TradingByCF review

Introduction to TradingByCF

TradingByCF has positioned itself as a comprehensive provider of trading signals for cryptocurrencies and forex, appealing to both novices and experienced traders thanks to its community-oriented platform. While the platform boasts a number of features such as proprietary trading strategies, automated trading options via the Cornix Trading bot, and specialized support, not everything is as seamless as it seems. Let's take a closer look at the provider and analyze it.

TradingByCF Website

TradingByCF's platform presents itself as a crypto and forex trading signal provider, offering a community-focused approach to trading. The website's homepage leads with a statement promoting their trading platform and community of traders, while emphasizing potential financial opportunities. Their primary offering appears to be trading signals designed for both cryptocurrency and forex markets.

The provider goes on to answer the question "Why Trading By Cf Is The Best Trading Platform?" on the website. TradingByCF describes their key offerings through several features: an experienced team utilizing proprietary trading strategies, automated trading through Cornix Trading bot, and beginner-friendly signal setups. The platform emphasizes quality over quantity in their signals, featuring what they describe as a unique analysis style focusing on Bitcoin support and resistance points. Their service includes VIP support through a dedicated chatroom and claims to provide specific guidance on market entry and exit points. The platform focuses particularly on identifying optimal trading opportunities in both crypto and forex markets

TradingByCF offers three subscription tiers for their trading signals service:

- Beginner Plan: $300 for 30 days, targeted at newcomers to crypto markets

- Superior Plan: $1,300 for 6 months, designed for intermediate traders

- Lifetime Plan: $2,300 for unlimited access

Each plan includes their signal service, though prospective users should carefully evaluate these pricing options against their trading goals and experience level.

In reviewing TradingByCF's 'About Us' section, it's notable that the platform maintains complete anonymity regarding its team composition, background, and trading experience. Instead of providing team credentials or operational history, they present a list of goals and service objectives. These include providing crypto and forex trading signals, technical analysis, trading education, and automated trading solutions across major cryptocurrency exchanges like Binance, Bitmex, and Bybit. While they outline comprehensive trading support services, the lack of transparency about the team behind the platform is a significant consideration for potential users conducting due diligence.

Looking at TradingByCF's FAQ section, several concerns emerge regarding transparency and risk disclosure. The section appears to focus on predetermined questions while avoiding critical industry-specific inquiries. When addressing profit potential, their response about signals 'reaching minimum first targets' lacks clear risk disclosure and specific performance metrics. This type of vague language about trading performance, combined with the absence of typical trading risk warnings, warrants careful consideration from potential users. Notably missing are important questions about risk management, historical performance statistics, and detailed trading methodologies.

