Trade Bulls review

Introduction to Trade Bulls

Today, we will be discussing a crypto signal provider known as Bulls VIP. In their Telegram channel, they describe their offerings as follows: "Crypto signals, crypto news, technical analysis, fundamental analysis, and information that make our trading signals reliable." They also emphasize the importance of conducting your own research before investing, stating that they are not responsible for any losses incurred. Let's take a closer look.

Trade Bulls' Social Media

The provider has maintained a presence on Twitter since 2017, but currently has a relatively modest following of 1,643 followers. On this platform, they share insights and news related to the cryptocurrency market. However, it's important to note that their activity on Twitter is not as frequent as on their Telegram channel. Occasionally, they also post trading signals pertaining to the crypto market.

Trade Bulls also has an Instagram profile, but it appears to be inactive and not particularly noteworthy. The account has not seen any updates in about two years and only has 83 followers. Given its inactivity and limited engagement, it may not provide valuable insights or information for those interested in their services.

https://www.instagram.com/tradebullsbitcoin/

In the crypto world, platforms like Twitter and Telegram play a crucial role in disseminating information and engaging with the community. Since the provider currently only utilizes these two social networks, there is potential for growth. By increasing their presence and activity on other social media platforms, they could attract a broader audience and boost their follower count.

Engaging content, consistent updates, and interactive posts could help the provider leverage additional social channels to reach more potential subscribers. Strategies such as hosting live Q&A sessions, sharing educational content, and collaborating with influencers in the crypto space might also enhance their visibility and engagement across various platforms.

Telegram

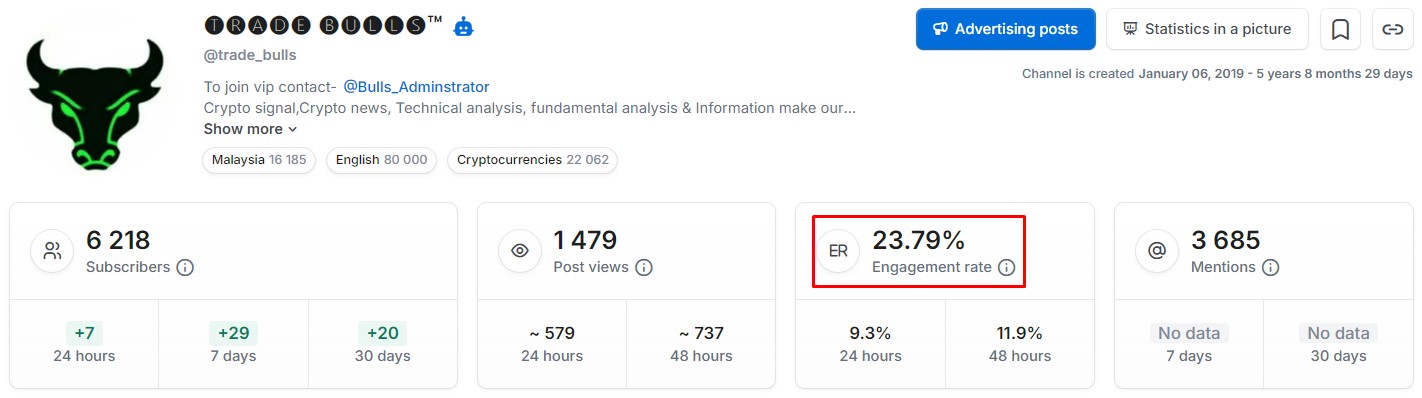

The primary source of signals for our operations is the public Telegram channel of Trade Bulls, which boasts a substantial subscriber base of over 6,200 individuals. While this figure reflects a decrease from last year's peak of more than 6,900 subscribers, the drop of only 4% is relatively minor.

Analyzing audience engagement reveals an impressive rate of 23.79%, a commendable performance within the cryptocurrency sector. This level of engagement highlights the channel's effectiveness in maintaining a dedicated community, making it a valuable resource for our trading activities.

