Which Crypto Currency Pairs Generate the Most Reliable Signals?

Introduction

Crypto trading signals are like a trader’s radar — they help detect opportunities before they appear obvious to the broader market. But not every signal is trustworthy. Reliable signals save time, reduce stress, and improve consistency, while unreliable ones can quickly erode capital. To separate the noise from the signal, we analyzed data from five of the most profitable providers, covering accuracy, profit per trade, risk/reward ratios, and overall returns. The results highlight which pairs you can trust — and which should be approached with caution.

The Leaders in Signal Reliability

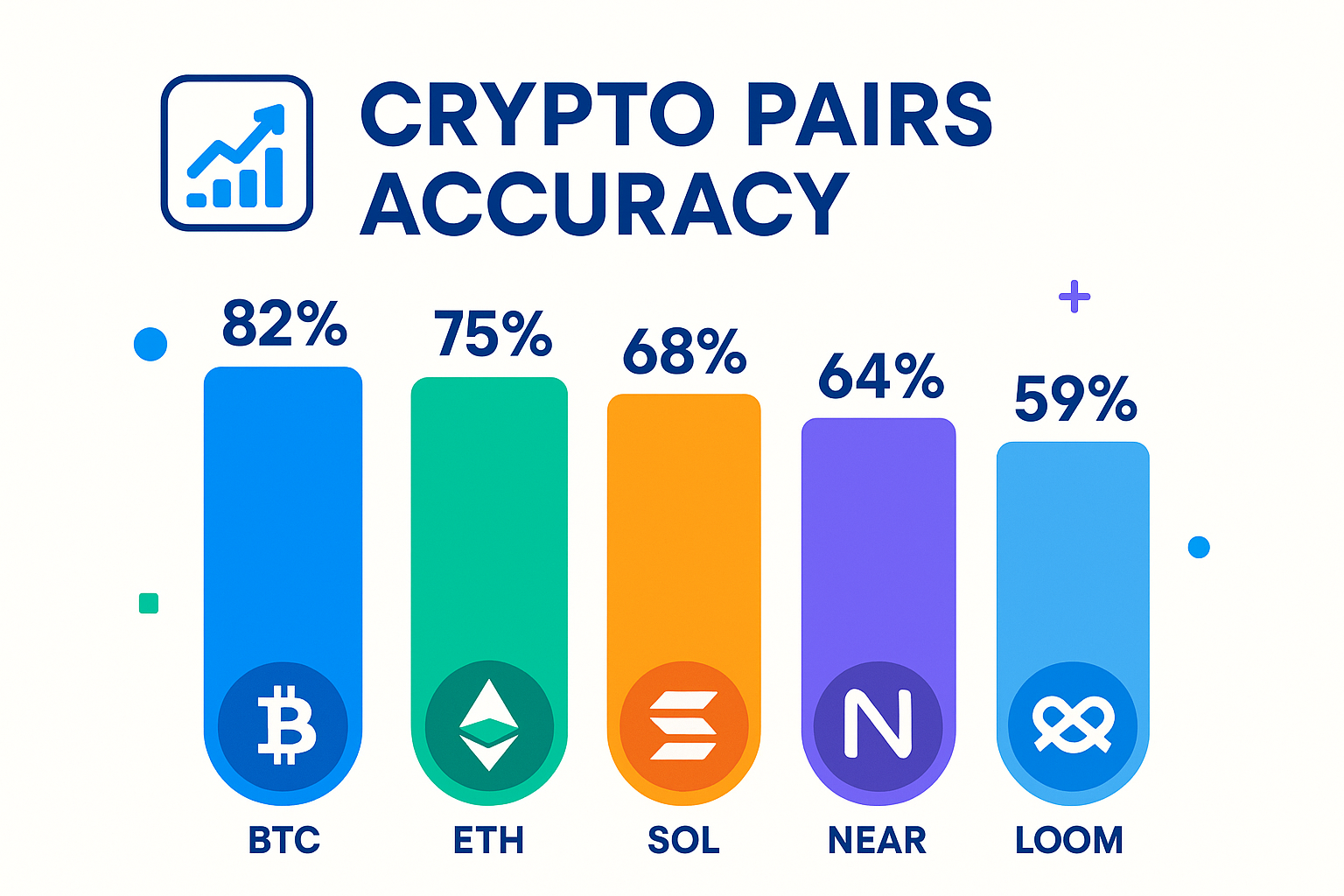

Unsurprisingly, Bitcoin and Ethereum dominate the landscape. Bitcoin has been the workhorse of crypto signals, and the numbers confirm it. One dataset tracked 400 trades with 336 successes, giving an 84% win rate and a staggering 98.54% overall return. Smaller datasets reinforce this reliability: in one case, BTC produced 22 out of 22 wins with an average profit of 1.72 and a 37.76% return.

