How to Choose a Reliable Crypto Signal Provider: A Comprehensive Guide

In the volatile world of cryptocurrency trading, having access to timely and accurate information can make the difference between profit and loss. This is where crypto signal providers enter the picture, offering insights and recommendations to traders seeking an edge in the market. However, with the proliferation of signal services, distinguishing between legitimate experts and opportunistic charlatans has become increasingly challenging. This guide aims to equip you with the knowledge and tools necessary to select a crypto signal provider that aligns with your trading goals, risk tolerance, and investment strategy.

What Are Crypto Signals and Why Do They Matter?

Crypto signals are trading recommendations or indicators provided by experienced traders or algorithmic systems that suggest potential entry and exit points for cryptocurrency trades. These signals typically include:

- The cryptocurrency pair to trade (e.g., BTC/USDT)

- Entry price or price range

- Take profit targets (often multiple levels)

- Stop-loss recommendations

- Risk assessment

- Timeframe for the trade

For traders, particularly those new to the cryptocurrency market, signals offer several advantages:

- Time Efficiency: Signals eliminate the need for constant market analysis, allowing traders to capitalize on opportunities without dedicating hours to chart analysis.

- Educational Value: Following signals from experienced traders can provide insights into market patterns and trading strategies.

- Emotional Discipline: Signal providers offer objective trade recommendations free from the emotional biases that often plague individual traders.

- Access to Expertise: Signals give traders access to the knowledge and experience of professional traders or sophisticated algorithms.

Types of Crypto Signal Providers

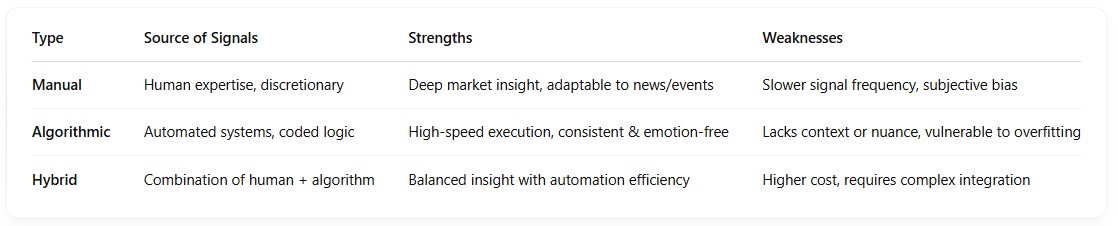

Understanding the different types of signal providers can help you identify which best suits your trading preferences:

Manual Signal Providers

These services are run by individual traders or teams who analyze markets and provide trade recommendations based on their expertise and analysis. The quality of these signals depends heavily on the provider's trading experience, analytical skills, and discipline.

Algorithmic Signal Providers

These use automated systems and trading algorithms to identify potential trade opportunities based on technical indicators, chart patterns, and market statistics. These providers often offer higher signal frequency and can monitor markets 24/7, but may lack the nuanced judgment of experienced human traders.

Hybrid Providers

Combining algorithmic analysis with human oversight, these services use automated systems to identify potential trades, which are then vetted by experienced traders before being sent to subscribers. This approach aims to balance the efficiency of algorithms with the discernment of human expertise.

Paid vs. Free Signals

While free signal channels may seem attractive, paid services typically offer more comprehensive information, higher accuracy, and better support. Free channels often serve as marketing funnels for paid services or may have hidden agendas, such as promoting certain cryptocurrencies.

