Crypto Hedger review

Introduction to Crypto Hedger

Today, we’re putting the spotlight on another crypto signal provider: Crypto Hedger. While it may seem like any other provider in the space, what sets Crypto Hedger apart is its unique approach — it does not offer any public signals. You can find it on Telegram, where it has amassed a significant following, as well as on platform X. Let’s take a closer look at Crypto Hedger and see what it has to offer!

Crypto Hedger's Social Media

Since the provider does not have a website, let’s begin by exploring its presence on Platform X. With nearly 10,000 subscribers, this platform serves as channel for Crypto Hedger. Here, the provider shares valuable insights from the world of cryptocurrencies, including information on airdrops, farming, and staking coins. Additionally, it covers special coin listings and offers a touch of market analytics to keep its audience informed.

Crypto Hedger (@cryptohedgerio) / X

The next platform we will discuss is TradingView. Unfortunately, Crypto Hedging does not share forecasts or analyze crypto assets. As a result, activity on the platform is minimal, with no recent posts and the last visit recorded on May 3. Additionally, the provider has only 12 subscribers, further highlighting the lack of engagement in this space.

https://www.tradingview.com/u/cryptohedgerio/

Telegram

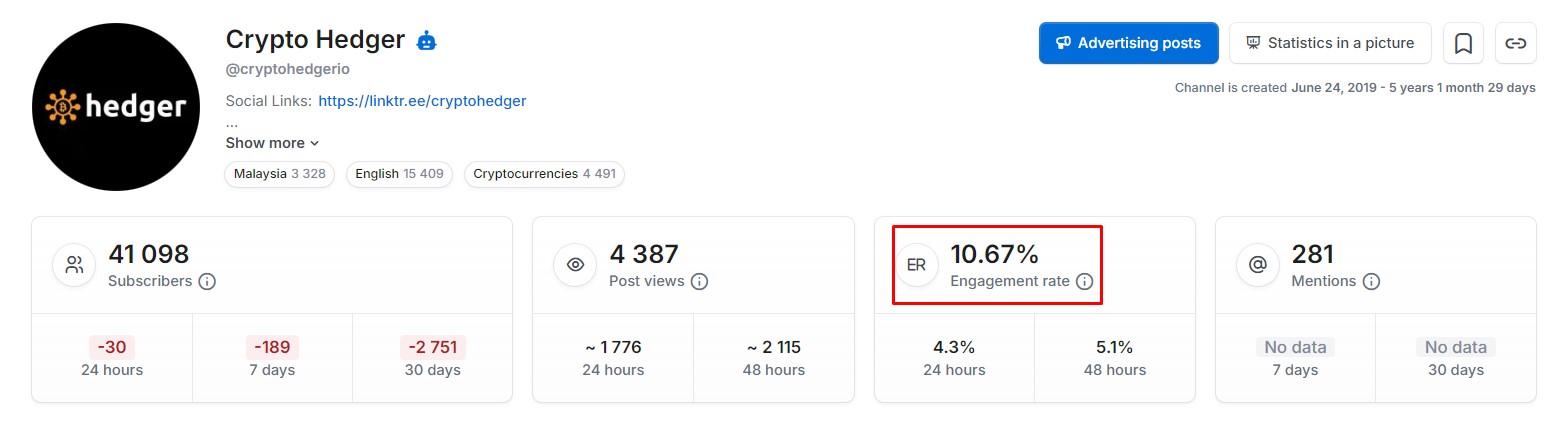

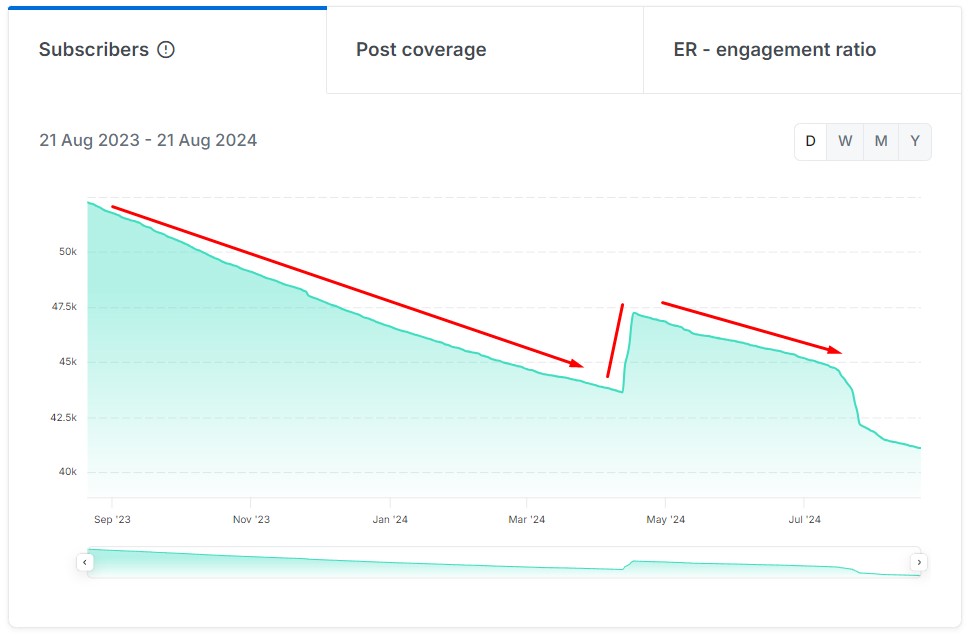

While Telegram is not the primary source of signals, it serves as a valuable reference point for analyzing the cryptocurrency market. A closer look at the subscriber growth reveals a concerning pattern of artificial inflation. Even though the platform boasts more than 41,000 subscribers, the actual engagement reflects a slow decline punctuated by sporadic spike—likely a result of advertising efforts? Nevertheless, audience engagement remains at 10%, which, when compared to many other signal providers, is a relatively strong indicator of interest.

On the public Telegram channel, users can expect to see a departure from traditional signals that typically focus on specific entry and exit points for trades. Instead, the provider has shifted its approach to identify potential crypto projects that could yield profits or air drops, offering alternative ways to earn. In recent months, the focus has been on “tap to earn” projects, which aim to provide users with opportunities to engage with platforms and maximize their earnings.

This shift from conventional trading signals to highlighting emerging projects and innovative earning methods is noteworthy and reflects a broader trend in the crypto space. It may cater to an audience looking for diverse ways to participate in the market beyond standard trading strategies.

Crypto Hedger's Signals

