Margin Whales review

Introduction to Margin Whales

Today, we are excited to introduce Margin Whales, a prominent cryptocurrency signal provider that has made a significant impact across various social media platforms. With a substantial number of subscribers on their Telegram channel, it’s clear that their content resonates with users—after all, engaging content is vital for fostering a thriving community. Let’s take a closer look at what Margin Whales has to offer.

Margin Whales' Social Media

On Twitter, Margin Whales has surprisingly few followers—only 82. It is noteworthy that the provider has been active since its launch in 2020, yet has not managed to build a substantial following during this time. Despite regularly sharing updates and news from the cryptocurrency world, it seems possible that they have not invested considerable effort in promoting their Twitter profile.

Next, let's take a look at Instagram, where Margin Whales boasts a significantly larger following of 3,687 subscribers. However, the provider appears to be relatively inactive, as the last post dates back to April 2023. The account does feature alleged customer reviews and results from the VIP group as of March 2023. In their bio, the provider states: "Margin Whales provides leverage signals for all cryptos. We are the crypto whales." This raises a question—if they indeed position themselves as "whales" in the industry, why is there such little engagement and few posts?

https://www.instagram.com/marginwhalesgram/

Telegram

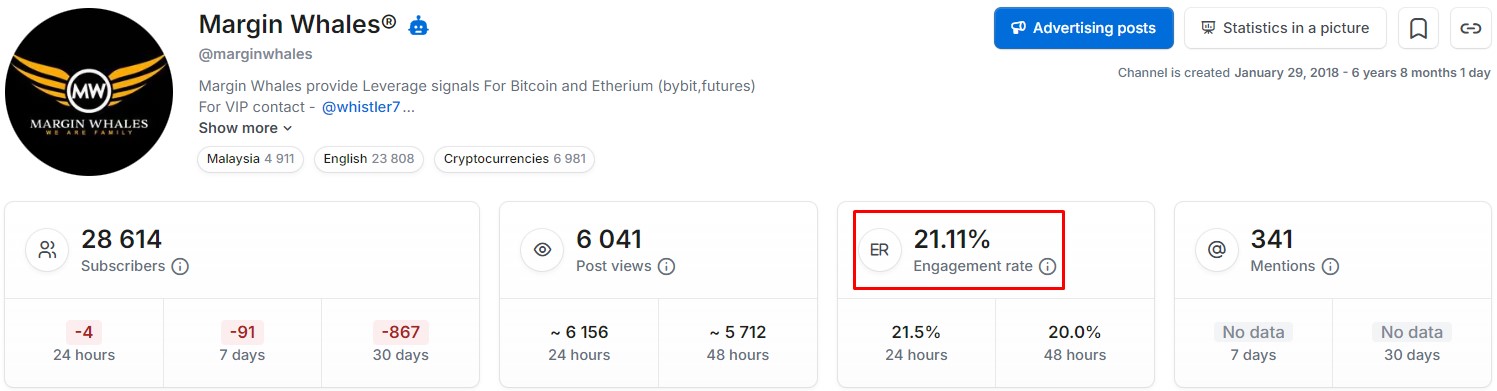

The primary source of trading signals for our analysis is the public Telegram channel, Margin Whales. Currently, this channel boasts an impressive 28,614 subscribers, which serves as a strong indicator of its popularity and relevance in the trading community. Even more noteworthy is the engagement rate, which stands at a commendable 21.11%, reflecting a vibrant and active community that contributes to the quality of the signals shared.