Key Factors in Assessing Signal Provider Credibility

Track Record and Performance Metrics

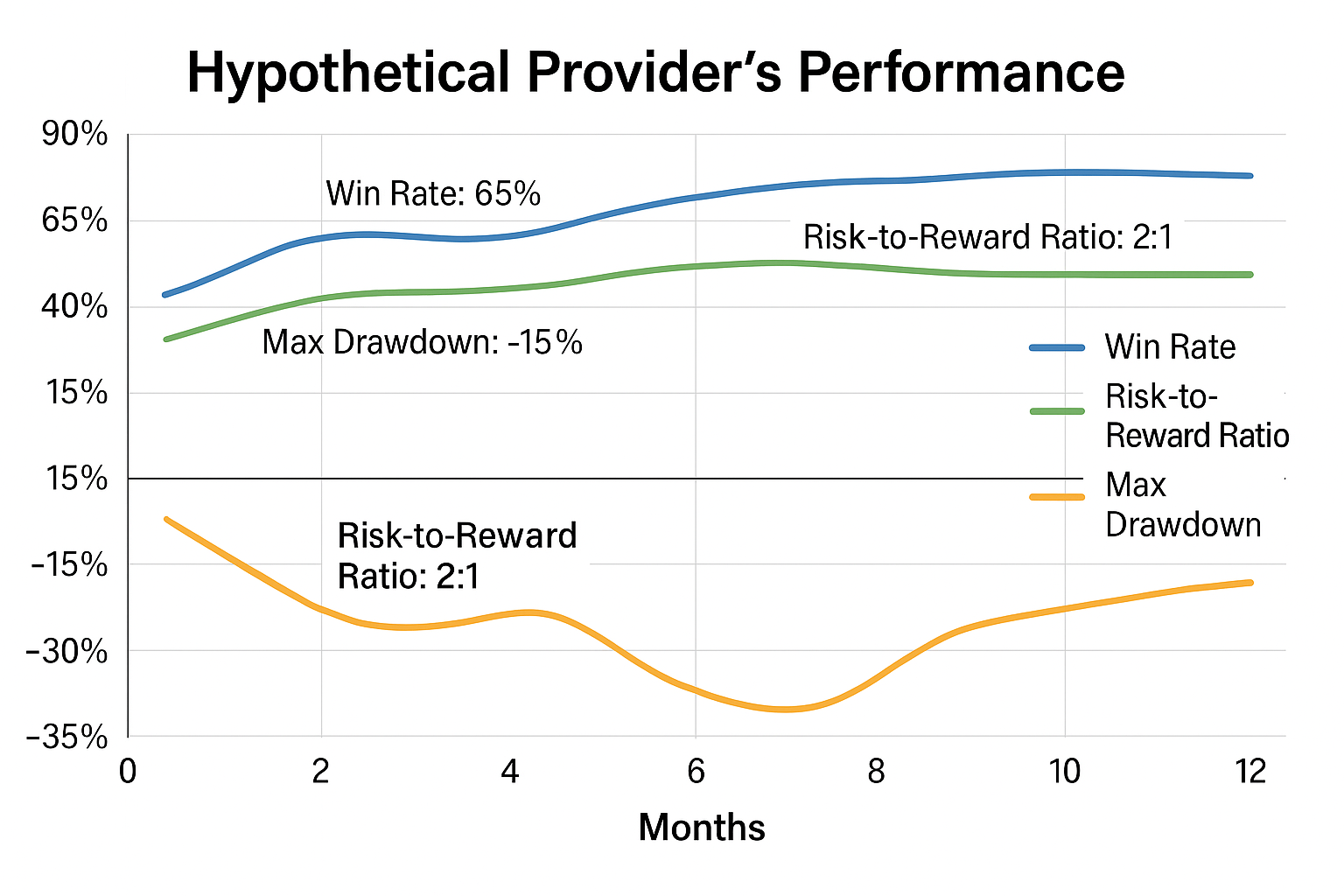

A reputable signal provider should maintain and display a verifiable track record of their performance. Key metrics to examine include:

- Win Rate: The percentage of signals that result in profitable trades.

- Risk-to-Reward Ratio: The average profit on successful trades compared to the average loss on unsuccessful ones.

- Maximum Drawdown: The largest peak-to-trough decline in account value.

- Profit Factor: The ratio of gross profits to gross losses.

- Consistency: Look for providers who perform reasonably well across different market conditions, not just during bull markets.

When evaluating these metrics, be skeptical of providers claiming unusually high success rates (e.g., over 90%) or extraordinary returns with minimal risk, as these often indicate misleading reporting or outright deception.

Transparency in Methodology

Credible signal providers are typically forthcoming about their general trading approach, even if they don't reveal their proprietary strategies in detail. They should explain:

- The types of analysis they use (technical, fundamental, or both)

- Their risk management principles

- Their general criteria for trade selection

- How they calculate and report their performance metrics

Providers who claim to have a "secret formula" or refuse to explain anything about their methodology should raise red flags.

Community Feedback and User Reviews

Third-party reviews and community feedback can provide valuable insights into a provider's reliability. Look for reviews on:

- Independent review platforms

- Trading forums and communities

- Social media groups focused on crypto trading

Pay attention to specific feedback regarding:

- The accuracy of signals

- The responsiveness of customer support

- Whether the provider honors their advertised services

- How they handle periods of poor performance

Be wary of reviews that seem overly promotional or lack specific details about the user's experience.

