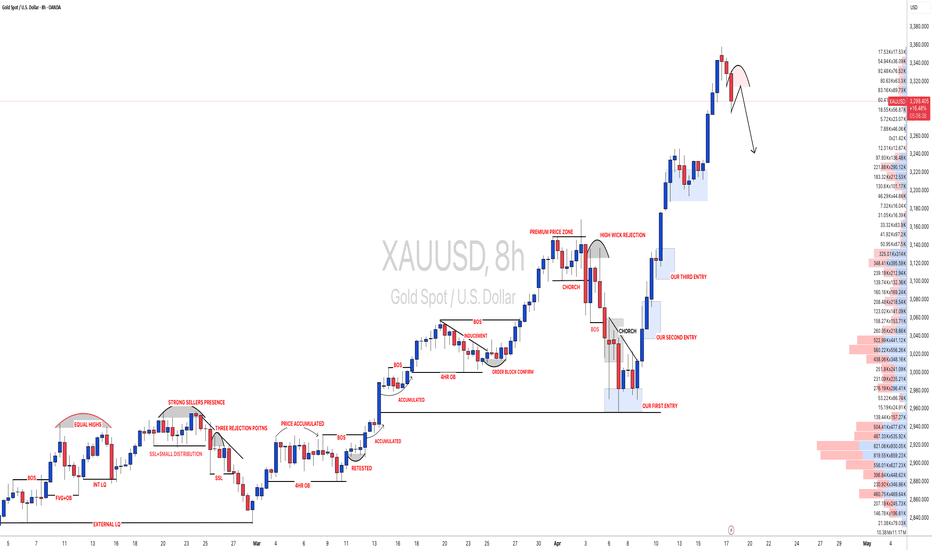

XAUUSD, 480

Long-Term

17 April 2025

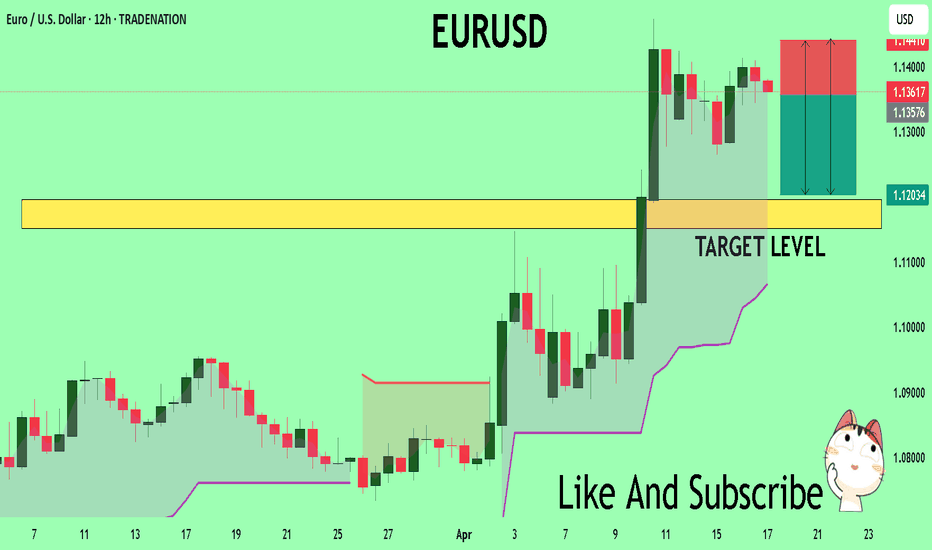

EURUSD, 720

Long-Term

17 April 2025

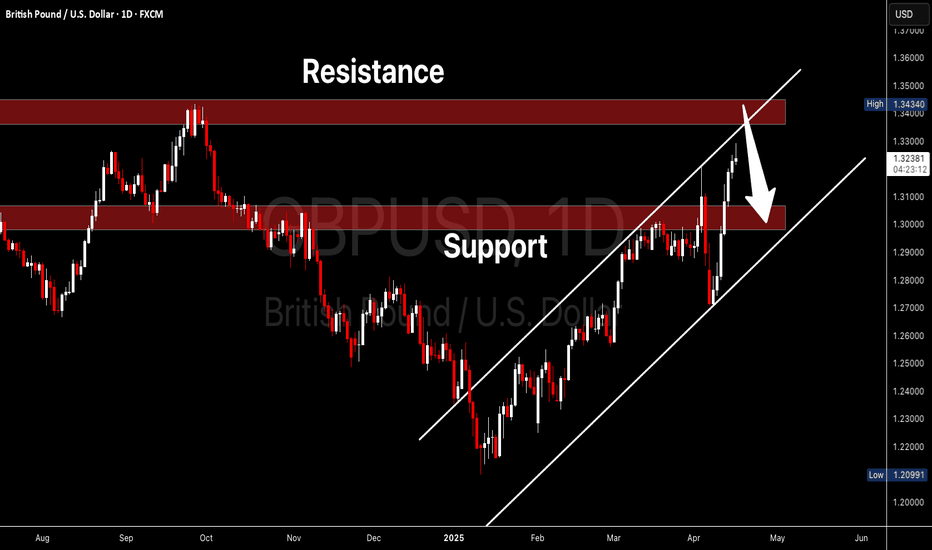

GBPUSD, 1D

Long-Term

16 April 2025

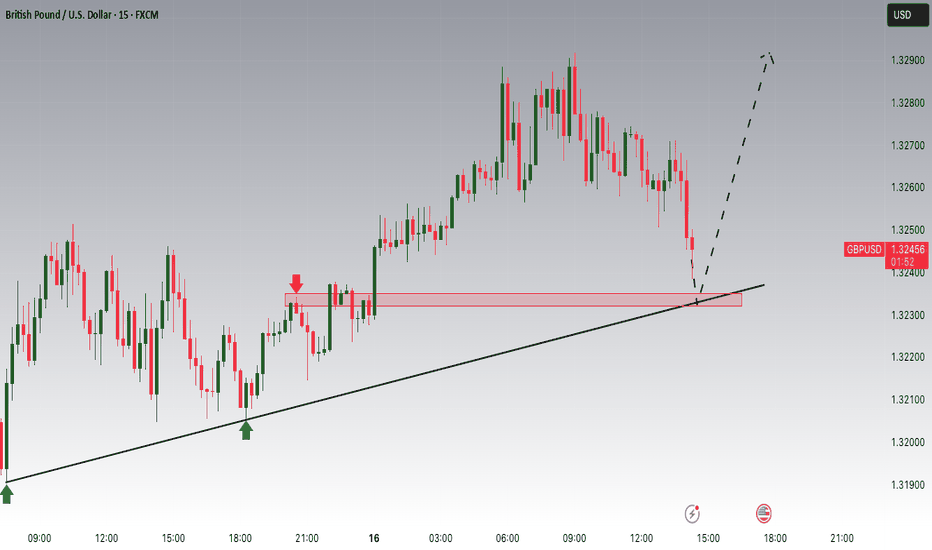

GBPUSD, 15

Short-Term

16 April 2025

