Crypto VIP Signals review

Introduction to Crypto VIP Signals

Crypto VIP Signals presents itself as a premier cryptocurrency trading signal provider with a substantial online presence across multiple platforms. Established in December 2017, the service has built a significant following, claiming over 462,000 Telegram subscribers and 126,700 followers on X. The provider offers technical analysis, market insights, and educational content primarily through its Telegram channel, positioning itself as "the World's Largest AMA Platform" for cryptocurrency trading. Their public-facing materials prominently feature claims of a 95-98% success rate on shared trades, though these figures lack independent verification. Despite the impressive subscriber numbers, closer examination reveals some concerning patterns.

Crypto VIP Signals Website

he Crypto VIP Signals website presents a simple interface that efficiently organizes essential information for potential clients. The navigation menu provides direct access to Features, Testimonials, Pricing, and Contact sections, allowing visitors to quickly find relevant information about the service.

Upon visiting the site, users are greeted with the prominent headline "Crypto VIP Signal: Leverage your full potential," which succinctly communicates the provider's value proposition. The design employs a gradient background that transitions from blue to red, creating a modern aesthetic that aligns with contemporary cryptocurrency platforms.

For those interested in exploring the service further, the "Get Started" call-to-action button directs visitors to the provider's public Telegram channel, where they can presumably access introductory signals or additional information before committing to a subscription plan.

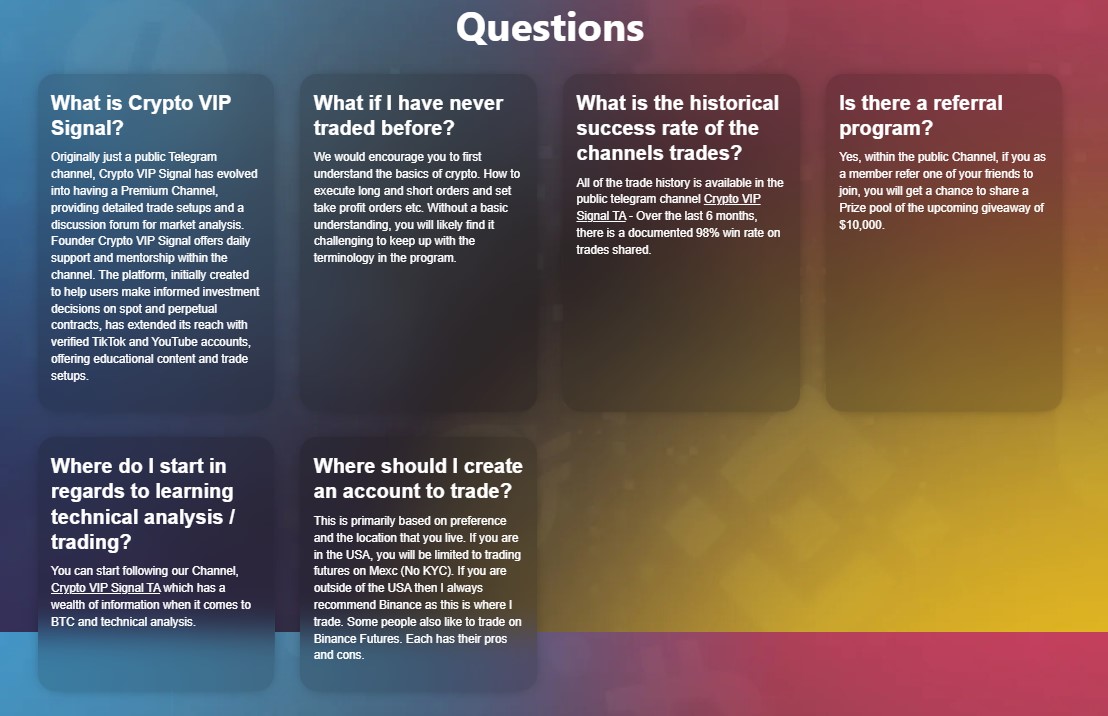

The FAQ section of the Crypto VIP Signals website addresses several common inquiries potential subscribers might have about the service. Each question is presented in a structured format with corresponding answers that provide basic information about the platform's offerings and functionality.

