Common Mistakes Beginners Make When Following Trading Signals

Introduction: The Allure and Risk of Trading Signals

In the fast-paced world of trading, trading signals are a tempting shortcut for those looking to profit without years of experience. These signals—whether generated by seasoned analysts, trading algorithms, or platforms—indicate potential buy or sell opportunities based on specific criteria.

For beginners, they can feel like a lifeline: a way to trade like the pros without deep market knowledge. Signals can indeed be valuable tools, offering insights into market timing, technical patterns, and sentiment shifts. But without a proper understanding and strategy, they can also lead to emotional decisions and painful losses.

In this article, we’ll explore the most common mistakes beginners make when following trading signals and show you how to avoid these traps. By the end, you’ll know how to use signals more wisely—and how platforms like Traderstat.com can help you trade with confidence.

.png)

Mistake 1: Blindly Following Signals Without Understanding

Many newcomers see a trading signal and jump into the market without asking a single question. Why this trade? What’s the strategy behind it? Is it based on technical indicators, fundamental news, or a combination?

Example: Imagine receiving a signal to buy EURUSD at 1.0820. You enter the trade but don’t realize that it’s part of a news-based strategy reacting to a central bank rate decision. When the market reverses suddenly, you're caught off guard.

The Problem: Without understanding the reasoning behind a signal, you become a passive trader—relying on instructions rather than informed decision-making. This approach can lead to confusion, panic exits, and missed learning opportunities.

What to Do Instead:

- Study the basics of technical and fundamental analysis. Even a foundational understanding of RSI, MACD, support/resistance, and economic calendars can make a big difference.

- Ask: What is this signal based on? Does it align with my analysis or market outlook?

- Use signals as a starting point for your own evaluation, not a final command.

Mistake 2: Ignoring Risk Management

One of the most dangerous mistakes is assuming that if a signal is good, it must be “safe.” Unfortunately, no signal is 100% accurate—and without proper risk management, even one losing trade can wipe out days or weeks of gains.

Example: A trader risks 50% of their account on a “sure thing” signal, convinced by past wins. The trade fails, and half their capital disappears overnight.

The Problem: Beginners often skip setting stop-losses, miscalculate position size, or over-leverage their accounts, leaving themselves exposed to catastrophic loss.

What to Do Instead:

- Never risk more than 1-2% of your capital on a single trade.

- Always use a stop-loss based on market structure—not emotions.

- Learn to calculate position size correctly based on your account balance and the distance to stop-loss.

- Accept that losses are part of the game, and protecting your capital is more important than chasing every win.

.png)

Mistake 3: Chasing Unverified Signal Providers

The internet is full of “experts” promising sky-high returns—especially on social media. Many offer signals through Telegram, Discord, or paid groups without any proof of performance.

Example: You join a Telegram group that advertises 95% win rates. After a few lucky trades, the losses pile up. The provider vanishes—or worse, blames you for not following their “exact instructions.”

The Problem: Many beginners fall victim to unverified, unregulated, and sometimes fraudulent signal providers. These scams erode trust and finances.

What to Do Instead:

- Research providers with a public track record and third-party verification.

- Look for transparency: Do they share past performance? Are their trades timestamped and independently verified?

- Be wary of guaranteed profits or pressure to act fast—these are red flags.

- Use platforms like Traderstat.com (more on that below) to verify a provider’s history and stats before subscribing.

Mistake 4: Overtrading Based on Signals

Signals can come in fast and furious—especially in active groups or during volatile market periods. It’s tempting to act on each one, thinking more trades equal more profit.

Example: You receive five signals in one day, enter all of them, and suddenly your margin is spread thin, your attention is divided, and your account is volatile.

The Problem: Overtrading leads to poor execution, high fees, increased emotional stress, and the risk of conflicting positions (e.g., going long EURUSD and short USDCHF simultaneously).

What to Do Instead:

- Set a daily or weekly trade limit to keep control of your activity.

- Filter signals based on your preferred strategy and time availability.

- Prioritize quality over quantity. One well-placed trade is better than five rushed ones.

- Develop a trading plan that includes criteria for when to enter based on a signal.

Mistake 5: Expecting Guaranteed Profits

Perhaps the biggest misconception beginners have is that trading signals = automatic profits. Even the best traders face drawdowns, missed entries, or unexpected market reactions.

Example: After a few wins from a signal provider, you start increasing your position sizes, believing you’ve found a magic formula. Then comes a losing streak, and you’re back at square one—or worse.

The Problem: This false sense of security leads to overconfidence, poor discipline, and emotional decision-making.

What to Do Instead:

- Treat trading signals as probabilities, not promises.

- Understand that drawdowns are normal, even with top-rated providers.

- Focus on consistency and risk management, not chasing every pip.

- Set realistic expectations: a good provider might win 60% of the time, but how they manage losses and capital matters more

How Traderstat.com Can Help

This is where Traderstat.com becomes an essential tool in your trading journey.