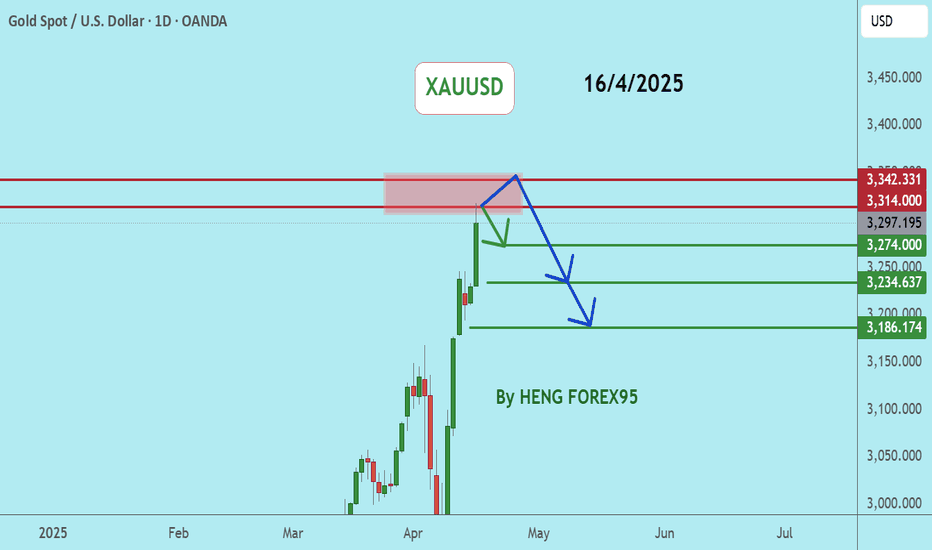

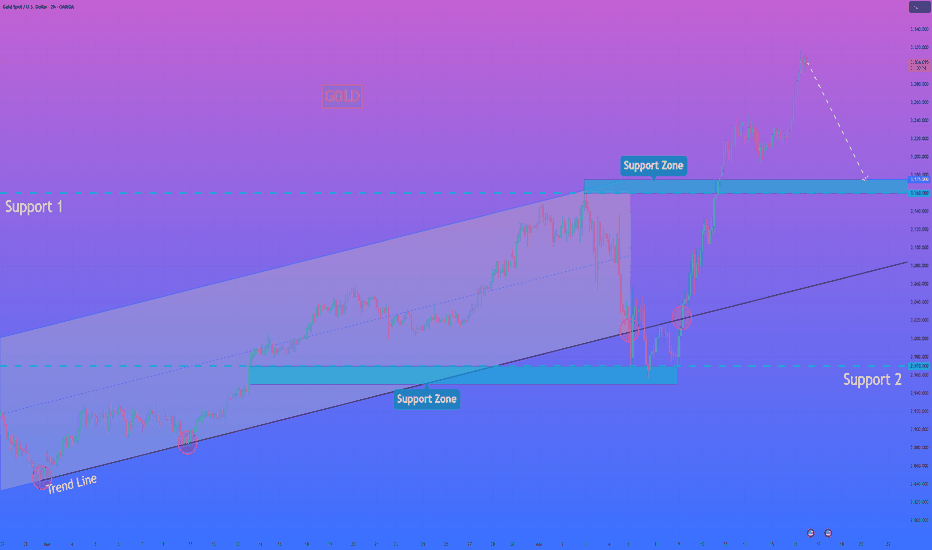

XAUUSD, 1D

Long-Term

16 April 2025

XAUUSD, 120

Medium-Term

16 April 2025

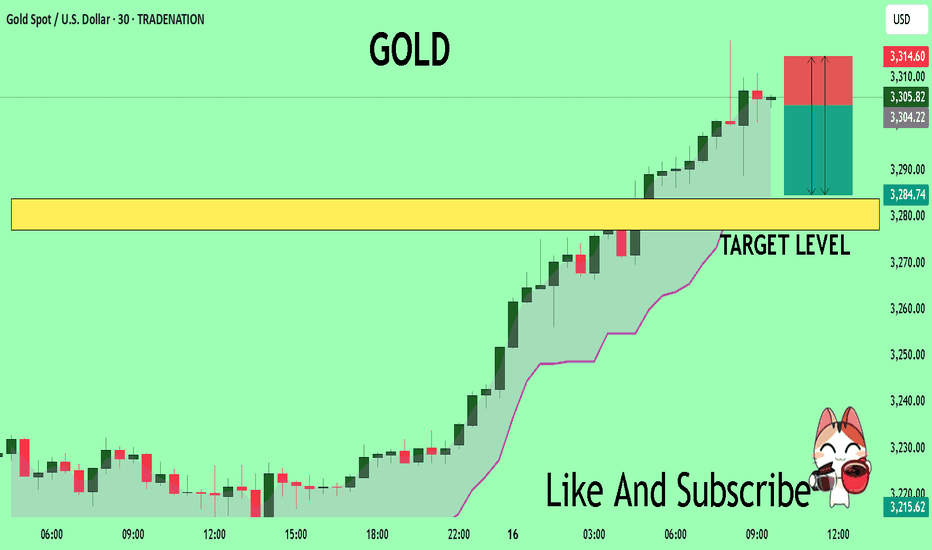

XAUUSD, 30

Short-Term

16 April 2025

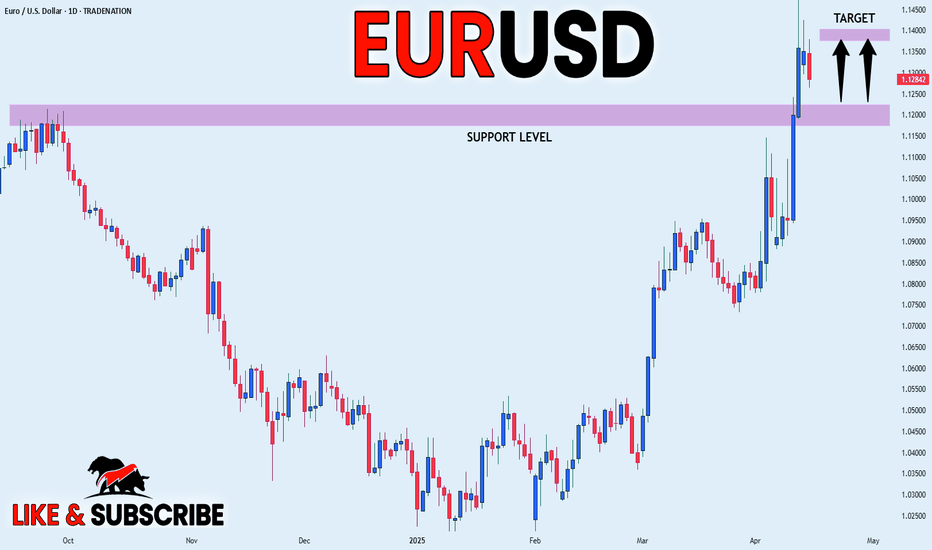

EURUSD, 1D

Long-Term

15 April 2025