Among the various informational points, the provider addresses their historical performance by claiming a documented 98% win rate on shared trades over the previous six months. This statistic, while prominently featured, warrants careful consideration, as such consistently high success rates in cryptocurrency trading are statistically uncommon in the volatile crypto market environment. Overall, the FAQ section attempts to address basic questions about the service while highlighting features that might appeal to potential subscribers at various experience levels.

The notable absence of pricing information on the Crypto VIP Signals website represents a significant omission in their transparency. Despite having a dedicated "Pricing" section mentioned in the navigation menu, the actual subscription costs are not readily displayed to visitors.

This approach requires potential customers to take additional steps—likely contacting the provider directly or joining their public Telegram channel—before learning about the financial commitment required for their services. Such a strategy may be intentional, allowing the provider to emphasize their claimed benefits and success rates before discussing costs.

For consumers conducting due diligence on cryptocurrency signal providers, this lack of upfront pricing information makes it challenging to compare value propositions against competitors in the market. A comprehensive review should highlight this omission as a consideration factor for readers evaluating whether to pursue further engagement with this service.

Crypto VIP Signals Social Media

The Crypto VIP Signal's presence on X (formerly Twitter) demonstrates a substantial social media footprint with approximately 126,700 followers, suggesting a considerable audience for their content. Their verified account (@CryptoVIPsignal) positions the service as an established player in the cryptocurrency signals space. In their profile header, the provider makes a bold claim as the "WORLD LARGEST AMA PLATFORM," emphasizing their focus on crypto education, news, technical analysis, and fundamental analysis. The primary messaging encourages visitors to "GET SIGNALS AND TRADE CRYPTO LIKE A PROFESSIONAL," which clearly articulates their value proposition.

Their profile bio presents a straightforward approach to market analysis, stating: "We believe in technical analysis and fundamental analysis. We try to give best analysis based on charts and upcoming events." This indicates their methodology combines chart-based technical indicators with event-driven fundamental factors. The account, which has been active since October 2017, primarily shares technical analysis of various cryptocurrency assets, providing their audience with market insights and potential trading opportunities.