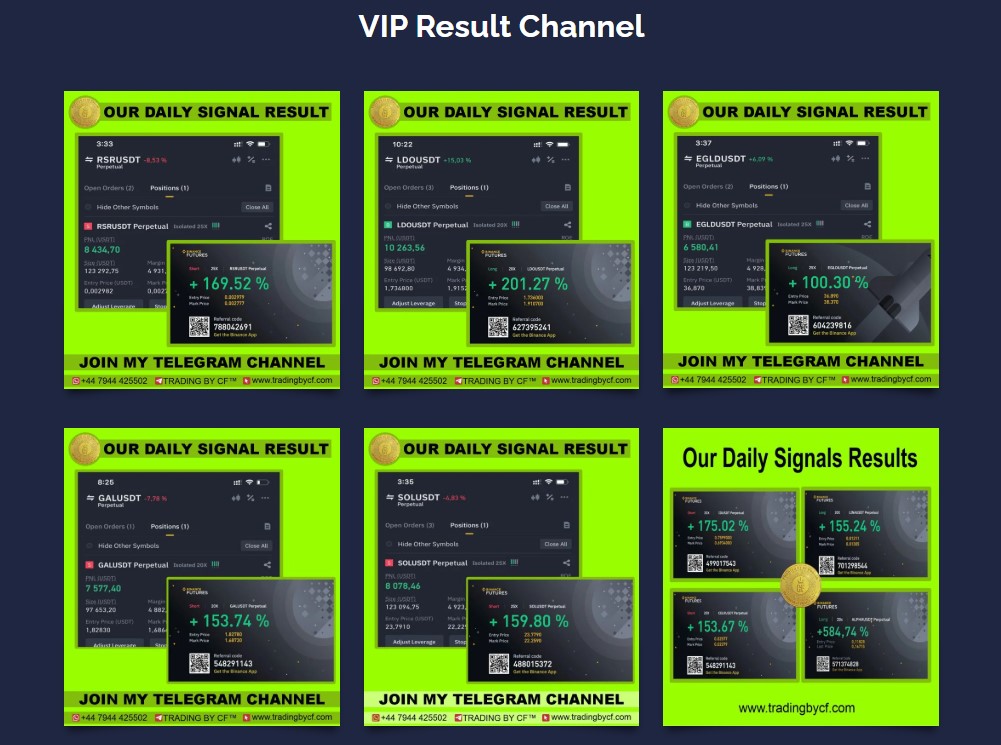

The 'Signals Results' section of TradingByCF displays what appear to be trading screenshots showing extremely high profit percentages, ranging from 100% to over 500%. These results warrant significant skepticism for several reasons:

- The images show isolated trading instances rather than a comprehensive track record

- The claimed profit percentages (reaching up to 500%) are unusually high and should be viewed with caution

- There's no way to verify these results independently

- The screenshots lack important context such as trade duration, risk management, or overall portfolio performance

It's important to note that legitimate trading performance reporting typically includes comprehensive statistics, verified track records, and clear risk disclosures rather than selective screenshots of exceptional gains. Potential users should exercise due diligence when evaluating such performance claims.