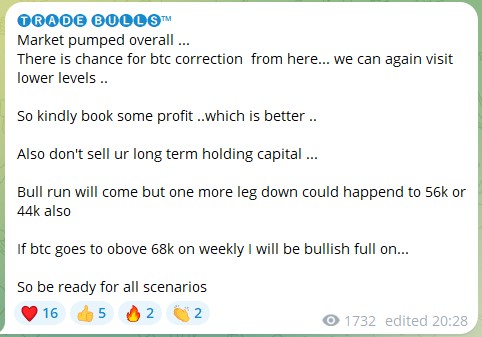

The provider's channel serves as an invaluable resource for those who prefer not to constantly analyze charts. Instead of overwhelming subscribers with complex graphs, the channel focuses on delivering concise signals, relevant news updates, and insightful commentary from the provider regarding capital flows within the cryptocurrency market. This streamlined approach allows users to stay informed and make strategic decisions without the need to monitor charts continuously. By offering a blend of actionable insights and market analysis, the provider's channel effectively caters to both novice and seasoned traders looking to enhance their trading strategies.

Trade Bulls Signals

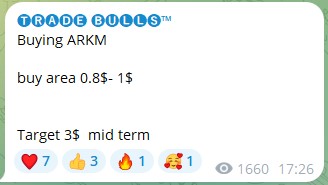

Let's analyze the crypto signals provided by Trade Bulls, starting with the first signal to buy the asset ARKM/USDT. The specified buy range was between $0.80 and $1.00, but it's important to note that the provider did not specify a stop loss level for this trade. The medium-term take profit target was set at $3.00.

As illustrated in the accompanying chart, the price initially rallied but did not reach the anticipated levels, peaking at approximately $1.60. While this represents a positive movement, it falls short of our target. However, there is still potential for the price to reach the $3.00 target in the near future, depending on market conditions and investor sentiment.

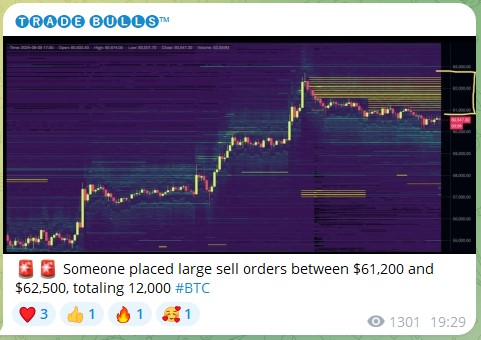

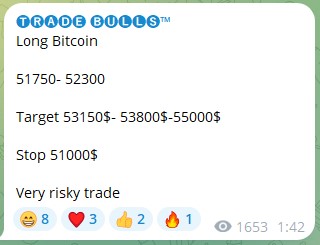

The next signal from Trade Bulls was also a buy recommendation. As previously mentioned, the provider generally focuses solely on long positions. This particular signal advised buying Bitcoin (BTC) within the zone of $51,750 to $53,200. It's important to note that the provider labeled this trade as "risky."

Upon reaching the entry levels, the price hovered around this range for an extended period. Unfortunately, rather than pushing upward, the price eventually declined and triggered the stop loss. This outcome underscores the inherent risk associated with this trade, as anticipated by the provider's warning.

Feedbacks

Currently, Trade Bulls lacks reviews, which is understandable given that the provider is relatively new and does not yet boast a substantial following on various social media platforms or within its Telegram channel, apart from its presence on Trustpilot. As the provider continues to develop and attract more subscribers, we may start to see a growing number of reviews and feedback, providing potential traders with more insight into the effectiveness of their signals and overall service. As Trade Bulls matures and garners more attention in the crypto community, it will be interesting to observe how their reputation evolves and whether they can establish a track record that resonates with traders.

Conclusion

Given that Trade Bulls primarily offers buy signals, traders may encounter a higher frequency of unsuccessful trades, especially in a bearish market trend. During periods of market decline, many of these signals are likely to face significant challenges, leading to increased risk and potential losses for traders. This scenario not only highlights the inherent risks associated with focusing exclusively on long positions but also raises questions about the analytical skills of the provider. It will be crucial for the provider to demonstrate an understanding of market conditions and adapt their strategies accordingly. If they can successfully navigate these challenges, it will be a strong indicator of their expertise and ability to provide value to their subscribers. Traders should remain mindful of the current market conditions and consider employing risk management strategies, especially when relying on long-only signals in a downturn.