Money Management When Following Signals

1. Introduction

Trading signals—recommendations generated by analysts or automated systems—have become increasingly popular among retail traders seeking to simplify decision-making. These signals often include entry points, stop-loss levels, and profit targets. While signals can offer valuable guidance, especially for beginners, they do not eliminate the inherent risks of trading.

Money management is the cornerstone of sustainable trading success. Following signals without a sound financial strategy often leads to large drawdowns and emotional burnout. In this guide, we break down how to manage your capital effectively while following third-party trading recommendations.

2. The Foundation: Risk Management Principles

One of the most important principles is the 1-2% rule. This means you should risk no more than 1-2% of your total capital on a single trade. For example, if your account size is $10,000, your maximum risk per trade should be between $100 and $200.

Understanding risk-to-reward ratios is essential. You should aim for a minimum ratio of 1:2, meaning if you risk $100, your target profit should be at least $200. Ignoring poor risk-reward setups often leads to compounding losses.

Diversifying your portfolio is also crucial when following multiple signals. Avoid putting all your capital into a single strategy or asset. Spread your risk across different, ideally non-correlated trades.

To avoid emotional overtrading, establish maximum daily and weekly loss limits. For example, you might cap your daily losses at 5% and your weekly losses at 10% of your total capital.

3. Position Sizing Strategies

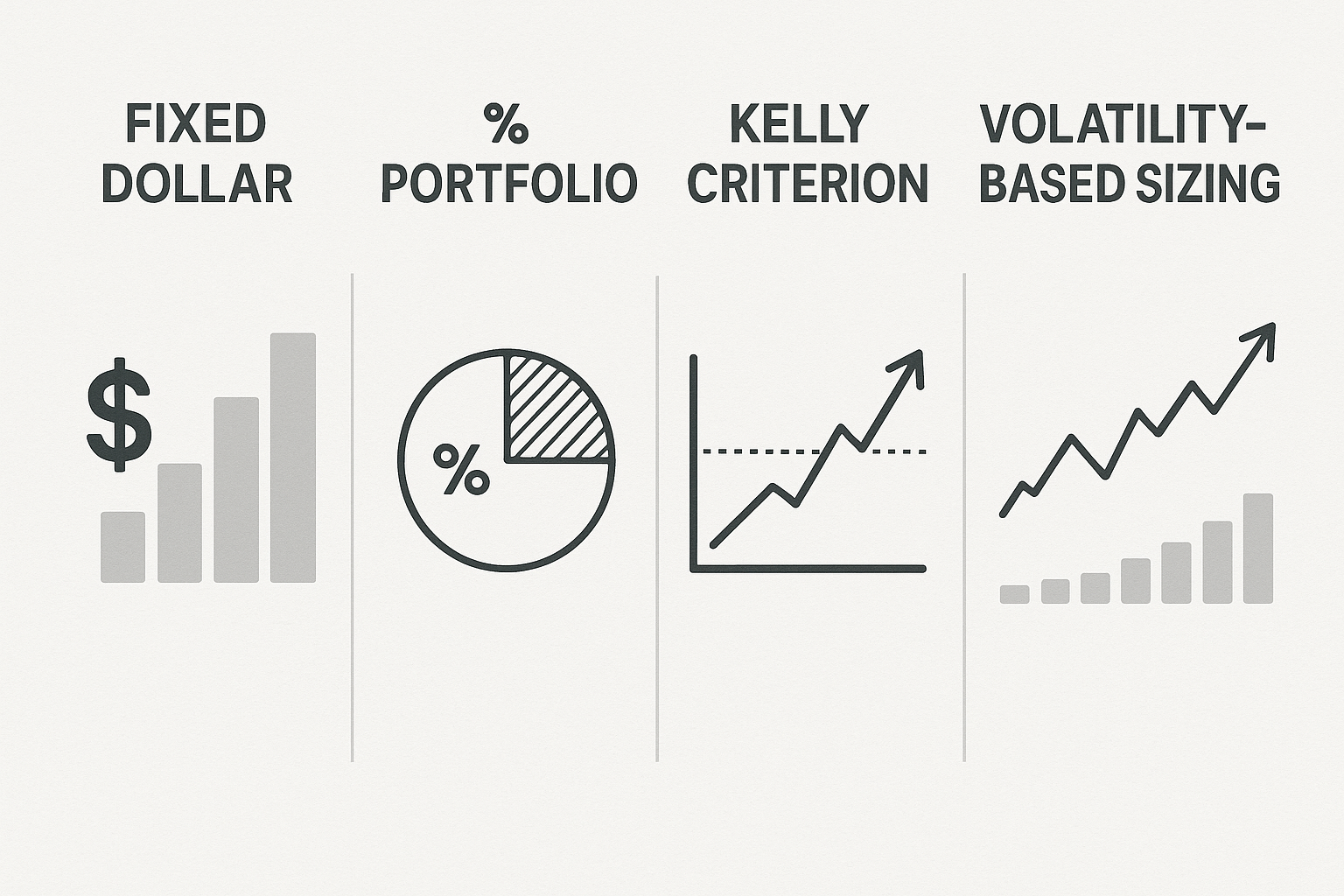

There are several ways to calculate position size. The fixed dollar amount approach involves risking a specific dollar amount on each trade, such as $200. This is simple but doesn’t adapt to account growth.