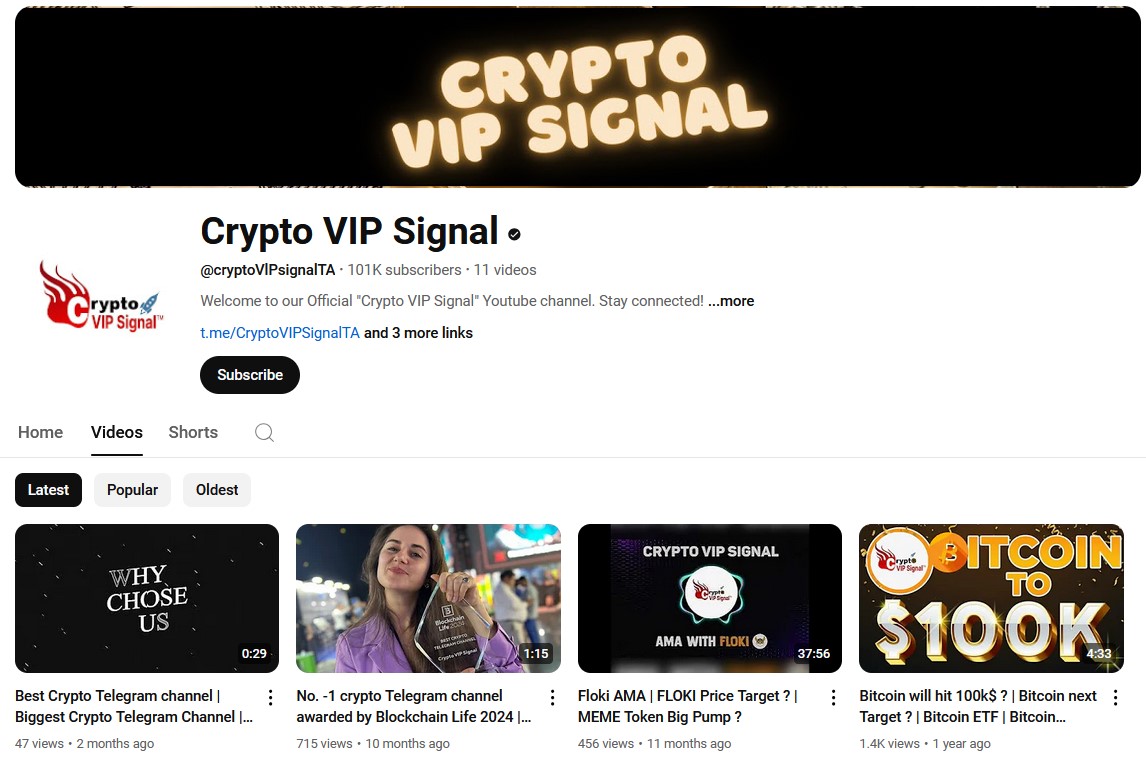

The provider YouTube channel presents a relatively modest presence compared to their other social media platforms, with approximately 101,000 subscribers but only 11 videos published to date. This suggests a selective approach to video content or potentially a secondary focus within their overall marketing strategy. Activity on the channel appears to have declined, with the most recent video posted approximately two months ago and limited engagement metrics—the latest video shows only 47 views. Previous content from 10-12 months ago demonstrates similarly modest viewership, with videos garnering between several hundred and 1,400 views.

https://www.youtube.com/@cryptoVlPsignalTA/videos

The content selection is diverse but somewhat limited, featuring:

- Self-promotional material ("Why Chose Us," "Best Crypto Telegram channel")

- Recognition claims ("No. -1 crypto Telegram channel awarded by Blockchain Life 2024")

- Cryptocurrency-specific analyses and price predictions (e.g., Floki token AMA, Bitcoin price targets)

Telegram

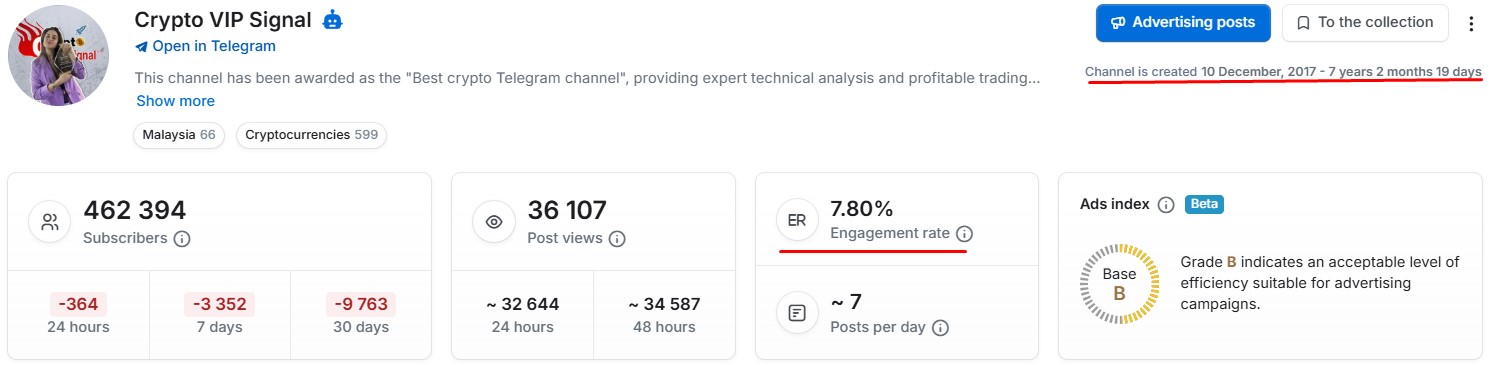

The Crypto VIP Signal Telegram channel serves as their primary platform for signal distribution and community engagement. Established on December 10, 2017, the channel has maintained a presence in the cryptocurrency signals space for over seven years, suggesting a degree of longevity in a highly competitive market.

With approximately 462,394 subscribers, the channel has achieved significant reach. However, the analytics reveal concerning trends regarding audience engagement and retention:

- The subscriber base shows consistent decline across all measured timeframes: -364 subscribers in 24 hours, -3,352 in 7 days, and -9,763 in 30 days

- Despite an active posting schedule (approximately 7 posts per day), the engagement rate stands at just 7.80%

- Post views average around 32,644 in 24 hours and 34,587 in 48 hours, representing engagement from only about 7% of total subscribers

The channel's self-description claims recognition as the "Best crypto Telegram channel" and promises "expert technical analysis and profitable trading signals." However, the declining subscriber numbers and relatively low engagement metrics suggest a potential misalignment between subscriber expectations and delivered value. The geographical tag identifies Malaysia as a point of reference, though the specific significance of this association is unclear from the available information.