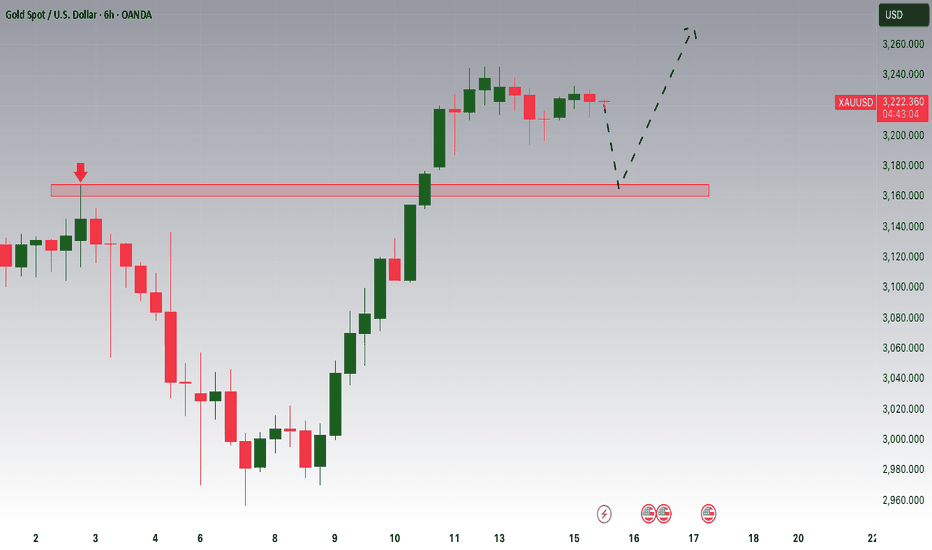

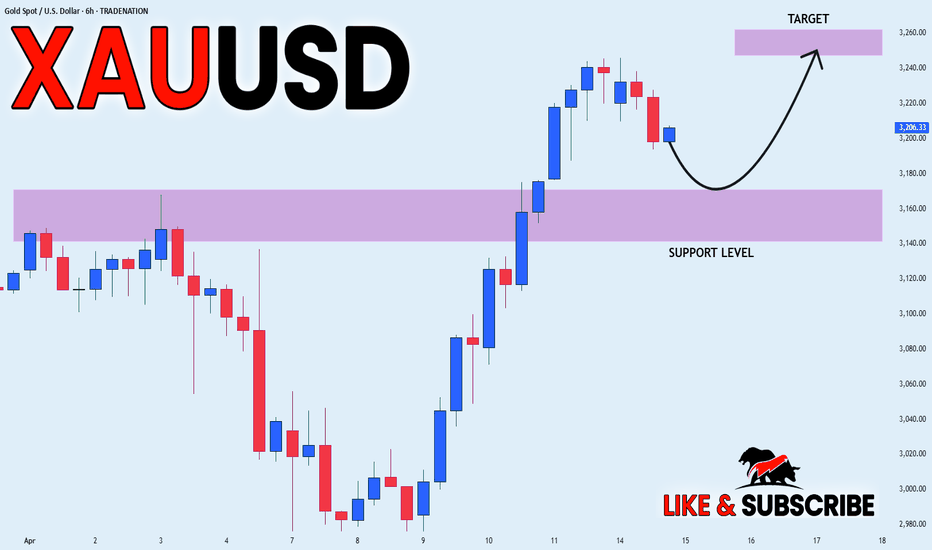

XAUUSD, 360

Long-Term

15 April 2025

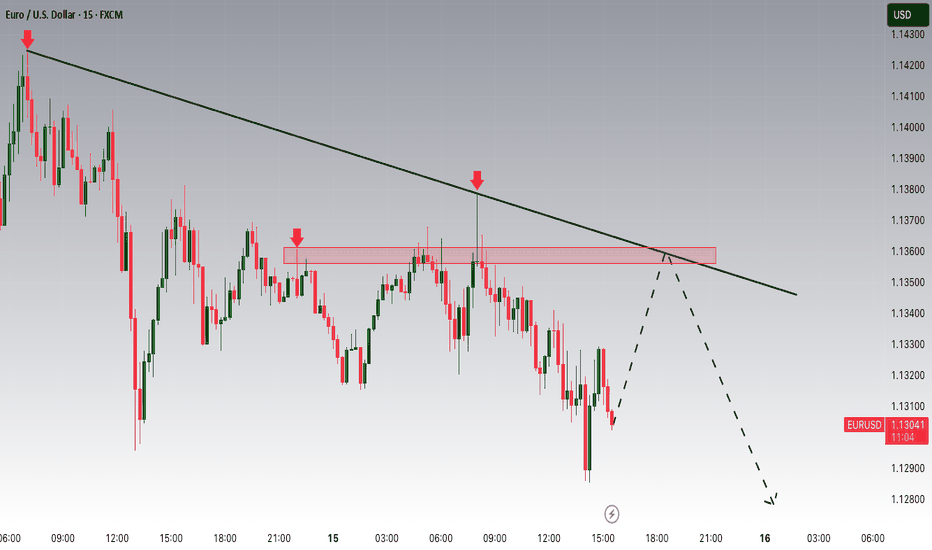

EURUSD, 15

Short-Term

15 April 2025

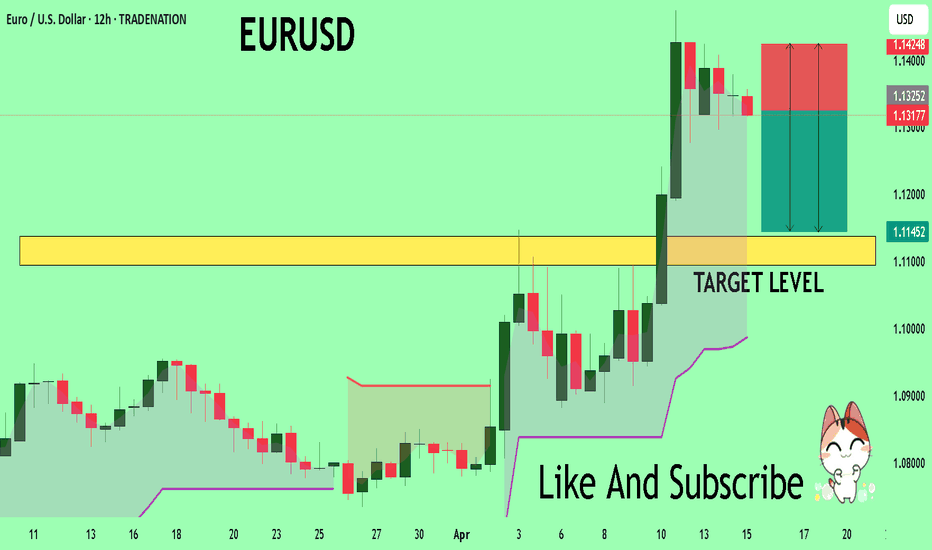

EURUSD, 720

Long-Term

15 April 2025

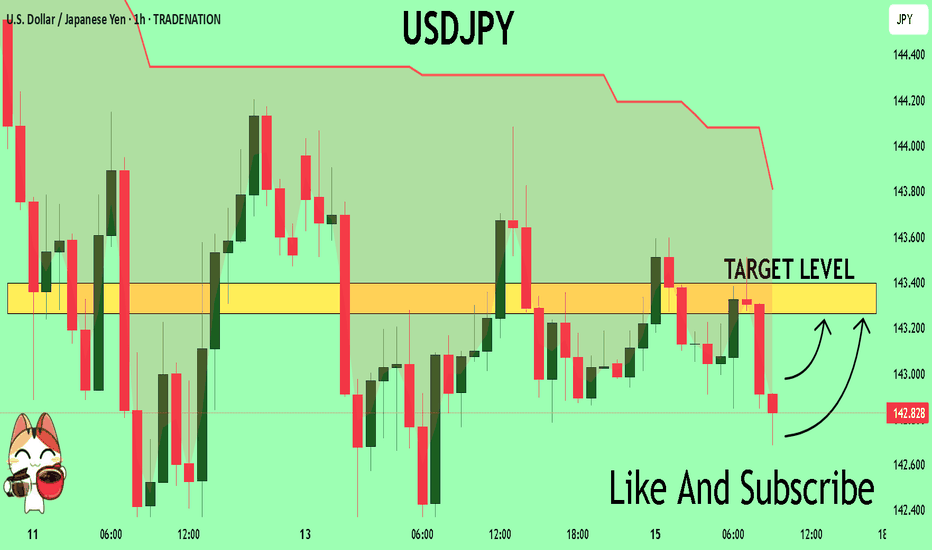

USDJPY, 60

Short-Term