Alternatively, the percentage-of-portfolio method allocates a fixed percentage, like 2%, of your current capital per trade. This method scales with your account.

Some advanced traders use the Kelly Criterion, which calculates optimal position size based on your win rate and reward-to-risk ratio. A more conservative approach is to use half-Kelly to reduce volatility.

Volatility-based position sizing adjusts the trade size based on asset volatility, such as using average true range (ATR). This ensures that more volatile assets don’t risk excessive amounts.

Finally, consider adjusting position sizes based on the confidence level of the signal. For high-confidence signals with a strong track record, you might slightly increase your position size—but still remain within your maximum risk limits.

4. Essential Money Management Rules

Never risk more than you can afford to lose. This principle alone can save you from catastrophic drawdowns. Emotional decision-making is another major pitfall. Stick to your plan regardless of recent outcomes.

Stop-loss orders are non-negotiable. Always set one according to the signal or your own analysis. At times, market conditions may warrant skipping a trade, even if a signal is triggered. For instance, during highly volatile news events, staying out can be the best strategy.

Winning and losing streaks must be managed. After a series of wins, avoid overconfidence. After losses, avoid revenge trading. Stay consistent.

5. Signal Evaluation and Selection

Before following any signal provider, evaluate their track record. Look for verified histories on platforms like TraderStat.com. Consistency is more important than a few big wins.

Understand the difference between win rates and average gains/losses. A trader with a 40% win rate and 3:1 reward-to-risk ratio may be more profitable than one with a 70% win rate but a 1:1 ratio.

Beware of red flags, such as promises of guaranteed profits, vague or inconsistent performance, and frequent strategy shifts. These are often signs of unreliable services.

It’s wise to diversify across multiple providers and strategies. This spreads risk and increases the chance of consistent returns.

Free signals can be useful for learning, but they often lack the transparency and support of paid services. Always weigh the cost against the value delivered.

6. Common Money Management Mistakes

Over-leveraging is perhaps the most dangerous mistake. It magnifies both gains and losses and can wipe out accounts quickly.

Chasing losses with larger positions rarely ends well. Stick to your predefined risk limits.

Ignoring your own risk tolerance in favor of signal suggestions can cause undue stress and poor decision-making. Your trading plan should fit your comfort level.

Following signals blindly without understanding the rationale is risky. Use your judgment and basic analysis to confirm the trade.

