Best Forex Signal Providers in May 2025: The Definitive Guide

In the ever-evolving world of forex trading, the ability to identify trustworthy signal providers is crucial. With hundreds of providers promising profitability, only a few consistently deliver results. That's where TraderStat steps in — the premier global platform for tracking, verifying, and comparing forex signal providers.

TraderStat's Mission and Unique Value Proposition

TraderStat is more than just a directory — it’s an intelligent analytics engine built to help traders make smarter, data-driven decisions. Each signal provider listed undergoes strict performance tracking and verification to ensure authenticity and transparency. With real-time data, comprehensive metrics, and side-by-side comparisons, TraderStat empowers both novice and experienced traders to select the signal providers that best align with their goals and risk appetite.

What makes TraderStat unique:

- Verified performance tracking based on real trades, not backtested results.

- User-friendly dashboards with clarity on win rates, average profits, holding periods, and transaction frequency.

- Ranking and filtering tools for fast and intuitive comparisons.

- Global access to the top-rated forex and crypto signal providers.

Let’s explore five standout forex signal providers dominating May 2025, according to verified data on TraderStat.

-

TraderStat

Key Features:

TraderStat isn’t a signal provider itself — it’s the ultimate hub that aggregates, verifies, and compares the world’s top-performing forex providers. With a proprietary system of real-time trade tracking and transparent metrics, TraderStat allows traders to cut through noise and identify signals that match their style and risk tolerance.

Pros:

- Industry-leading verification for accurate performance insights

- Comprehensive tools for comparing signal providers

- Centralized platform with a growing global database

- Empowering traders with transparency and control

-

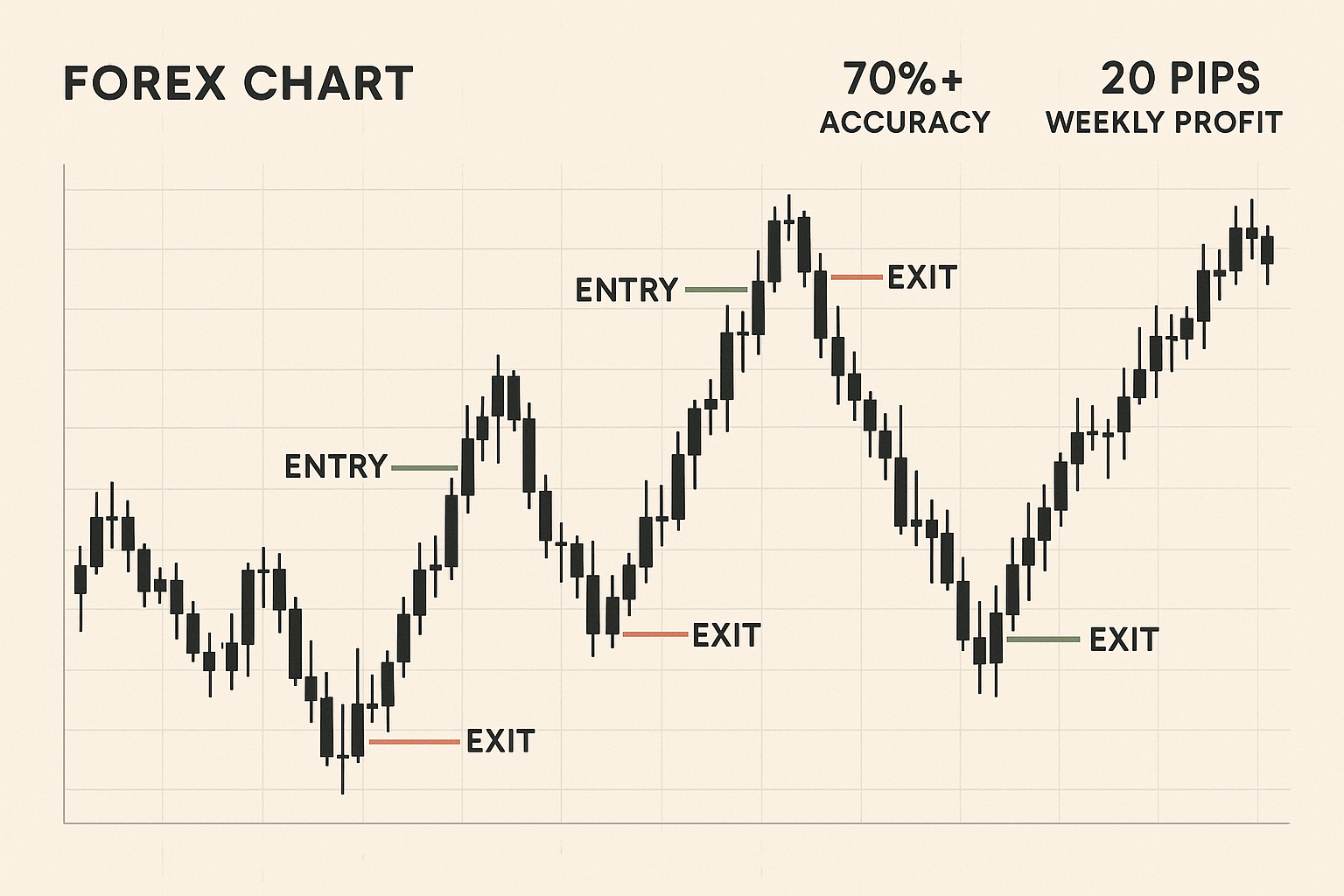

420FX

Key Features:

420FX is a low-frequency, precision-based signal provider ideal for traders who prefer minimal market exposure with solid returns. With a 70.32% accuracy rate and 14 pips average profit per trade, it delivers a consistent 20 pips weekly on average.

Pros:

- High win rate for low-frequency trading

- Ideal for passive or part-time traders

- Consistent weekly gains

-

Major Profit FX

Key Features:

Major Profit FX balances high accuracy (73.56%) with long-term profitability, accumulating 4077 pips in under 3 years. It maintains a moderate 0.5 trades per day and a 17-day average holding time for strategic growth.

Pros:

- Excellent risk-to-reward profile

- Efficient trade management

- Strong long-term performance

-

Pardus VIP

Key Features:

Pardus VIP is an active signal provider generating 2564 pips in just 351 days. With a 54.81% win rate and weekly profit average of 51 pips, it targets high-impact trades with an average holding period of 16.3 days.

Pros:

- High pip return in a short time

- Quick holding periods for faster trade cycles

- Good fit for high-volatility strategies

-

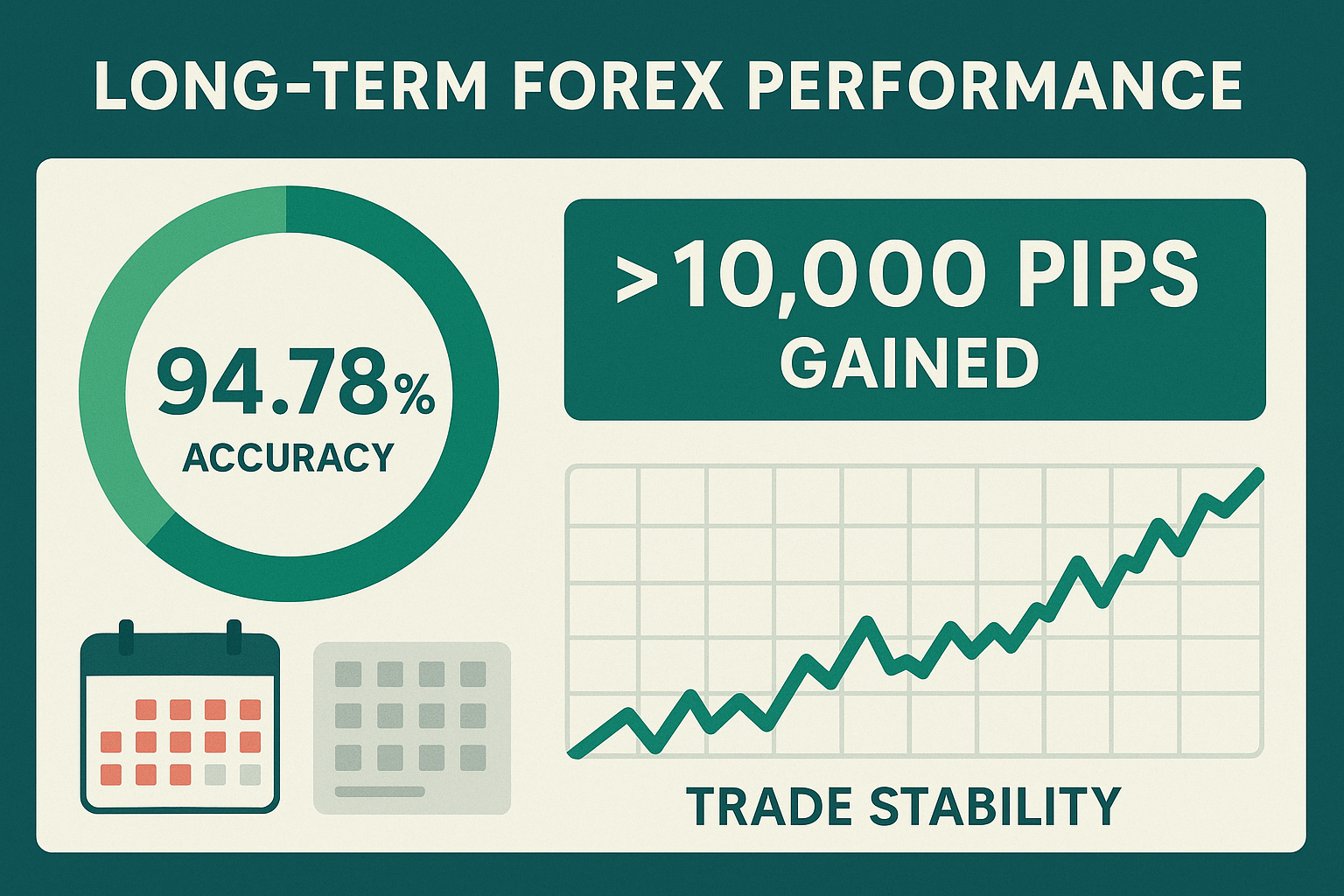

Lion FX

Key Features:

Lion FX stands out with a remarkable 94.78% accuracy and over 10,000 pips gained over 1534 days. Averaging 48 pips profit per week with a 22.7-day holding time, it is a model of long-term consistency.

Pros:

- Exceptional accuracy

- Long-term reliability and trust

- Excellent track record

-

Daily Forex DFS

Key Features:

Daily Forex DFS combines a 65.02% accuracy with 8852 pips of total profit across 1171 days. It delivers 53 pips weekly on average while maintaining longer-term trades with a 31.6-day holding period.

Pros:

- High pip volume with moderate trading

- Consistent weekly returns

- Strategic long-hold positions

Stay Vigilant: Avoid Forex Signal Scams

While there are legitimate providers delivering verified results, the forex industry is also plagued by scams and misleading claims. Many providers exaggerate performance, use backtested results, or manipulate trade histories to attract unsuspecting traders.

TraderStat combats this by offering verified, real-time tracking and only listing providers with transparent, proven records. Even so, traders should:

- Always verify performance data.

- Be cautious of unrealistic promises.

- Look for long-term consistency, not short-term hype.

- Use platforms like TraderStat to cross-check credibility.

Stay informed, compare providers carefully, and never rely on unverified sources for financial decisions. The best defense against scams is transparency — and that’s exactly what TraderStat delivers.

Final Thoughts:

Choosing the right forex signal provider can make a significant difference in your trading success. With the rise of misleading services and hype-driven marketing, it’s essential to rely on platforms that emphasize data integrity, long-term performance, and user empowerment. TraderStat brings transparency to the forefront of the forex industry, giving traders the clarity they need to act with confidence.