15 April 2025

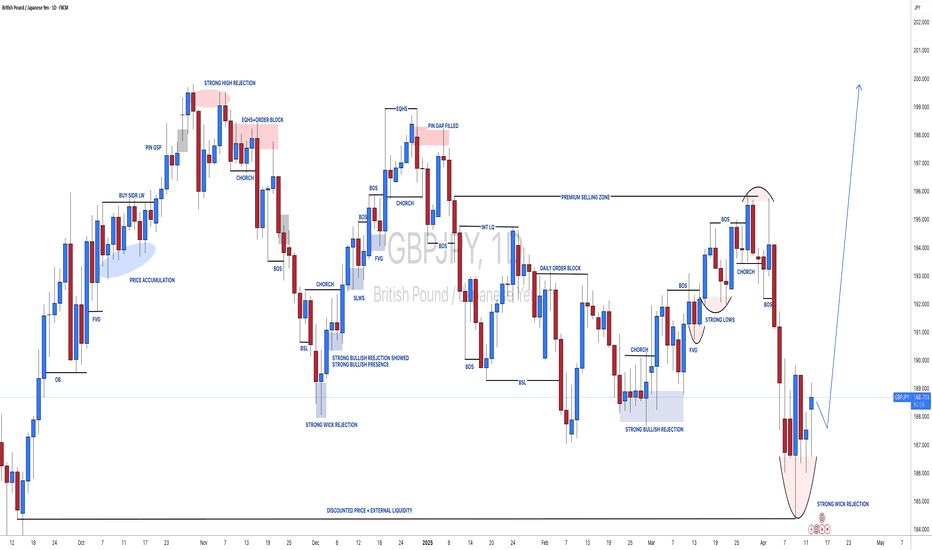

GBPJPY, 1D

Long-Term

14 April 2025

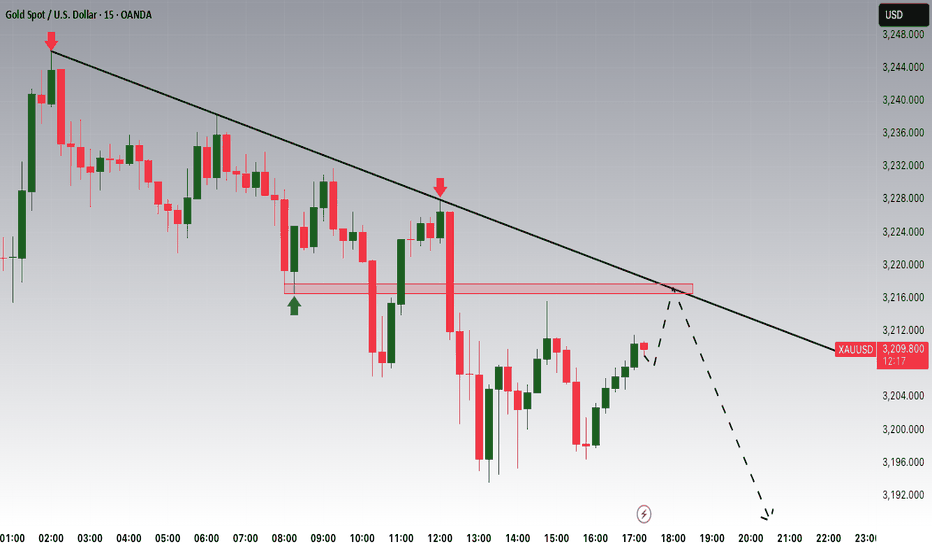

XAUUSD, 15

Short-Term

14 April 2025

XAUUSD, 360

Long-Term

14 April 2025

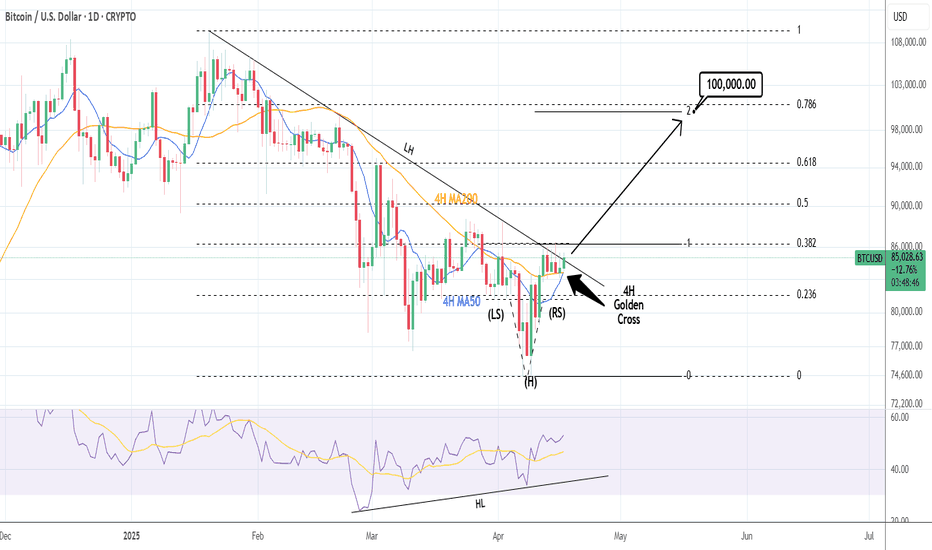

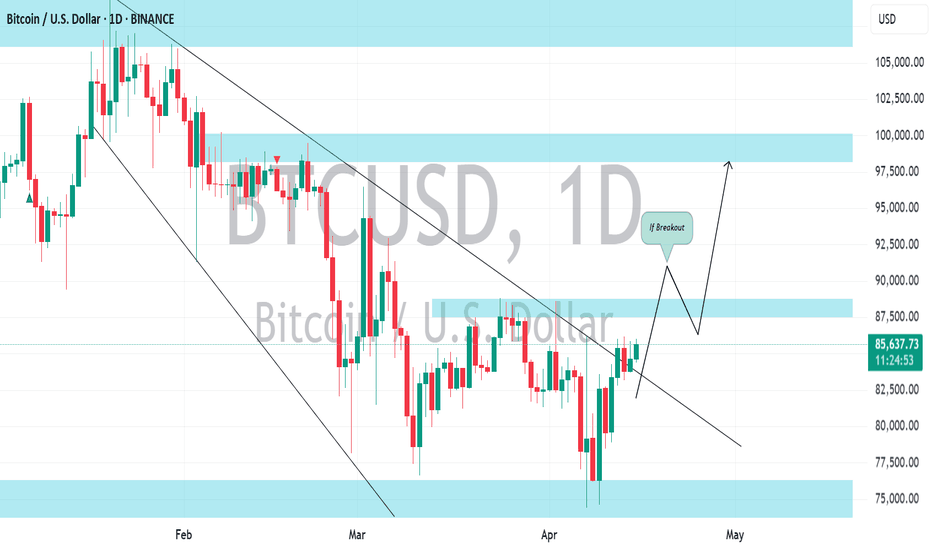

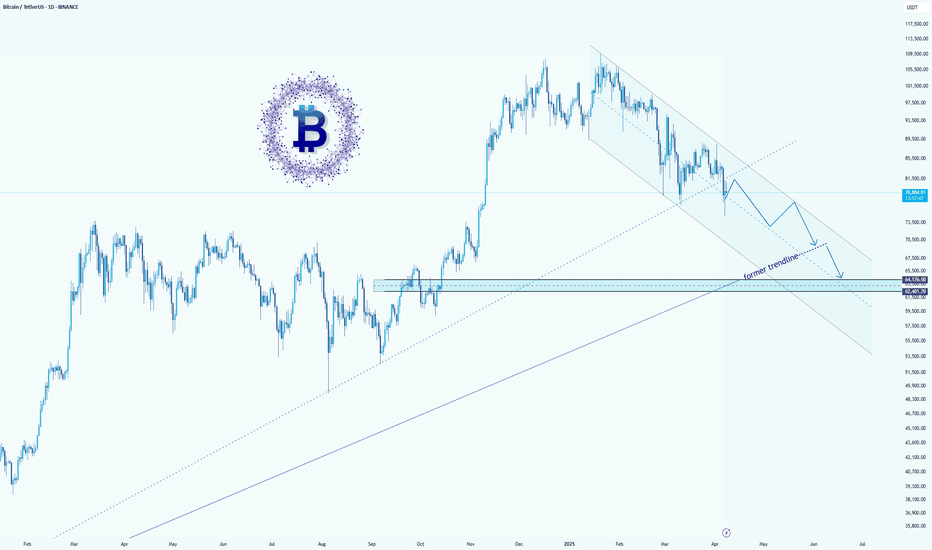