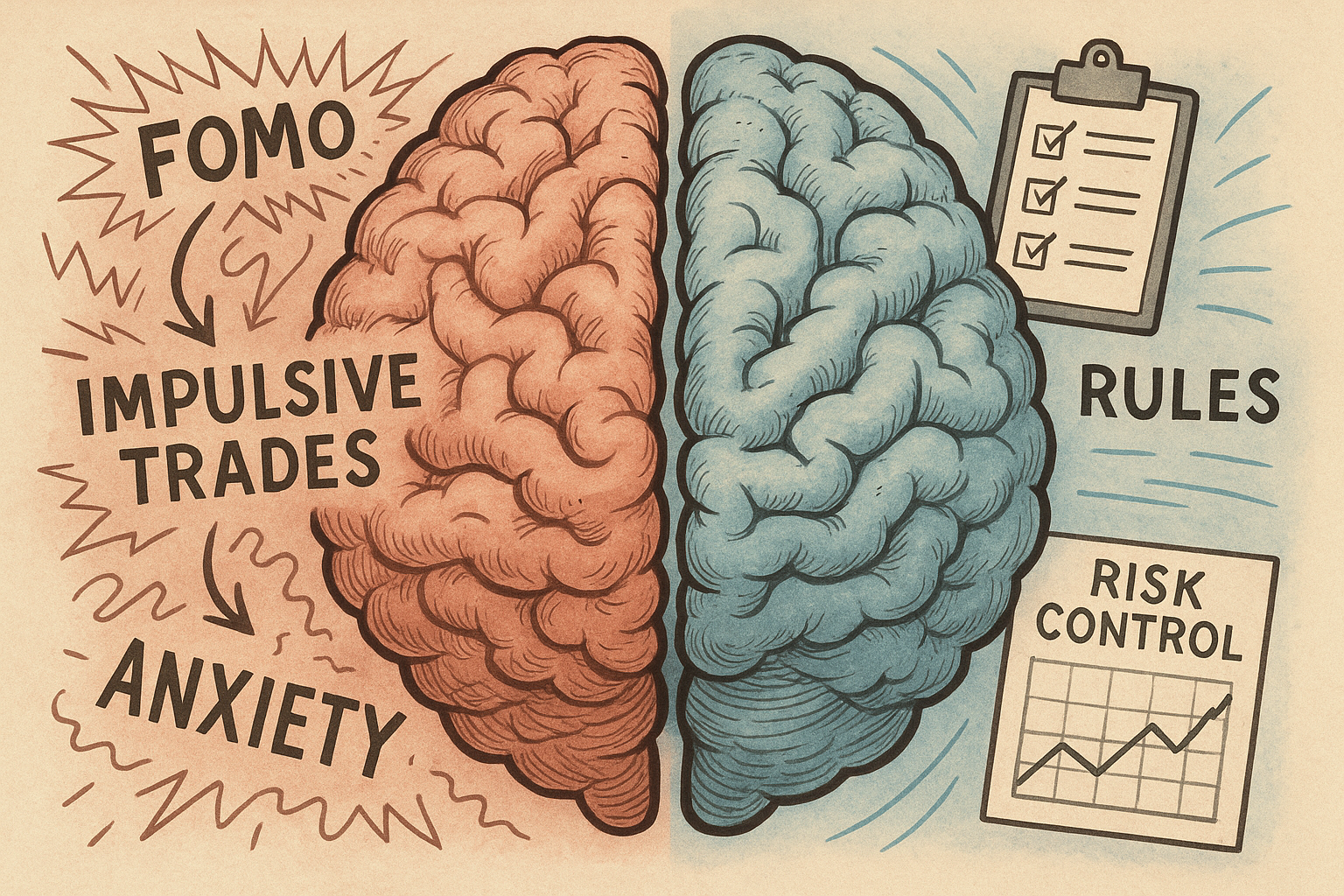

After consecutive losses, emotions can take over. This often leads to impulsive trades and further losses. Taking a break or reducing trade size can help.

7. Building Your Money Management Plan

A trading journal is essential. Record each signal-based trade along with the entry, stop loss, target, outcome, and emotional context. This helps identify what works and what doesn’t.

Set realistic profit expectations. Aiming for consistent 2-5% monthly growth is a healthy goal. It promotes sustainability and discourages reckless behavior.

Don’t rely solely on exit levels provided in the signal. Use tools like trailing stops or partial profit-taking to adapt to market movements.

Regularly review your performance. Look at your win rate, average risk-reward, and total drawdown. Make adjustments to improve consistency.

Finally, balance your use of signals with personal analysis. Learning basic technical or fundamental analysis enhances your confidence and decision-making.

8. Advanced Considerations

When following multiple signals, use a centralized platform or dashboard to manage them efficiently. Ensure you aren’t doubling down on similar trades.

Understand how correlated the signals are. If multiple providers suggest similar trades, you may be overexposed to a single market condition.

Be aware of the current market environment. Signals that work well in trending markets may fail during consolidation. Adapt your exposure accordingly.

Integrate fundamental analysis where possible. If a signal suggests going long before a major economic report, it might be wise to wait or reduce risk.

Lastly, consider tax implications. Frequent trading may be taxed differently. Consult a tax advisor to avoid surprises.

9. Psychological Aspects

FOMO, or fear of missing out, is a common psychological trap. Not all signals need to be taken. Missing one opportunity is better than entering a bad one.

Analysis paralysis occurs when overthinking leads to inaction. Define clear criteria for acting on signals and trust your system.

Building discipline takes time. A pre-trade checklist can help maintain consistency. For example: Is risk under 2%? Is the trend supportive? Am I in the right mindset?

Some may criticize signal-based trading. Focus on your performance and goals. What matters is results, not opinions.

Maintain realistic expectations. Trading is not a shortcut to wealth. It’s a skill that rewards education, patience, and discipline.

10. Conclusion

Using trading signals can be an effective strategy, but only when paired with disciplined money management. No signal service can guarantee profits, and the real edge comes from your ability to control risk, size positions appropriately, and maintain emotional discipline.

Key lessons include prioritizing money management over signal accuracy, trading within your risk tolerance, and understanding that consistency matters more than occasional big wins. Avoid the illusion of easy profits and invest in your trading education.

Signal-based trading should empower your decision-making, not replace it. Follow a structured approach, review performance regularly, and never forget: your capital is your most important asset.