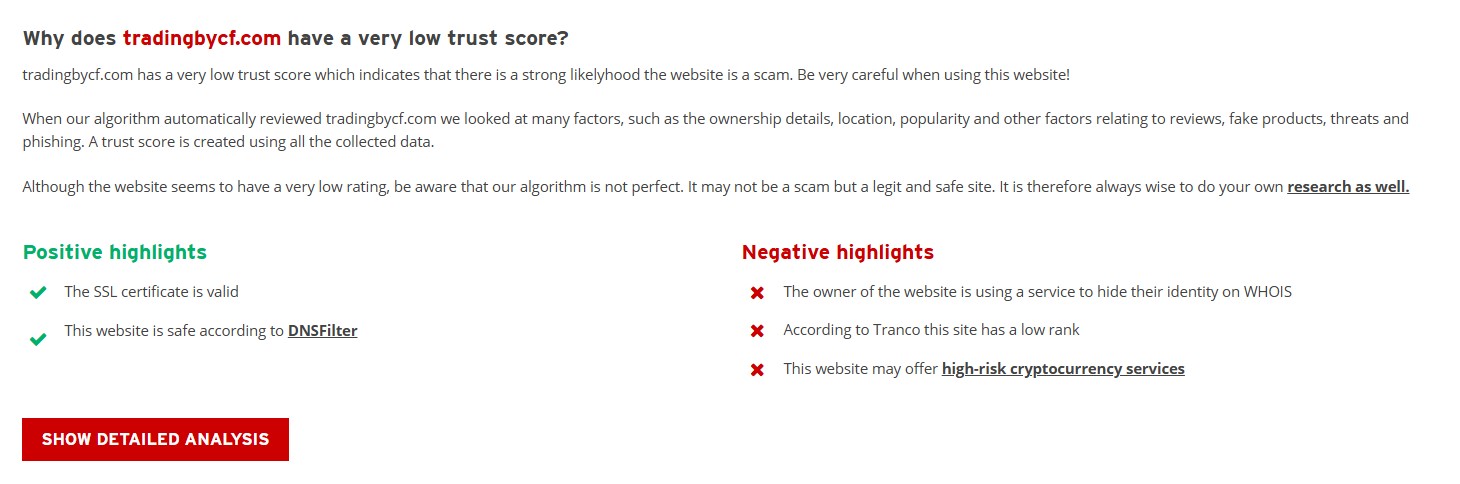

TradingByCF.com currently shows a very low trust score at Scamadviser, suggesting a significant possibility that the website could be unreliable. Users should exercise caution when interacting with this platform. Scamadviser algorithmic review of tradingbycf.com examined multiple factors, including ownership details, location, popularity, user reviews, potential fake products, security threats, and phishing risks. The trust score was calculated based on this comprehensive data analysis. While the website has received a low rating, it's worth noting that our algorithm isn't infallible. The platform could potentially be legitimate and safe, despite the low score.

TradingByCF Social Media

TradingByCF maintains a presence across multiple social media platforms. On one platform, the account operates under the name "Tradingbycf billionaire" and has accumulated a following of approximately 18,100 followers, with 8,800 likes and 1,600 shares of their content.

https://www.binance.com/en/square/profile/tradingbycf_public

The provider also maintains an account on X (formerly Twitter) under the name “Tradingbycfpro”, where they have significantly fewer followers - only 48 people. This account is linked to their Telegram channel, but it shows a different website.