An analysis of the Crypto VIP Signal's Telegram channel metrics reveals a complex pattern in their subscriber base. While the overall yearly subscriber count shows an increase, the detailed growth patterns display concerning irregularities that merit attention. The channel's subscriber graph exhibits unnatural fluctuations—periods of sudden, steep growth followed by sharp declines—a pattern typically inconsistent with organic audience building. Such distinctive "sawtooth" patterns in subscriber analytics often indicate artificial manipulation of follower counts, potentially through the use of bot accounts or paid subscription services.

The provider's Telegram channel serves as a multifaceted resource within the cryptocurrency ecosystem, balancing several content categories to address the needs of diverse subscriber segments. Technical analysis constitutes the core of their content strategy. These analyses appear to form the foundation of their signal service offering.

Complementing their technical focus, the channel regularly disseminates market insights and cryptocurrency news, helping subscribers contextualize market movements within broader industry developments. Notably, the channel demonstrates an educational dimension through posts designed to benefit newcomers to cryptocurrency trading. These educational materials cover fundamental concepts, trading strategies, and market principles—resources that can prove valuable for beginners navigating the complex cryptocurrency marketplace.

The Crypto VIP Signal Telegram channel's claim of achieving over 95% success rate with their trading signals warrants careful scrutiny, as this represents an extraordinary level of accuracy in the inherently volatile cryptocurrency markets. Despite this bold performance claim, the channel does not provide transparent verification mechanisms that would allow subscribers or potential customers to independently validate these results. The absence of verifiable trade records, timestamped entry and exit points, or third-party verification systems creates a significant accountability gap.

In the cryptocurrency signals industry, performance claims require substantial documentation to establish credibility. Without access to:

- Historical signal archives with precise timestamps

- Clear entry and exit points for each recommendation

- Comprehensive performance metrics including both successful and unsuccessful trades

- Third-party verification or tracking systems

Subscribers have limited means to confirm the stated 95% success rate. This lack of transparency represents a notable limitation for traders conducting due diligence before committing to a paid service.

Signals

The Crypto VIP Signal's analytical approach demonstrates certain limitations when examining their practical trading guidance. A review of their NEO/USDT analysis reveals a representative example of their methodology. In this particular analysis, the provider presents a technical assessment highlighting support ($8.50-$9.00) and resistance ($11.50-$12.00) zones, predicting potential upward momentum contingent upon breaking above the identified resistance level. The analysis bases this projection primarily on the observation that "the price has dropped to the support area and taken in the available liquidity."

However, contrary to this prediction, the actual price movement for NEO subsequently declined, contradicting the anticipated upward trajectory. This divergence between prediction and market reality highlights a fundamental limitation in their signaling approach.

Additionally, it's significant that the provider generally avoids providing specific entry and exit points in their signals. Instead, they offer broader market interpretations and conditional projections rather than actionable trade parameters with defined risk management guidelines. This examination of their actual content further contextualizes the disconnect between their claimed 95% success rate and the demonstrable accuracy of their market projections.

In this case, the provider offered more specific trading guidance than in the NEO example, suggesting an actionable strategy rather than merely describing market conditions. Their analysis identified a support zone ($1.73-$1.88) where the price was "testing the support area," and recommended "opening a long position with a stop loss in place." They further noted that "the trendline will act as the first resistance area" ($2.45-$2.55) and specified that "the price must break above this level to gain upward momentum."

Despite this more detailed recommendation, subsequent price action moved contrary to their forecast, with DEGO's price declining below the identified support level rather than rebounding as predicted. This outcome represents a second documented instance where market movement contradicted their technical analysis and trading recommendation.