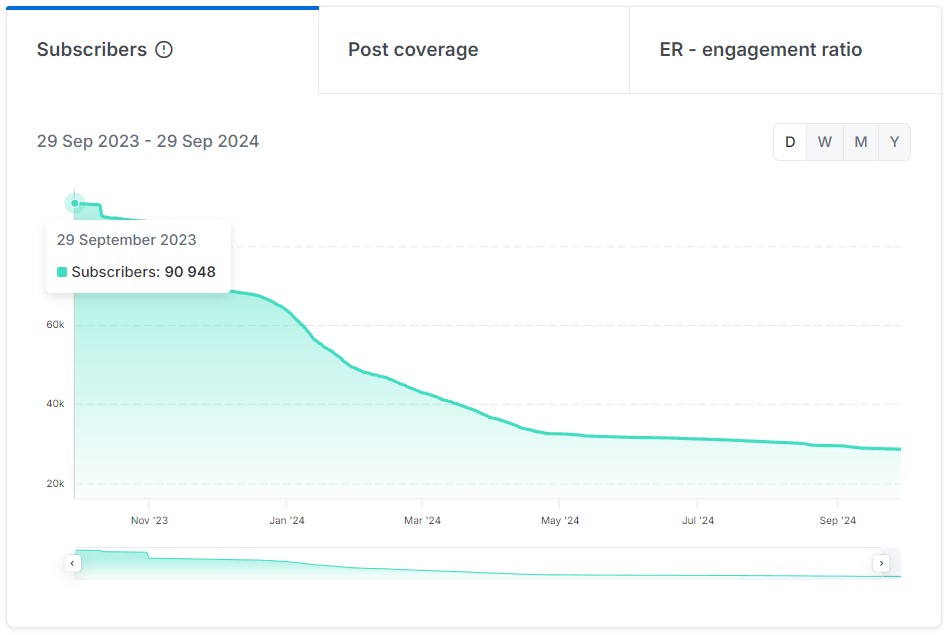

Despite these positive indicators, the Margin Whales channel has experienced a significant decline in subscribers over the past year. It’s hard to fathom that just a year ago, the channel boasted over 90,000 members, meaning it has lost approximately 60,000 subscribers during this period. The trend is concerning, as the provider continues to see a decline, with around 1,000 people unsubscribing in the last month alone. Several factors could contribute to this loss, including the prevailing bear market, a decrease in signal frequency, or a perceived decline in the quality of the signals being offered. Understanding these dynamics will be crucial for gauging the channel’s future trajectory.

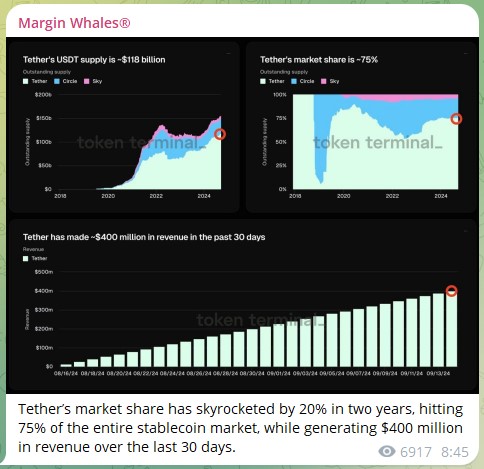

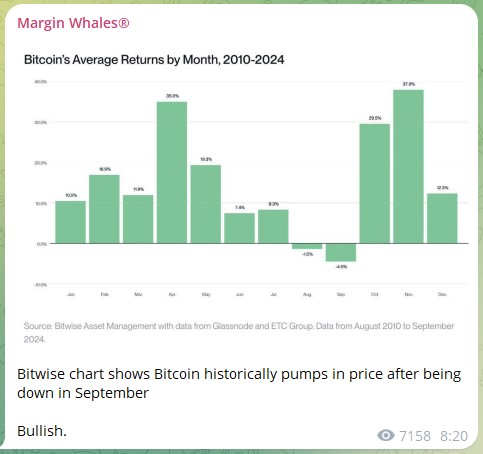

The provider’s Telegram channel is a valuable resource for the latest updates from the cryptocurrency world. By focusing on key economic factors that influence the crypto market, the channel ensures subscribers stay informed about crucial developments. This commitment to delivering timely news helps users navigate the ever-evolving landscape of cryptocurrencies effectively.

One interesting fact about this provider is that the original name of the channel was “Airdrop.” This name reflects the early focus on promoting various airdrop opportunities in the cryptocurrency space, which was a popular way to engage users and distribute tokens. Over time, the channel has evolved to cover a broader range of topics, including market news and economic factors affecting the cryptocurrency ecosystem.

Margin Whales Signals

The provider infrequently shares free signals on its Telegram channel, with the last signals being issued at the beginning of this year. Instead of providing specific entry and exit numbers, the focus is primarily on conducting technical analysis that indicates the expected direction of future price movements. One notable signal involved the crypto asset BNBUSDT, where the provider highlighted specific zones for buying, suggesting a potential upward movement for the asset. This approach allows subscribers to gain insights into market trends while relying on the provider's analysis rather than explicit trading instructions.

After the provider's publication regarding the BNBUSDT asset, the price entered a period of consolidation for a significant time. However, it ultimately moved in the anticipated direction, rising and eventually reaching the predicted price levels outlined in the analysis.