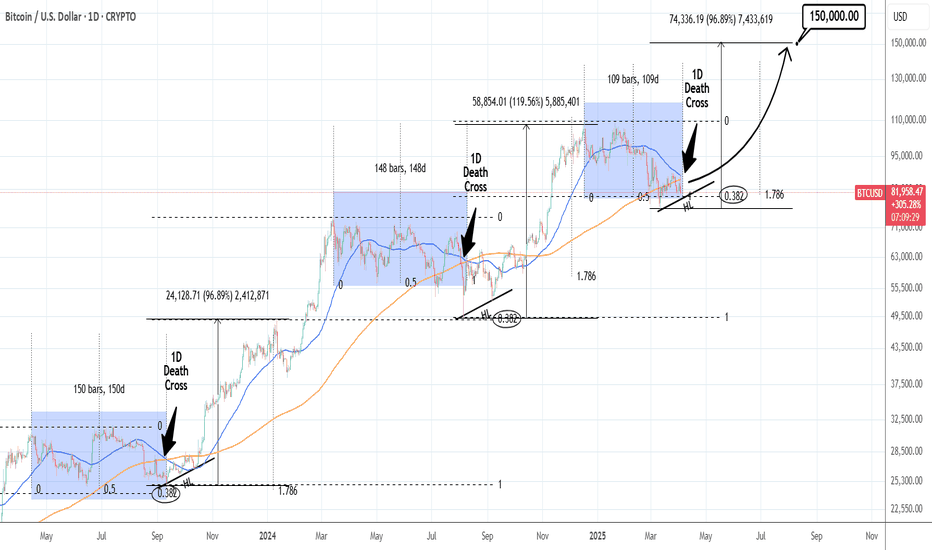

BTCUSD, 1D

Long-Term

17 April 2025

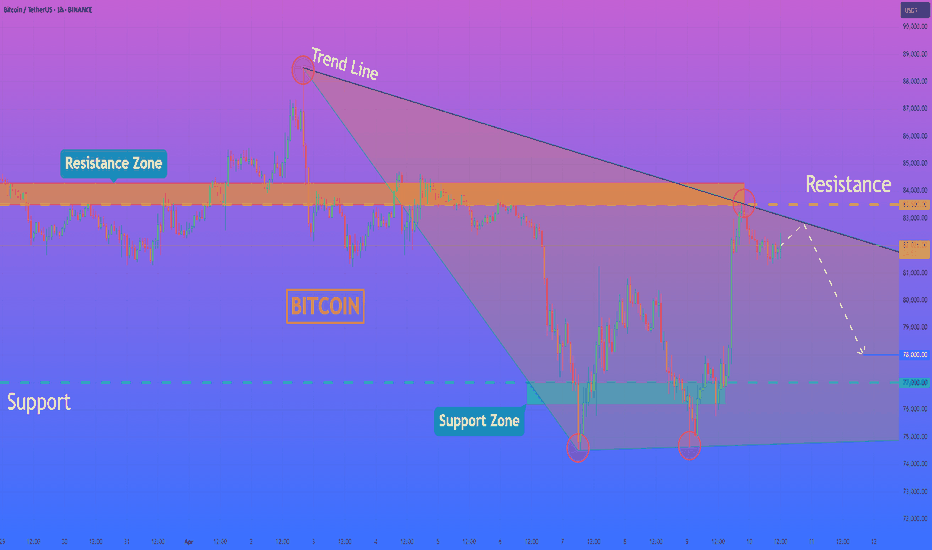

BTCUSDT, 60

Short-Term

17 April 2025

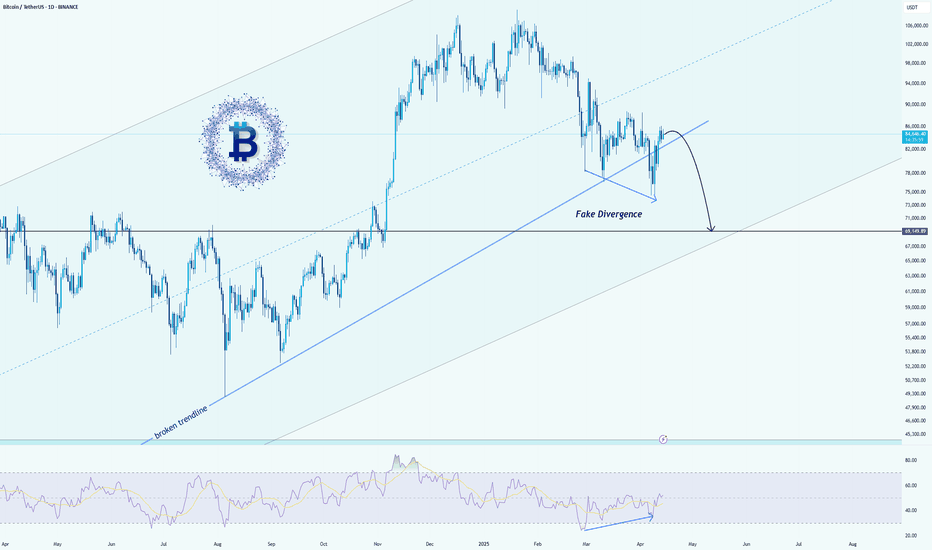

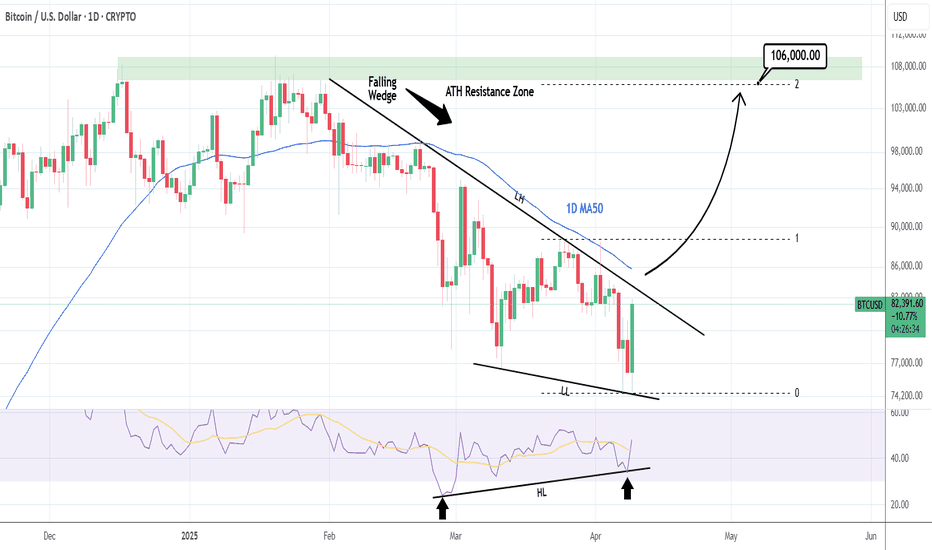

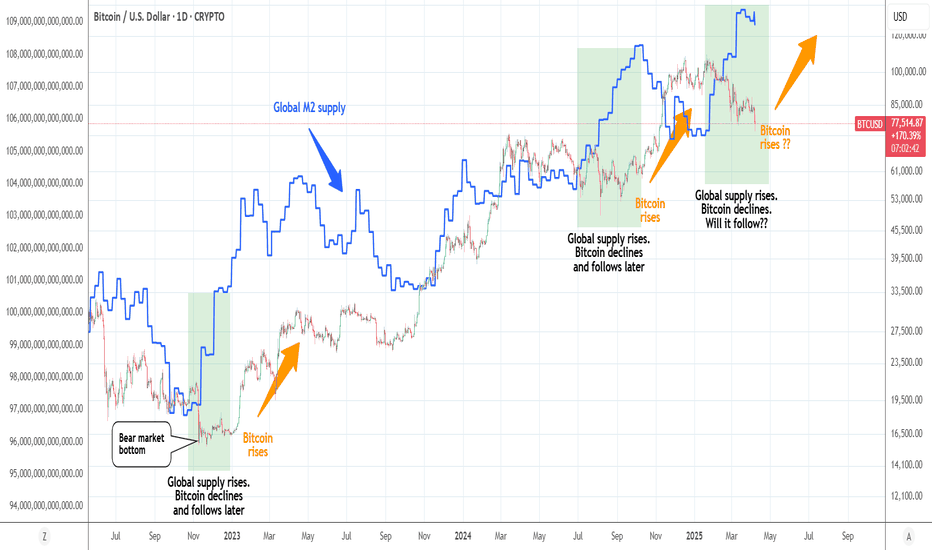

BTCUSD, 1D

Long-Term

15 April 2025

