Simple4x review

Introduction to Signal Provider

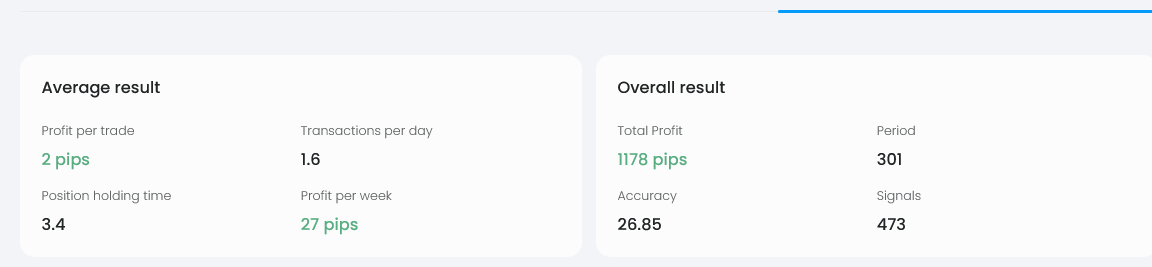

Simple4x has generated a substantial buzz in the Forex community by accruing a total profit of 1178 pips over a period of 301 days, though it comes with a modest accuracy of 26.85%. This report delves into the various aspects of Simple4x’s performance, highlighting potential risks and rewards associated with their trading signals.

Profitability and Accuracy

Despite an overall profit of 1178 pips, Simple4x's relatively low accuracy rate of 26.85% raises concerns about the consistency and reliability of their signals. The service executes an average of 1.6 transactions per day with an average holding time of 3.4 hours per trade, indicating a short-term trading strategy focused on quick market movements.

Profit and Loss Breakdown

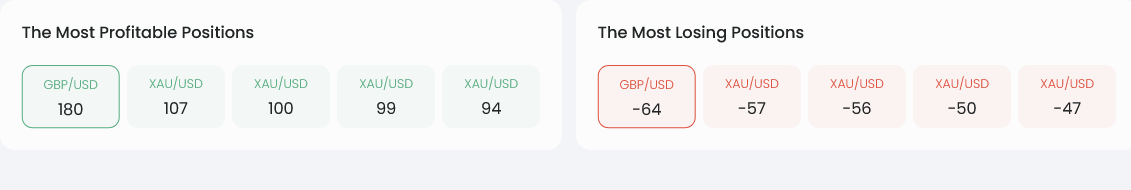

- Most Profitable Positions:The service has shown considerable gains in currency pairs like GBP/USD, XAU/USD, and XAU/JPY, with the highest single profit recorded at 180 pips on GBP/USD.

- Most Losing Positions:On the flip side, the most significant losses were seen in pairs involving gold, such as XAU/USD, with losses up to -64 pips.

Trading Strategy Insights

Simple4x utilizes a short-term trading approach, mainly distributing signals through Telegram. This strategy is reflected in the high turnover of trades but low average profits per trade, indicating a higher frequency, lower yield model.

Signal Delivery Efficiency

- Signal Frequency and Duration:With signals lasting an average of just 3.4 hours and aiming for quick profits, the service caters to day traders who prefer fast-paced trading.

- Cost:Simple4x charges a substantial monthly fee of $100, without offering a trial period, which might be a barrier for potential new subscribers unsure about committing to the service.

Instrument-Specific Success Rates

An analysis of specific instruments reveals:

- High Performance:The most profitable instruments include GBP/USD, with an average profit of 322 pips, and XAU/USD, although it also features among the most losing positions, indicating high volatility in gold trades.

- Underperforming Instruments:GBP/CHF has shown particularly poor performance, with a net loss of -127 pips, suggesting a strategy mismatch or inadequate analysis for this currency pair.

Recommendations

- For Aggressive Traders:Traders with a higher tolerance for risk might find the volatile swings in gold trading (XAU/USD) appealing, given the significant but inconsistent returns.

- For Conservative Traders:Considering the overall low accuracy but high potential returns, conservative traders should exercise caution, possibly waiting for more consistent performance data before subscribing.

- For New Subscribers:The absence of a trial period and the high monthly fee suggest that new users should thoroughly review historical performance and possibly seek month-to-month subscription options to test the service's efficacy.

Conclusion

Simple4x presents a high-risk, high-reward opportunity for Forex traders. The service’s strategy focuses on short-term gains through frequent trades, which can yield significant profits but also substantial losses, as reflected in its low