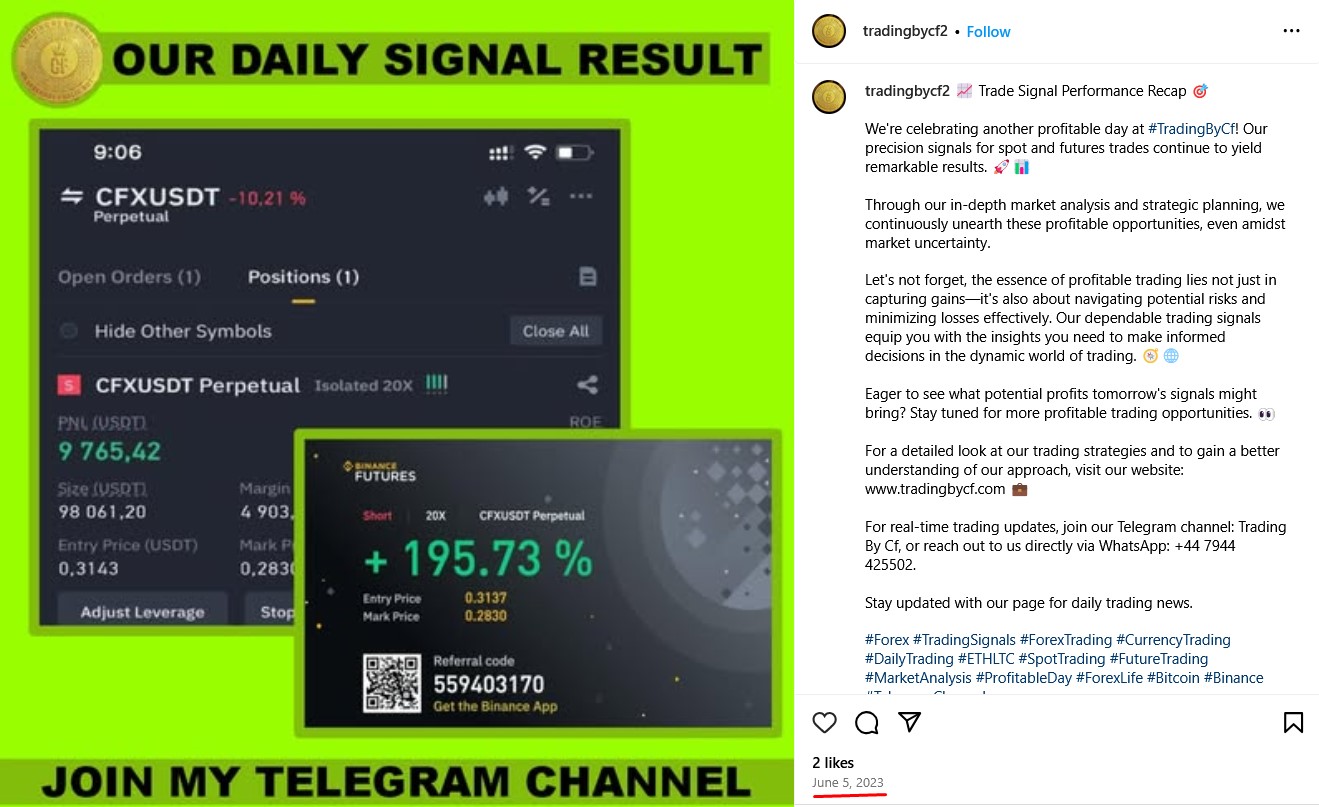

A quick glance at of TradingByCF's Instagram presence (@tradingbycf2) shows a limited social media footprint with only 116 followers and 54 posts, with their last activity recorded in June 2023. The account follows just 4 other profiles, suggesting minimal platform engagement. Their Instagram content mirrors their website's approach, primarily sharing screenshots of purported trading results showing high percentage gains. The posts maintain the same promotional tone seen on their website, emphasizing profitable trades and market opportunities.

https://www.instagram.com/tradingbycf2

A significant concern is the continued lack of transparency regarding their team composition. While they describe themselves as a "Team Of Professional Traders" and frequently use collective terms like "we" and "team" in their posts, there is no information about who these traders actually are or their professional backgrounds. This anonymity, combined with the relatively low follower count, raises questions about the provider's market presence and professional credibility. Their social media strategy appears focused on displaying selective trading results rather than building trust through verified expertise or educational content.