Experience and Background

Research the background of the team or individuals behind the signal service:

- How long have they been trading cryptocurrencies?

- Do they have relevant professional experience in finance or trading?

- Do they maintain a public profile that can be verified?

- Do they participate in the wider crypto community through educational content, webinars, or speaking engagements?

Established providers with a history in the market tend to be more reliable than anonymous services that appeared overnight.

The Importance of Trial Periods

Before committing to a paid subscription, take advantage of:

- Free trial periods

- Money-back guarantee periods

- Lower-tier subscription options

During these trial periods, critically evaluate:

- Signal Quality: Are the signals clear, timely, and actionable?

- Signal Frequency: Does the provider send an appropriate number of signals for your trading style? Too many signals may indicate low-quality filtering.

- Support Responsiveness: How quickly and effectively does the provider respond to questions?

- User Experience: Is the platform or communication channel user-friendly and accessible?

- Educational Value: Does the provider explain their rationale or offer educational insights alongside signals?

Track the performance of signals during your trial period, but remember that a few weeks may not provide a statistically significant sample size to judge long-term performance.

Alignment with Your Trading Strategy

A signal provider should complement your trading approach:

Trading Timeframe

Match the provider's timeframe with your own preference:

- Scalping/Day Trading: Look for providers offering multiple signals daily with short holding periods.

- Swing Trading: Seek providers focusing on multi-day or multi-week positions.

- Position Trading: Consider providers who identify longer-term trends and major market shifts.

Risk Tolerance

Evaluate whether the provider's risk management aligns with your comfort level:

- What percentage of capital do they recommend risking per trade?

- How wide are their stop-loss recommendations relative to profit targets?

- Do they advocate for proper position sizing?

Asset Focus

Ensure the provider covers the cryptocurrencies you're interested in:

- Some focus exclusively on Bitcoin and major altcoins

- Others specialize in DeFi tokens or NFT-related cryptocurrencies

- Some cover a broad spectrum of assets

Communication Methods and Signal Format

The way signals are delivered affects their usability:

Communication Channels

Common delivery methods include:

- Telegram channels or groups

- Discord servers

- Email alerts

- Dedicated mobile apps

- API access for automated trading

Consider which platform is most accessible and convenient for your needs.

Signal Clarity

Effective signals should include:

- Clear entry and exit instructions

- Specific price levels

- Risk management guidelines

- Timeframe expectations

- Rationale behind the recommendation

Vague signals that lack specific parameters force you to make critical decisions without proper guidance.

Common Pitfalls to Avoid

Unrealistic Promises

Be wary of providers who:

- Guarantee specific returns

- Claim to never have losing trades

- Promise to make you wealthy with minimal effort or risk

- Use aggressive marketing tactics that focus on luxury and wealth

Lack of Risk Management

Avoid providers who:

- Don't include stop-loss recommendations

- Encourage overleveraging

- Suggest allocating large percentages of your portfolio to single trades

- Don't acknowledge the inherent risks in cryptocurrency trading

Pump and Dump Schemes

Some signal groups are fronts for market manipulation:

- They accumulate positions in low-liquidity cryptocurrencies

- They recommend these assets to their subscribers, causing price increases

- They sell their positions as subscriber buying pushes up prices

These schemes often focus on obscure tokens with low market capitalization and trading volume.

Lack of Support During Drawdowns

How providers behave during losing periods reveals their integrity:

- Do they acknowledge losses transparently?

- Do they provide analysis of what went wrong?

- Do they have strategies for preserving capital during unfavorable market conditions?

- Do they disappear or make excuses when their signals underperform?

Conclusion

Selecting the right crypto signal provider requires thorough research, critical evaluation, and alignment with your trading objectives. By considering performance metrics, transparency, community feedback, and methodology, you can identify providers that offer genuine value.

Remember that even the best signal providers will have losing trades, and no service can guarantee profits. Ultimately, you remain responsible for your trading decisions and risk management. A signal provider should be viewed as a tool in your trading arsenal—not a substitute for developing your own knowledge and judgment.

Before committing to any provider, take advantage of trial periods, start with small position sizes, and continuously evaluate the service's impact on your trading results. With due diligence and realistic expectations, a quality signal provider can become a valuable asset in navigating the complex world of cryptocurrency trading.