From the signals provided, we can analyze how the crypto hedger provider attempts to predict the general direction of the market. For instance, the provider indicated a bullish outlook for the crypto asset XVGUSDT, advising to "buy!" This signal was based on the anticipation of a breakout from a flag pattern, a commonly recognized technical analysis pattern.

Upon reviewing the subsequent price action shown in the chart, it's evident that while the price eventually moved upwards, it first experienced a decline. This price fluctuation—potentially a "false breakout" or a dip before the anticipated rise—illustrates a scenario where the initial entry point may not have been optimal. If traders acted on this signal without proper risk management or consideration of the potential for short-term volatility, they could have faced an unprofitable trade before the asset began its upward movement.

In the case of the APTUSDT forecast, the provider's analysis suggested a bullish outlook, indicating that the price was expected to rise from a support zone. By advising to "buying $APT some here," the provider pointed to a strategic entry point where they believed the asset would start to gain momentum.

The effectiveness of this prediction is illustrated by the subsequent price movement, which indeed rose to the level indicated by the provider. This successful forecast highlights the provider’s ability to identify key support levels and predict market trends—an essential skill in trading.

Traders who acted on this signal could have potentially benefitted from the predicted upward movement, demonstrating the value of following informed signals that incorporate technical analysis. Successful trades like this one can reinforce the credibility of the crypto hedger provider and their methodologies in market analysis, encouraging traders to stay engaged with their insights for future opportunities.

Feedbacks

It's quite surprising that despite having 41,000 subscribers, the provider lacks any reviews, including on their Telegram channel. Additionally, Crypto Hedger has no reviews on prominent sites like Trustpilot. In the cryptocurrency industry, reviews are essential as they build trust and credibility. It would be beneficial for the provider to showcase feedback from customers and subscribers, as this could significantly enhance their reputation and instill confidence in potential clients.

Conclusion

Crypto Hedger demonstrates strong analytical capabilities, which is commendable. However, the absence of reviews and a decline in subscribers raises some concerns. Additionally, the lack of signals in the Telegram channel may suggest limitations in the trader's abilities. On a positive note, the provider's sharing of potential projects indicates a proactive approach to engaging with their audience. Overall, while there are strengths to note, addressing the areas of concern could significantly enhance credibility and attract more followers.