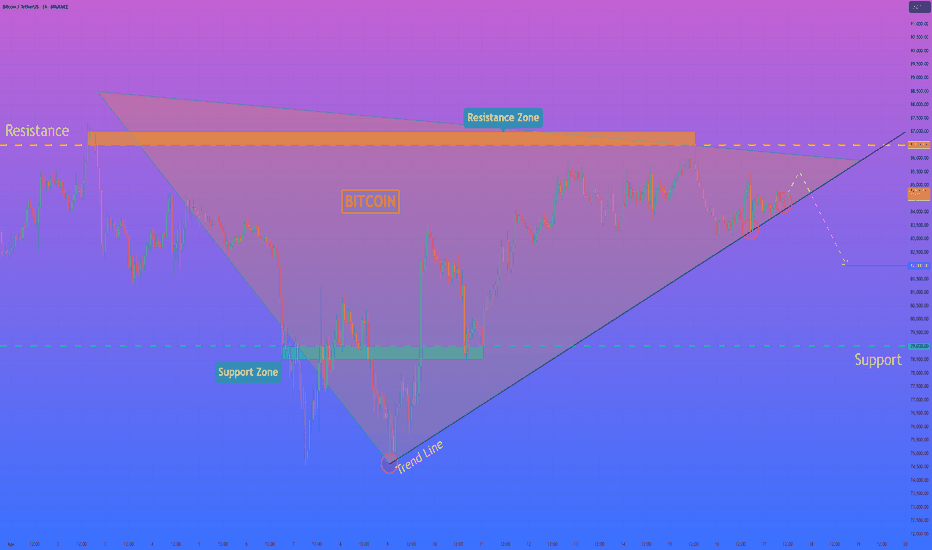

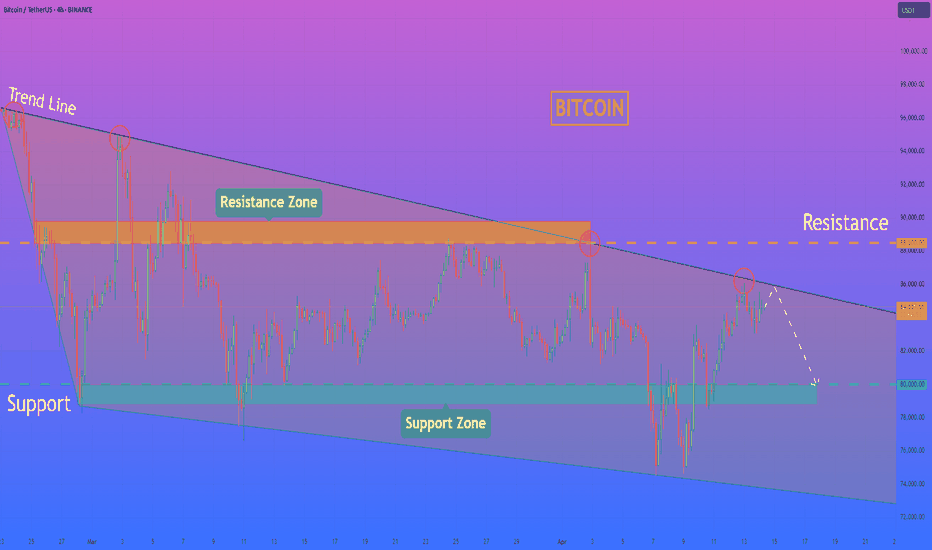

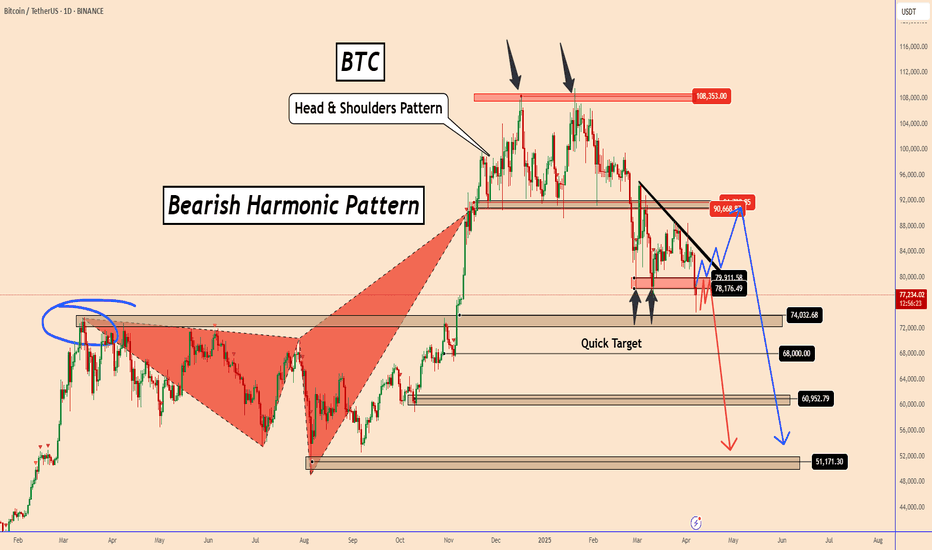

BTCUSDT, 1D

Long-Term

14 April 2025

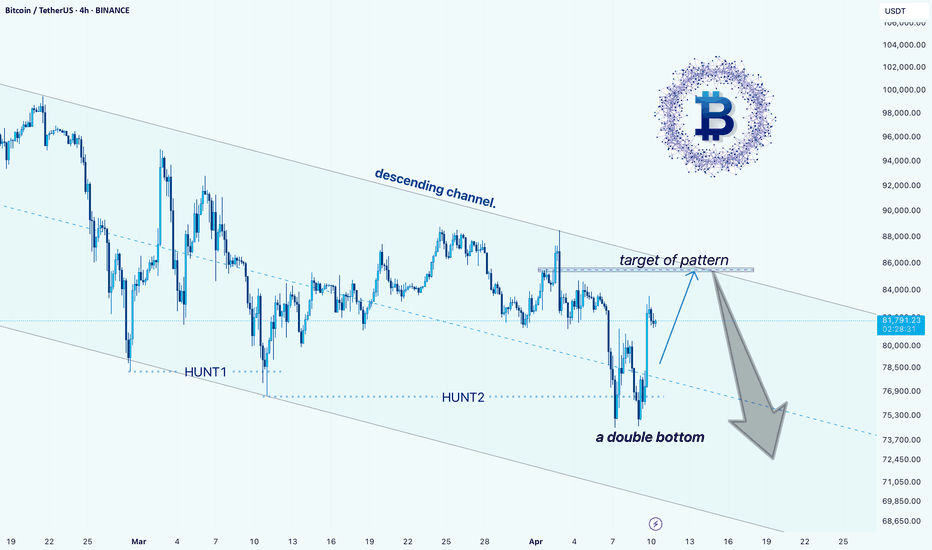

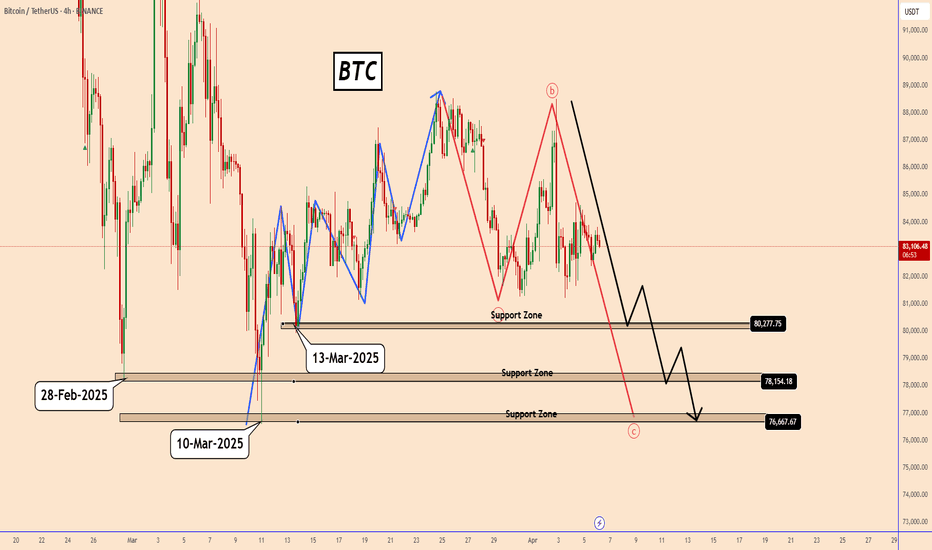

BTCUSDT, 240

Long-Term

14 April 2025

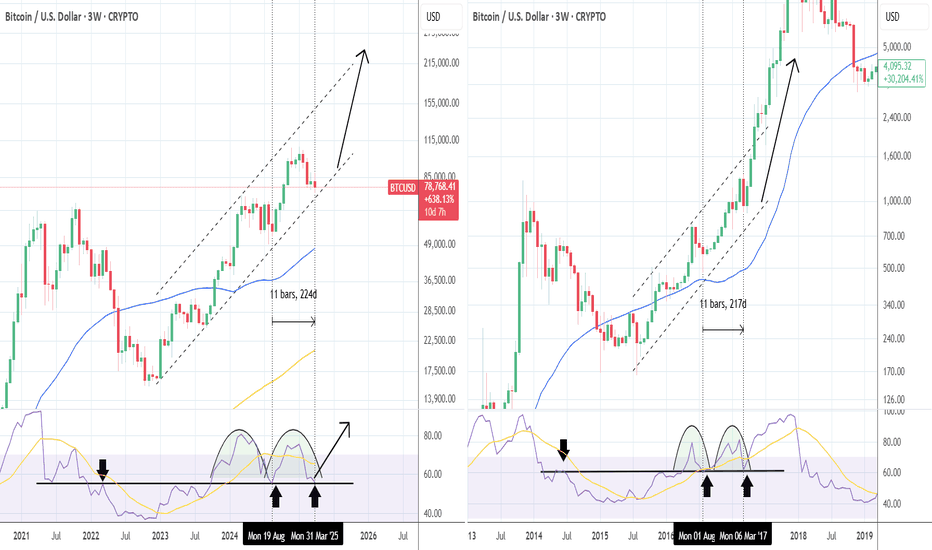