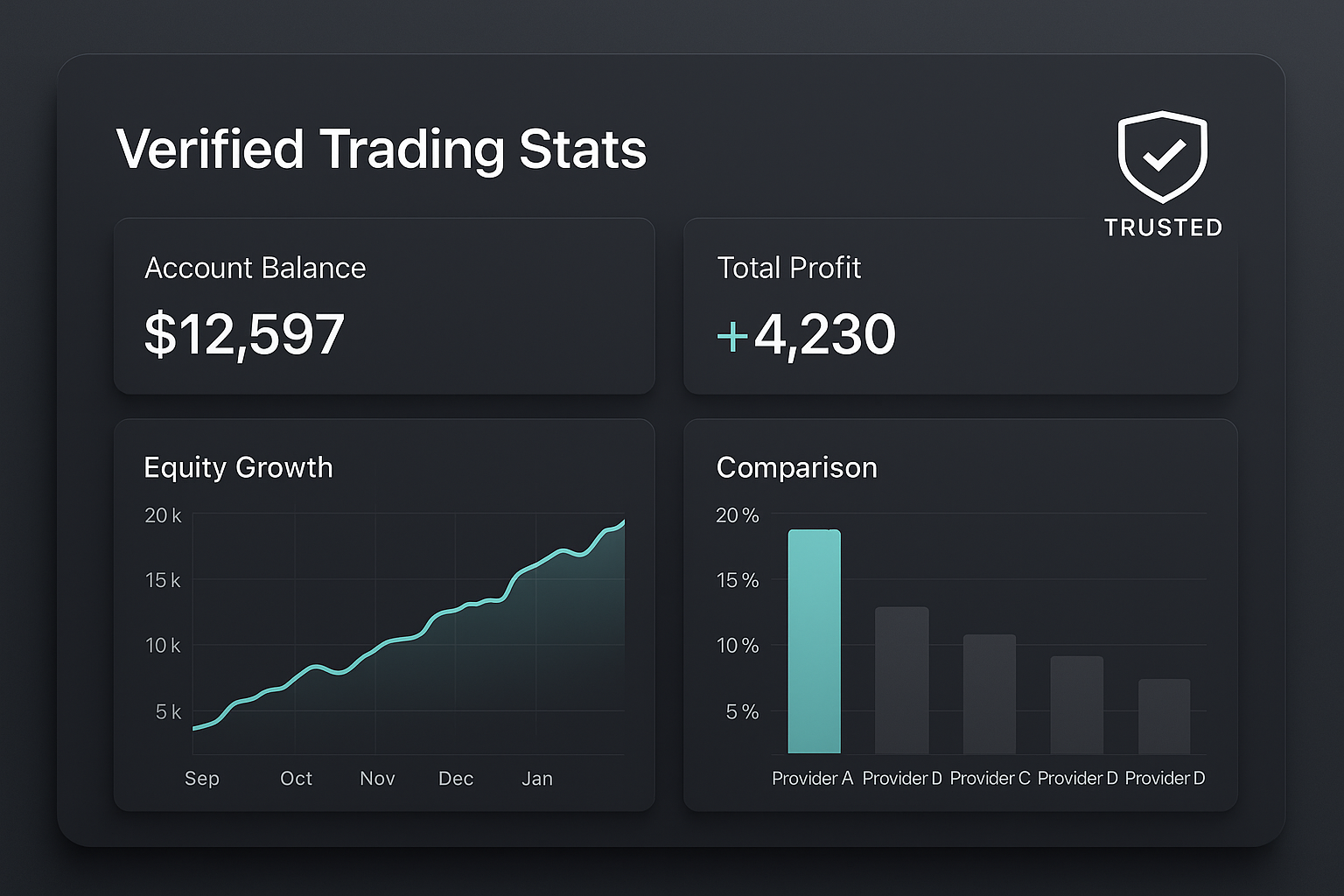

Traderstat.com is a global platform that independently tracks, verifies, and ranks trading signal providers. It gives you access to real performance data, allowing you to filter signal services by accuracy, return rate, drawdown, asset type, and trading strategy.

Here’s how it helps you avoid the mistakes above:

- ✅ Transparent Metrics: View verified statistics like win rate, average return per trade, and risk/reward ratios before following any provider.

- ✅ Scam Prevention: Only trustworthy, performance-verified traders are ranked—reducing the risk of falling for fake signals.

- ✅ Strategic Insights: Understand what type of strategies top performers use (scalping, swing, long-term investing).

- ✅ Side-by-side Comparison: Compare providers directly to find the one that matches your style and goals.

- ✅ Education Through Data: Learn from top traders by analyzing how they approach markets, manage risk, and respond to different conditions.

Call to Action:

Ready to take control of your trading journey? Explore Traderstat.com to find verified signal providers, backed by real data—not hype.

Conclusion: Trade Smarter, Not Harder

Trading signals can be a helpful tool for beginners, but they’re not a shortcut to guaranteed success. The most common pitfalls—like blind trust, poor risk management, overtrading, and unrealistic expectations—can turn a promising journey into a painful one.

To avoid these mistakes:

- Learn the why behind each signal.

- Practice strict risk control.

- Use only verified providers.

- Trade selectively and stay disciplined.

- View signals as tools, not truths.

With education, caution, and smart tools like Traderstat.com, you can navigate the world of trading signals confidently—and start building a foundation for long-term success.