The Bull review

Introduction to The Bull

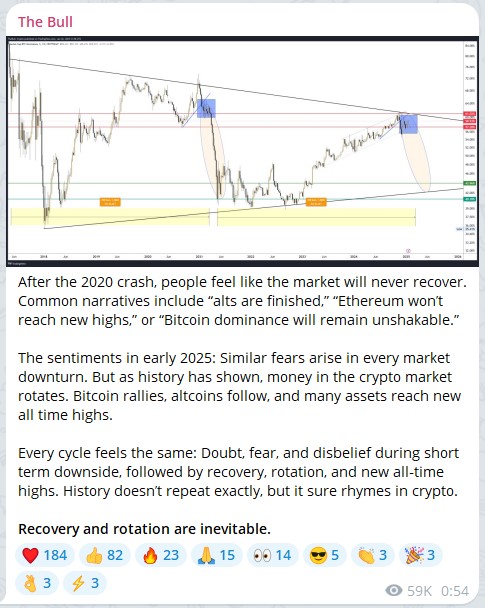

The Bull is a cryptocurrency market analysis provider operating primarily through Telegram and X (formerly Twitter) platforms. Since January 2018, they have built a significant online presence with over 242,000 Telegram subscribers and 147,000 X followers. The provider specializes in sharing technical analysis and market observations, particularly focusing on cryptocurrency price movements and trading patterns. Rather than offering traditional entry/exit trading signals, The Bull shares market insights and chart analysis while consistently emphasizing that their content represents personal observations rather than financial advice. Their content maintains a high engagement rate of 25.21%, suggesting active community interest in their analytical approach.

The Bull Social Media

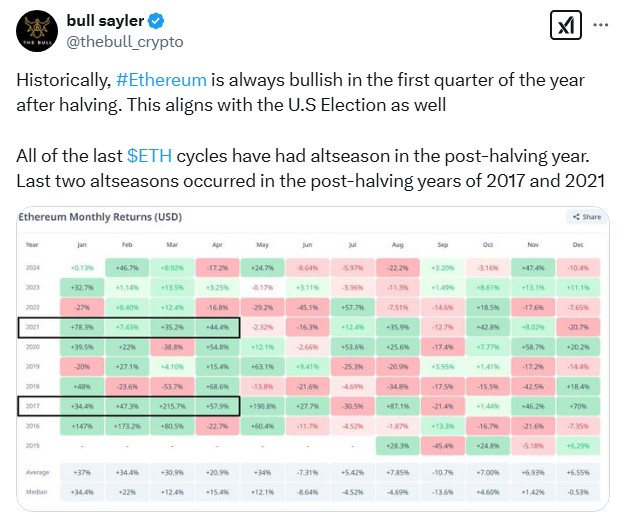

The Bull maintains an active presence on X (formerly Twitter) under the handle @thebull_crypto, where they have amassed a substantial following of over 147,300 followers since joining the platform in January 2018. The account regularly shares market analysis and observations about cryptocurrency trends, with a particular focus on Bitcoin and BNB. It's worth noting that the provider explicitly states in their profile that their posts constitute personal observations and opinions rather than financial advice, encouraging followers to conduct their own research.