BTCUSD, 3W

Long-Term

10 April 2025

BTCUSDT, 60

Short-Term

10 April 2025

BTCUSDT, 240

Long-Term

10 April 2025

BTCUSD, 1D

Long-Term

09 April 2025

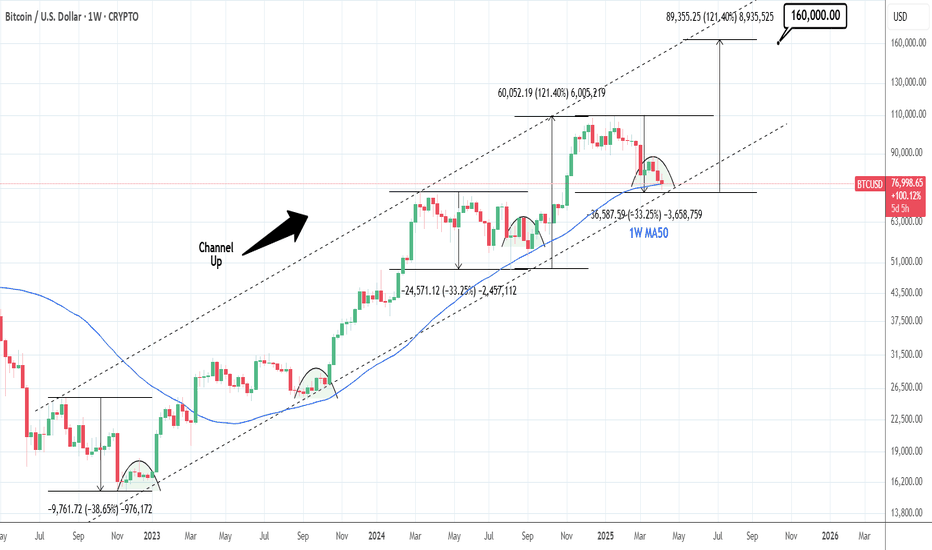

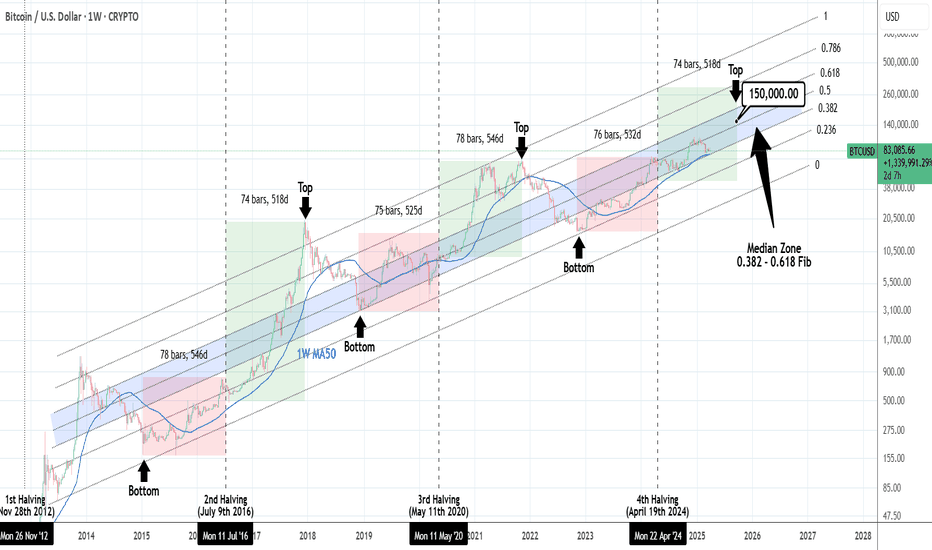

BTCUSD, 1W

Long-Term

08 April 2025

BTCUSDT, 1D

Long-Term

08 April 2025

BTCUSD, 1D

Long-Term