The Crypto VIP Signal's FARM/USDT analysis presents a third case study that further illustrates patterns in their analytical approach and recommendation accuracy. In this instance, the provider identified a "downtrend and a small falling wedge pattern" on the daily chart while suggesting a potential tactical approach. Their recommendation advised followers to "place your buy orders in the support area for new entries," identifying the support zone between $35.00-$37.00. Despite acknowledging the prevailing downtrend, they anticipated "some sideways movement before the next upward move," positioning this as a potential accumulation opportunity.

As with the previous examples, subsequent price action demonstrated continued downward momentum, with FARM's price declining below the identified support zone. While the provider briefly acknowledged broader market conditions might be influencing price action, they still recommended entering long positions against the prevailing trend.

These analyses suggest that subscribers following their recommendations without independent verification or additional risk management strategies might face challenges in achieving favorable trading outcomes.

Feedbacks

The examination of Crypto VIP Signal's media presence reveals concerning patterns regarding their promotional strategy and claims of media endorsement. Rather than featuring authentic customer reviews on their website, the provider instead highlights their coverage in several publication outlets—a tactic that warrants closer scrutiny.

The article featured on Daily Coin carries a clear disclaimer stating: "This article is a press release and was not written by Daily Coin," explicitly identifying the content as paid promotional material rather than independent editorial coverage. This disclosure confirms that the content represents sponsored messaging rather than objective journalism or genuine third-party validation.

More problematic is the provider's citation of Yahoo Finance coverage that appears to be nonexistent upon verification. Similarly, the material on Binance Feed merely republishes the same paid content from Daily Coin rather than providing original reporting or analysis. The presentation of promotional content as "news" on Bitcoinik further blurs the line between advertisement and legitimate media coverage.

This pattern of highlighting paid promotional content while presenting it as independent media coverage raises significant transparency concerns. The absence of verifiable customer testimonials on their own platform, combined with reliance on purchased media placements portrayed as endorsements, suggests a strategic approach to reputation management that prioritizes controlled messaging over authentic user feedback.

For potential subscribers conducting due diligence, this promotional approach should prompt additional verification efforts before committing to the service, particularly when considered alongside the performance discrepancies and subscriber trend patterns identified in earlier analyses.

The notable absence of reviews for Crypto VIP Signal on established third-party review platforms represents a significant gap in verifiable customer feedback. Despite their substantial claimed subscriber base and years of operation, the provider lacks a presence on Trustpilot—a standard industry platform for collecting authenticated user experiences. Similarly, their Telegram channel appears to be carefully moderated, with no visible user testimonials or feedback discussions that would allow potential subscribers to gauge actual customer satisfaction.

This review vacuum creates a one-sided information environment where potential customers must rely solely on the provider's self-reported success rates and promotional materials. The combination of:

- No independent reviews on established platforms

- Absence of visible customer feedback in their own channels

- Reliance on paid promotional content presented as media coverage

- No transparent performance tracking or verification systems

Creates a significant information asymmetry for consumers attempting to evaluate the service objectively. This lack of accessible, independent feedback stands in stark contrast to legitimate service providers in other industries who typically accumulate substantial review histories over multiple years of operation. For potential subscribers, this absence of verifiable user feedback should be considered alongside the questionable trading recommendations and engagement metrics documented earlier, as it represents another significant element missing from standard due diligence criteria.

Conclusion

Crypto VIP Signal demonstrates significant reach within the cryptocurrency trading signals space, maintaining a substantial following across multiple platforms since its establishment in 2017. Their content strategy encompasses technical analysis, market insights, and educational resources aimed at traders of varying experience levels. Despite their considerable online presence, several elements merit consideration for potential subscribers. The service's claimed 95-98% success rate lacks transparent verification mechanisms, while randomly sampled trading recommendations show inconsistent alignment with subsequent market movements. Engagement metrics indicate declining subscriber trends despite the large total audience numbers.

The provider's media presence consists primarily of paid promotional content rather than independent editorial coverage, and the absence of accessible customer reviews on third-party platforms creates challenges for objective service evaluation. Additionally, the lack of transparent pricing information requires potential subscribers to take additional steps before understanding the financial commitment involved. For cryptocurrency traders considering signal services, these factors highlight the importance of comprehensive due diligence, independent verification of performance claims, and careful consideration of risk management practices when evaluating Crypto VIP Signal or similar providers in this specialized market segment.