bull sayler (@thebull_crypto) / X

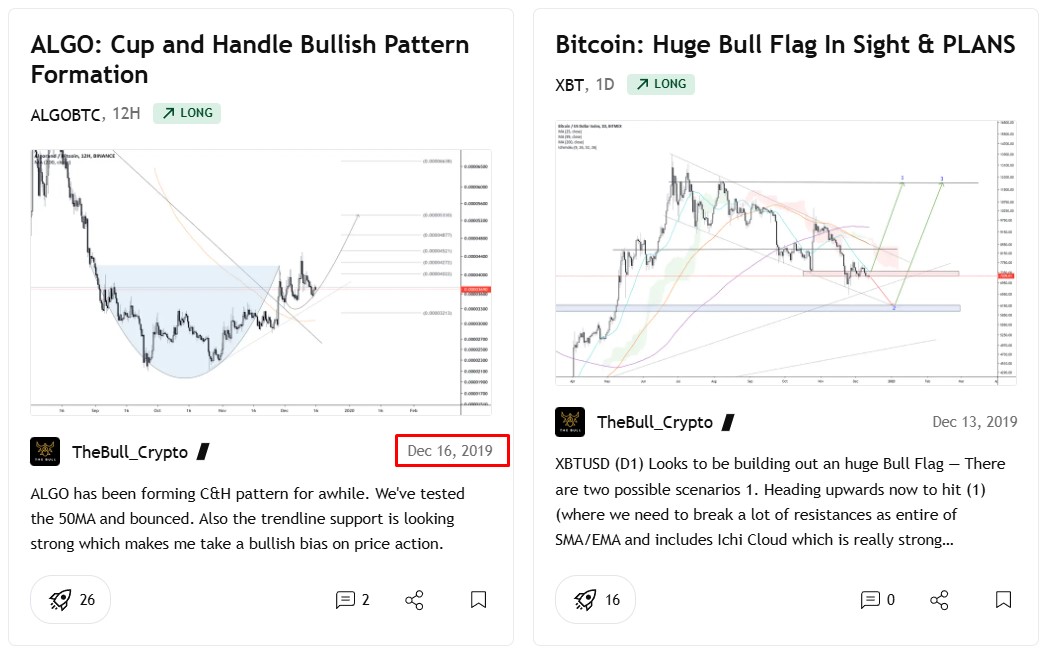

In addition to their presence on X, The Bull has maintained a profile on TradingView since 2018. Although the account has attracted around 1,300 subscribers, their activity on the platform seems to have stopped: their last market forecast dates back to 2019. Prior to that, they published 15 trading ideas, although they did not post any custom scripts through their profile.

https://www.tradingview.com/u/TheBull_Crypto/

Telegram

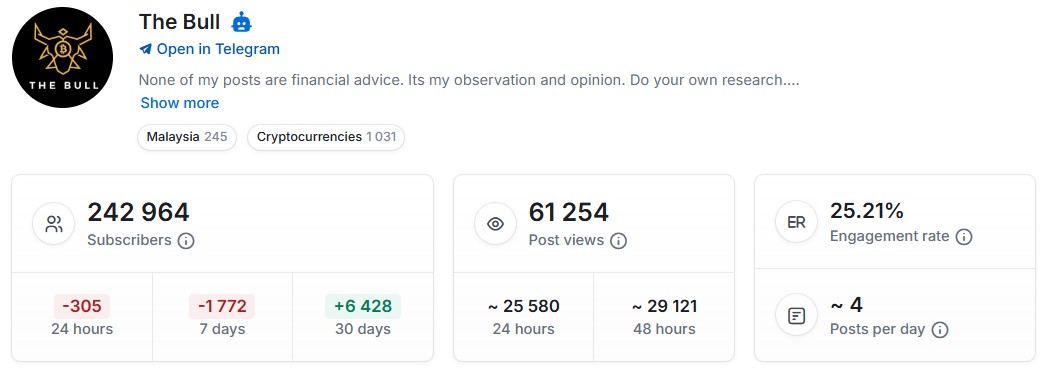

The main platform for the Bulls to exchange opinions on the market is their Telegram channel, which has reached 242,964 subscribers. The channel shows notable engagement rates: 25.21% and an average of 4 posts per day. Individual posts gain significant visibility, racking up around 25,580 views in the first 24 hours.

Historical data shows interesting growth patterns. While the channel has seen steady organic growth since February 2024 (174,286 subscribers) for most of the year, but December 2024 saw a significant spike in subscribers. This unusual growth pattern diverges from the previously established trend. Is this advertising or artificial growth?

The Bull maintains a clear organizational structure across their Telegram presence, with distinct channels for different purposes. Their main channel (@thebull_crypto) features a prominent disclaimer in its description, explicitly stating that all posts constitute personal observations and opinions rather than financial advice, with an emphasis on users conducting independent research.

The channel's management structure includes two key entities:

A business contact channel (@thebullowner), labeled as "El Camino"

An exclusive group (@TBE_SUPPORTER), designated as "BULL SUPPORT"

It's worth noting that while the channel maintains professional branding and consistent messaging across platforms, the administrators operate without disclosing their personal identities, choosing instead to communicate through dedicated business and support channels.