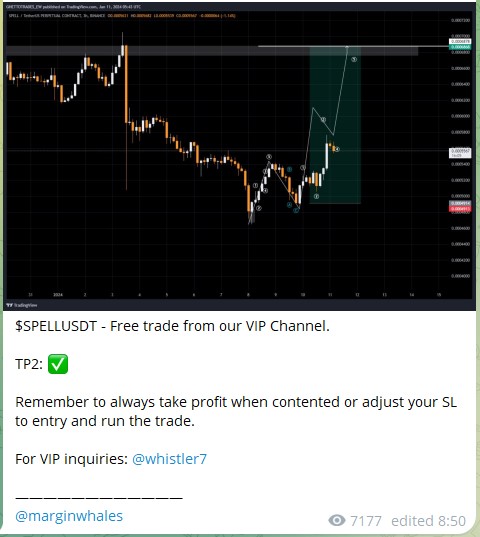

Following the successful analysis of BNBUSDT, the provider issued a complete buy signal for the SPELL/USDT asset at an average entry price of 0.0005. Along with the buy signal, the provider recommended placing a stop loss just below the local minimum to manage risk. After the signal was issued, the price of SPELL/USDT experienced an immediate upward movement, resulting in a return of 2R (twice the risk taken). As the trade progressed, the provider advised subscribers to move their stop loss to breakeven, which is a common risk management tactic to protect profits.

However, those who held onto their positions experienced two drawdowns during the upward movement. Despite this volatility, the price eventually reached all designated take profit levels, leading to a successful trade overall. This experience illustrates the potential rewards of trading based on the provider's signals, even amidst fluctuations, and underscores the importance of adhering to risk management strategies in trading.

Feedbacks

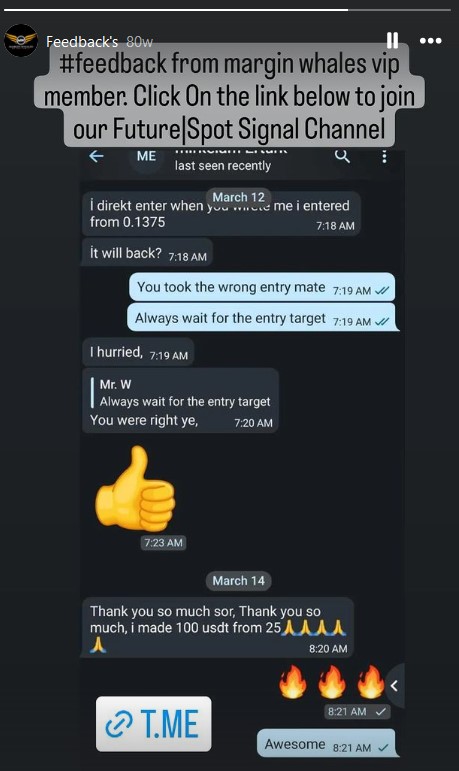

While the provider in question boasts a substantial number of subscribers on their Telegram channel, there is a noticeable scarcity of feedbacks about their services across the wider internet. Major review sites like Trustpilot do not have entries discussing this provider, which raises some concerns regarding their reputation and transparency. Additionally, despite the presence of the provider on Instagram, the only customer feedback available dates back to March 2023, with no subsequent reviews or testimonials appearing since then. This lack of recent feedback might suggest limited engagement from customers or a reluctance to share experiences publicly.

For potential subscribers considering this provider's services, it would be prudent to exercise caution. The absence of diverse and updated testimonials may indicate either a lack of client satisfaction or perhaps that the provider's audience has not felt compelled to share their experiences. Therefore, it's advisable to conduct thorough research and seek reliable reviews before making any commitments. Engaging with current subscribers on platforms like Telegram for their insights could also provide a clearer picture of the provider's performance and trustworthiness.

Conclusion

Margin Whales appears to position itself as a valuable news channel for those interested in the cryptocurrency market, providing insights and analysis that could be beneficial for understanding market trends. While the provider seems to demonstrate a solid level of analysis, the lack of reviews raises some concerns regarding its credibility and the experiences of its users. The decline in subscriber numbers over the past year may suggest that existing users are not fully satisfied with the services provided or that they have found alternative sources of information.

Additionally, the absence of a track record from the VIP group further complicates matters, as potential clients lack concrete data to evaluate the effectiveness of Margin Whales' signals. Without this information, it becomes challenging to assess the quality and reliability of the insights offered. Overall, while Margin Whales can serve as a good source of general information about the cryptocurrency landscape.