07 April 2025

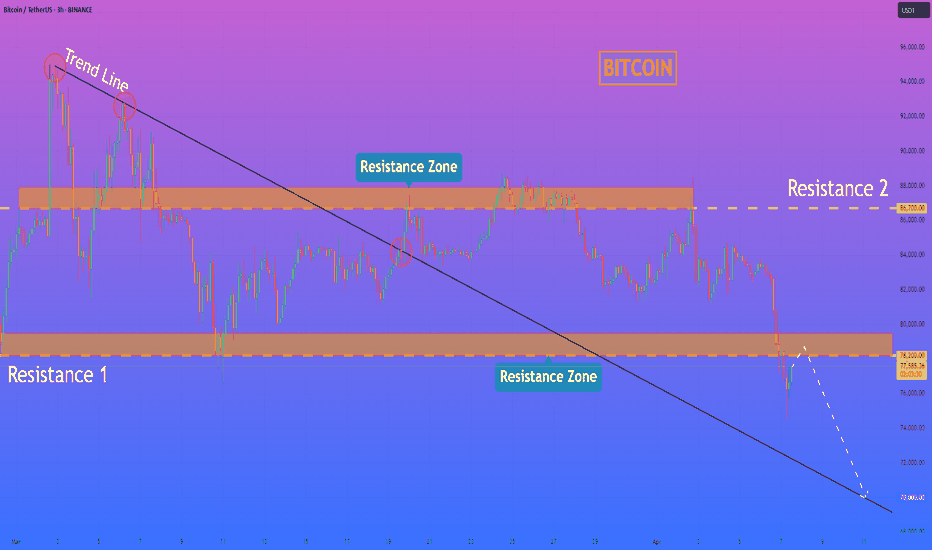

BTCUSDT, 180

Medium-Term

07 April 2025

BTCUSDT, 1D

Long-Term

07 April 2025

BTCUSDT, 240

Long-Term

06 April 2025

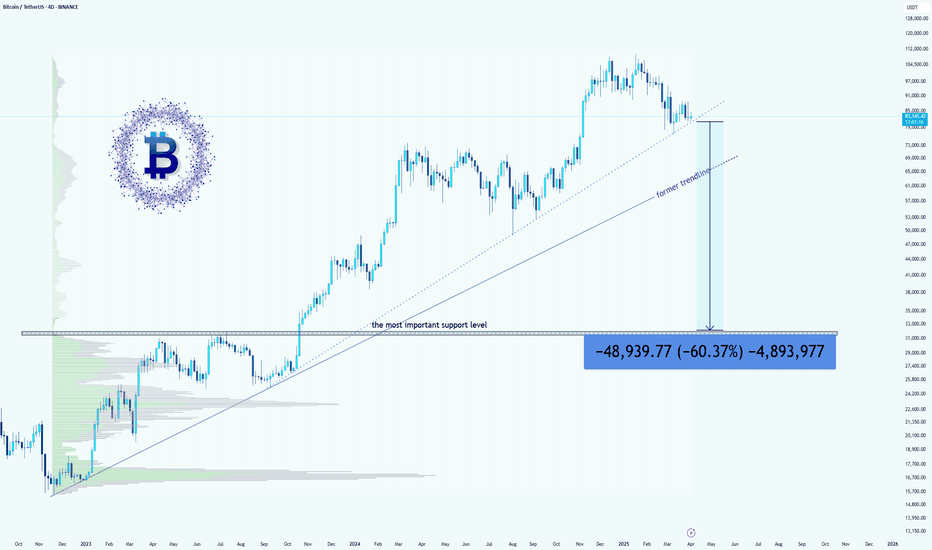

BTCUSDT, 4D

Long-Term

06 April 2025

BTCUSD, 1W

Long-Term

04 April 2025

BTCUSD, 1D

Long-Term

03 April 2025