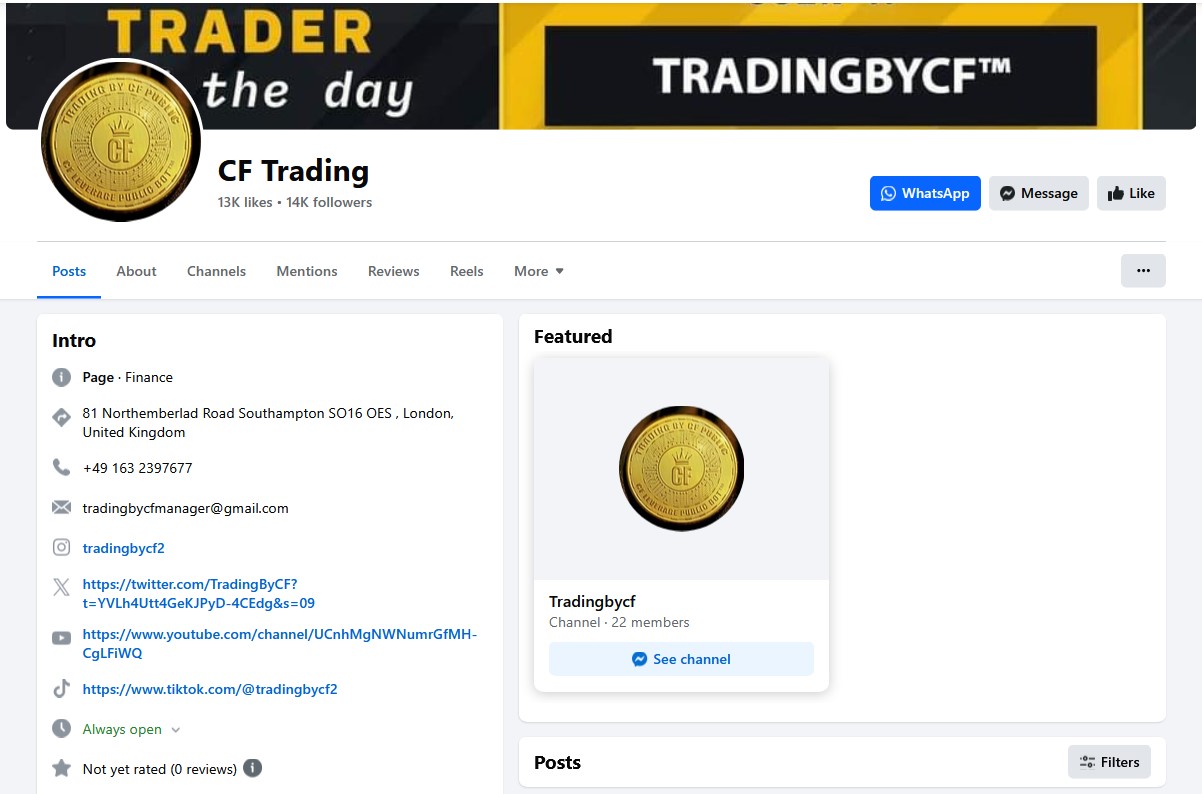

Examining TradingByCF's Facebook presence reveals concerning inconsistencies and questionable practices. The service maintains two separate profiles with notably different follower counts: "CF Trading" with 14,000 followers and "Pro Crypto Tarder" (notably misspelled) with 1,200 followers.

The main profile, "CF Trading," lists a London address and contact information including a German phone number (+49) and a Gmail address, which is unusual for a purportedly professional trading service. The use of a generic email provider rather than a corporate email address raises additional credibility concerns.

https://www.facebook.com/tradingbycf2

The second profile, "Pro Crypto Tarder," appears more active with recent posts from January, but uses questionable marketing tactics with quotes like "I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up." This type of promotional language oversimplifies trading and could mislead potential clients about the risks involved.

The existence of two separate profiles with different branding, inconsistent professional presentation, and varying follower counts raises questions about the service's legitimacy and transparency. This split presence, combined with the use of non-professional communication channels, warrants careful consideration from potential users.