Ethereum also proves its worth. Over 224 trades, ETH signals achieved a 75% accuracy rate and delivered 45.34% total returns. More refined datasets showed even stronger performance — one provider logged 17 straight wins, with 1.64 profit per trade and nearly 28% total return. ETH tends to carry steadier risk ratios than BTC, making it a favorite for traders who want both reliability and manageable volatility.

Altcoins Emerging as Reliable Options

Several altcoins demonstrate strong reliability, sometimes even surpassing the majors in accuracy. Solana stands out with accuracy levels consistently above 85%. In one set of 22 trades, 19 were successful, producing a 30.63% return. Larger samples showed steady returns in the 17–20% range, proving that SOL offers consistency across different timeframes.

Near Protocol has also impressed. With 16 recorded trades, 14 closed profitably, resulting in 87.5% accuracy, 1.32 profit per trade, and a 21% total return. This balance of liquidity and volatility makes NEAR signals both reliable and actionable.

A few smaller-cap pairs have delivered near-perfect accuracy. LOOM achieved 13 wins out of 13 trades with an average profit of 1.86 and a 24.19% return. TLM showed similar precision, with 86% accuracy across 15 trades and the single best total return in the dataset at 32.91%. While these pairs lack the depth of BTC and ETH, their precision makes them attractive for tactical traders.

Balancing Risk and Reward

Accuracy doesn’t tell the whole story. The average risk/reward ratio (RRR) reveals how much exposure traders take on to achieve results.

- BTC/USD: Wild swings, with ratios ranging from 21.59 up to 209+. The reward is high, but so is the drawdown risk.

- ETH/USD: More moderate, often between 18 and 175, offering steadier setups.

- SOL and NEAR: Ratios typically between 12 and 20, a sweet spot for balance.

- Microcaps like ENJ, KSM, DYDX: Lower ratios around 5–7, which shows contained risk but also reflects limited liquidity.

This demonstrates why some pairs are more comfortable to trade than others. A 90% win rate isn’t helpful if stop-losses are constantly oversized, while pairs like SOL and NEAR deliver smoother equity growth because of balanced risk profiles.

Why Certain Pairs Are More Reliable

The reliability of signals often reflects deeper market dynamics. Bitcoin and Ethereum benefit from enormous liquidity and institutional participation, which make technical levels more trustworthy. Solana and Near thrive because of strong retail and ecosystem growth, giving them steady volatility without chaotic unpredictability. By contrast, pairs like ADA and ATOM show mixed performance across providers, sometimes reaching 91% accuracy, other times dropping near 62%. That inconsistency often comes from uneven liquidity and the influence of speculative hype.

Using Signals Effectively

To make the most of reliable pairs, traders should adopt a simple but disciplined framework:

- Anchor trades in BTC and ETH for liquidity and proven long-term profitability.

- Add selective altcoins like SOL, NEAR, LOOM, and TLM for diversification, focusing on high-accuracy setups.

- Track both accuracy and RRR to avoid pairs that win often but carry disproportionate risks.

- Confirm with technical analysis before entering trades — signals are guides, not guarantees.

This approach prevents overtrading and ensures that reliability is combined with smart execution.

Conclusion

So, which crypto currency pairs generate the most reliable signals? The data is clear: Bitcoin remains the powerhouse, while Ethereum offers a steadier, lower-risk alternative. Among altcoins, Solana and Near stand out for their balance of accuracy and risk, while LOOM and TLM provide tactical opportunities with remarkable precision. The key takeaway is that traders should value quality over quantity. Reliable signals, especially when combined with sound risk management, can transform trading from a stressful gamble into a disciplined strategy.