The Bull's Telegram channel primarily focuses on technical analysis of cryptocurrency markets through chart analysis and market commentary. Their content structure typically includes:

- Chart-based market analysis

- Technical pattern identification

- Market trend observations

- Price movement interpretations

While these analytical posts can serve as educational material for those new to cryptocurrency trading, it's important to note that the provider consistently emphasizes these are personal observations rather than trading recommendations. This analytical approach allows beginners to understand how experienced traders interpret market data, though users should remember to treat the analysis as educational rather than directive.

The Bull Signals

In examining The Bull's predictive analysis for FET/USDT, we can observe how market outcomes can differ from technical analysis expectations. The provider analyzed the FET/USDT chart and shared a forecast indicating an upward movement, identifying a specific resistance level as a target. Looking at the actual market outcome, while the price initially achieved a breakout above the identified resistance level, the momentum proved unsustainable. The price subsequently reversed its course and declined significantly, eventually returning to price levels last seen in August.

This case effectively illustrates several aspects of cryptocurrency market analysis that traders should consider. Technical analysis, no matter how detailed, cannot guarantee future price movements, and market volatility often overrides technical indicators. Furthermore, initial breakouts don't necessarily translate into sustained trends, highlighting why the provider consistently emphasizes that their posts are observations rather than financial advice. The unpredictable nature of cryptocurrency markets means that even well-reasoned technical analysis can lead to different outcomes than anticipated.

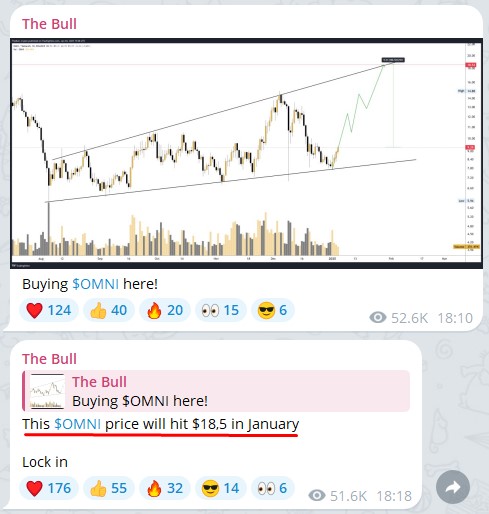

In analyzing The Bull's predictions for OMNI/USDT, we can examine multiple statements made by the provider. Initially, they expressed buying interest at a particular price level, apparently anticipating a bounce from the support level toward the channel resistance. While the price did maintain position above the support temporarily, it ultimately failed to sustain this level and declined.

What makes this case particularly notable is the provider's subsequent definitive statement about OMNI's future price, specifically predicting a target of $18.5 in January. This represents an interesting shift from their usual approach of sharing market observations to making a more precise price prediction with a specific timeline.

In examining the IO/USDT signal, we can observe a more successful analysis from The Bull. The provider identified a breakout from an established price range, forecasting an upward movement. The market action that followed partially confirmed this analysis, as the price did indeed move higher, though it didn't reach the full extent of the projected target.

This case demonstrates that technical analysis can effectively identify potential market opportunities, even if the final outcome doesn't fully match the initial expectations. While the price didn't achieve the ultimate target level the provider anticipated, traders who acted on the breakout observation could have potentially captured the intermediate price movement.

This particular analysis represents one of the provider's more accurate market reads, where the core premise of the trade - the breakout and subsequent upward movement - materialized as expected. However, it also illustrates the common scenario in trading where partial targets may be more realistic than maximum projected gains.

Feedbacks

Regarding user feedback and testimonials, there is limited external validation available for The Bull's services. The provider lacks presence on major review platforms such as Trustpilot, which typically serve as independent sources of user experiences. Additionally, while the provider maintains an exclusive group, they do not publicly share feedback or reviews from members of this premium service in their main Telegram channel.

This absence of public reviews makes it challenging for potential subscribers to assess the effectiveness of the provider's premium services or verify the experiences of current members. While this lack of reviews doesn't necessarily reflect on the quality of the service, it does limit the amount of independent information available to those considering joining their exclusive group.

Conclusion

The Bull demonstrates competent market analysis skills in the cryptocurrency space, evidenced by their substantial following of over 242,000 Telegram subscribers and consistent 25.21% engagement rate. Despite their large following and active community engagement, the notable absence of public reviews on major platforms like Trustpilot or testimonials from their exclusive group creates uncertainty about the long-term effectiveness of their service. However, their consistent emphasis on independent research and transparent approach to market analysis continues to resonate with their audience.