https://www.facebook.com/TradingByCF123

Telegram

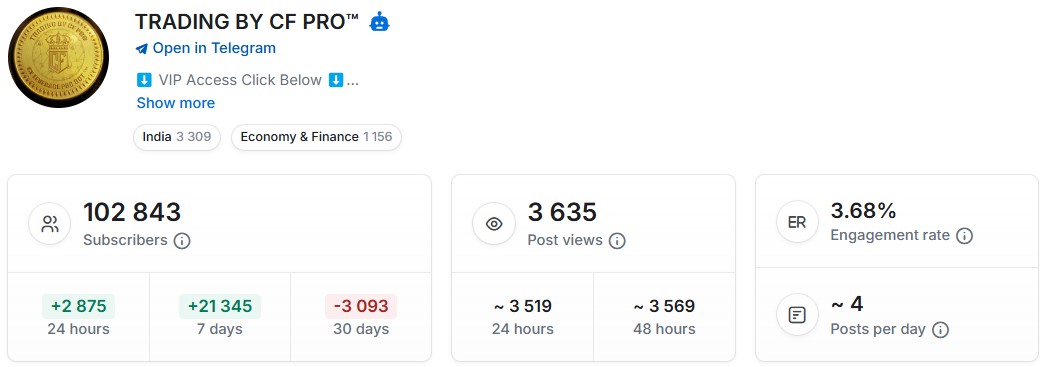

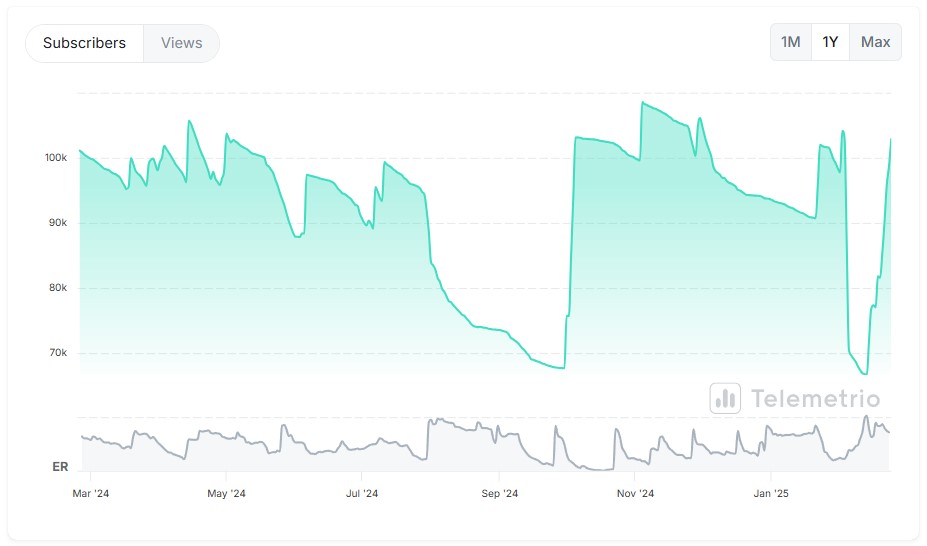

TradingByCF PRO's Telegram channel presents some concerning patterns regarding its subscriber base and engagement metrics. While the channel boasts over 102,000 subscribers, several indicators suggest potential artificial inflation of these numbers. The engagement rate stands at just 3.68%, which is notably low for a channel of this size. The channel posts approximately 4 times per day and generates around 3,635 post views, numbers that seem disproportionately small relative to the subscriber count.

The subscriber growth chart reveals distinctive patterns of sharp increases followed by sudden drops, particularly evident in maintaining a baseline of around 100,000 subscribers throughout the year. These unusual fluctuations strongly suggest artificial subscriber manipulation. Based on the engagement metrics and viewing patterns, the actual active audience may be closer to 5,000 genuine subscribers.

The channel, which focuses on cryptocurrency trading signals and operates in the India and Economy & Finance categories, shows recent statistics of gaining 2,875 subscribers in 24 hours and 21,345 in 7 days, while losing 3,093 subscribers over 30 days. These volatile numbers further reinforce concerns about the authenticity of the channel's growth.

When visitors click on "Our Telegram Channel," they are redirected to a channel called "Green Rock Signal" rather than TradingByCF's official channel. This suggests either a promotional partnership or paid advertising arrangement between the platforms. Users should be aware of this redirect to avoid confusion about which service they are actually accessing.

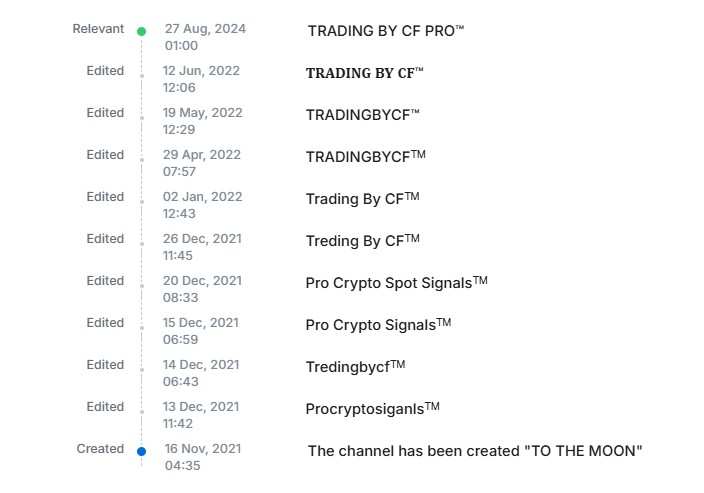

The Telegram channel's history reveals an interesting progression of name changes since its creation on November 16, 2021. The channel initially launched with the ambitious title "TO THE MOON" - a popular cryptocurrency community phrase. From there, it underwent multiple rebranding efforts: Starting as "Procryptosigianls," it evolved through various iterations including "Pro Crypto Signals," "Pro Crypto Spot Signals," and several variations of "Trading By CF" with different capitalizations and formatting. The channel finally settled on its current name "TRADING BY CF PRO" as of August 27, 2024.

TradingByCF Signals

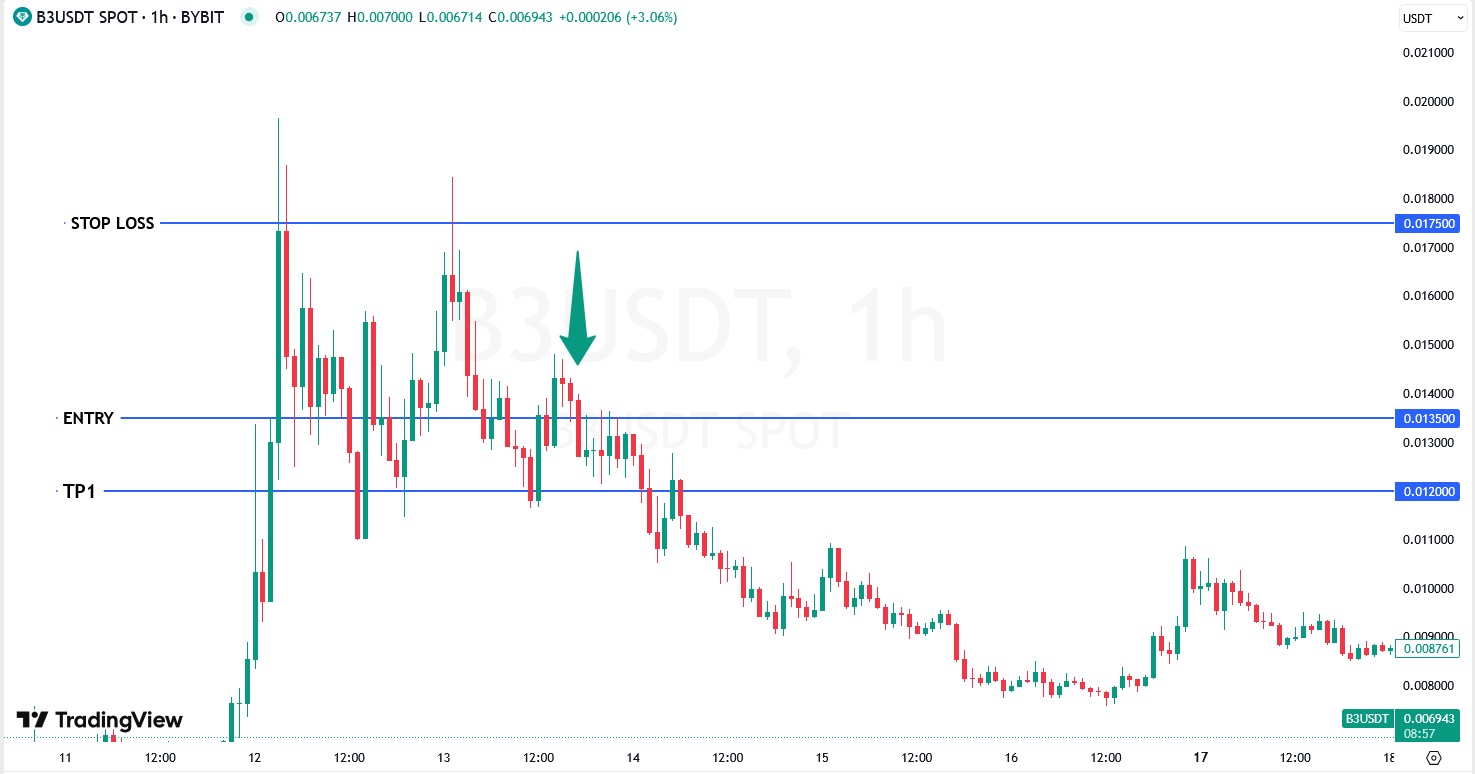

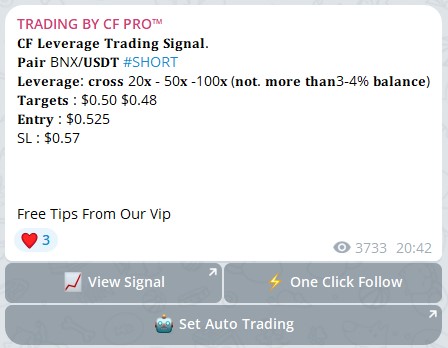

The provider occasionally shares sample signals from their VIP group on their free Telegram channel. One such example is a B3/USDT short position recommendation.

Notable aspects of this signal include:

- Entry price: $0.0135

- Stop loss: $0.0175

- Targets: $0.013 and $0.012

When examining the subsequent price action on the chart, we can verify that the price did indeed reach the first take profit target of $0.012. What stands out about this signal is its negative risk-reward ratio, as the stop loss is positioned 0.004 units away from entry while the profit target is only 0.0015 units from entry.

It's important to note that these shared signals may represent cherry-picked examples of successful trades rather than a comprehensive representation of all signals provided by the service. This selective sharing is a common practice among signal providers to showcase favorable outcomes.

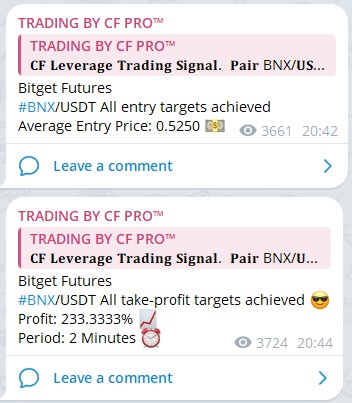

The provider shared another VIP signal for BNX/USDT, which presents an interesting case study. This short position recommendation had the following parameters:

- Entry price: $0.525

- Stop loss: $0.57

- Target prices: $0.50 and $0.48

When examining the subsequent price action on the chart, we can clearly observe that immediately after the recommended entry point, the price spiked upward and reached the stop loss level of $0.57. This would have triggered a loss for anyone following the signal.

Notably, despite this clear stop loss hit, the provider apparently claimed in a follow-up post that the price reached the target. This discrepancy between the actual chart movement and the provider's reporting raises significant concerns about the transparency and accuracy of their trade performance communications. This inconsistency highlights the importance of independently verifying signal performance rather than relying solely on a provider's self-reported results. Such contradictions between actual market movements and claimed outcomes are important considerations when evaluating the credibility of any trading signal service.

Feedbacks

The absence of reviews for TradingByCF across major review platforms and within their own Telegram channel is noteworthy. This lack of public feedback makes it difficult for potential users to assess the service's performance through third-party verification or community experiences. For a provider claiming substantial trading profits and maintaining a large subscriber base, the absence of verified user testimonials or independent reviews represents a significant information gap for those conducting due diligence. This missing element in their online presence further emphasizes the importance of approaching the service with caution and conducting thorough independent research before engaging with their trading signals.

Conclusion

After examining TradingByCF's online presence, trading signals, and user metrics, significant concerns emerge about the service's credibility. The suspicious patterns in subscriber growth—sharp increases followed by equally abrupt drops—strongly suggest artificial inflation of user numbers. The actual engaged audience appears to be a fraction of the claimed 100,000+ subscribers.

The provider's track record raises additional red flags. The complete absence of verifiable reviews despite years of operation is particularly troubling. While TradingByCF may offer legitimate signals in some instances, the combination of suspicious metrics, inconsistent reporting, and lack of transparent user feedback indicates that potential users should approach this service with considerable skepticism and exercise extreme caution before committing funds to their recommended trading strategies.