Crypto Inner Circle review

Introduction to Crypto Inner Circle

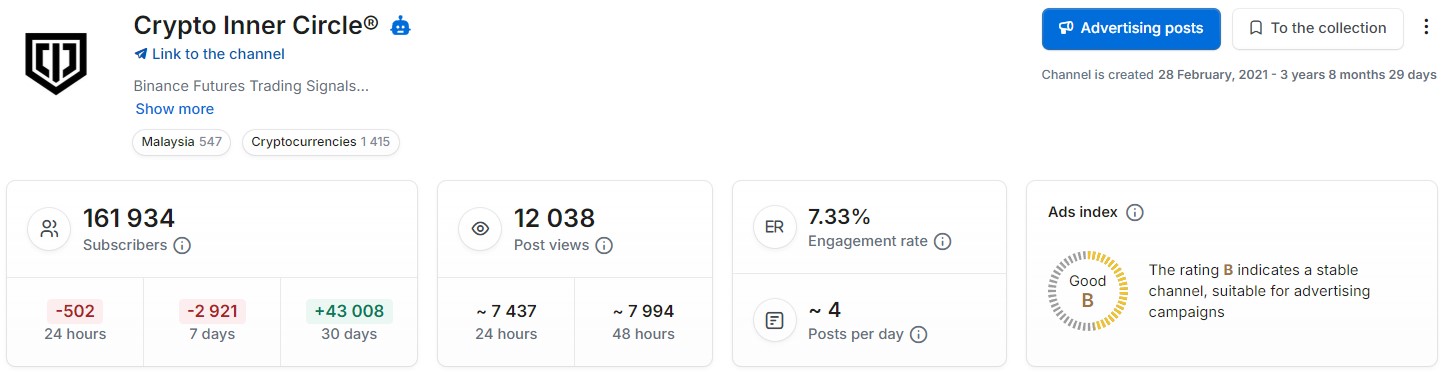

Today, we're diving into a prominent signal provider: Crypto Inner Circle. With an impressive following of over 164,000 subscribers on its Telegram channel, this provider has established itself as a significant player in the cryptocurrency landscape. In this review, we will explore the offerings of Crypto Inner Circle in detail and uncover what users can expect from such a large and influential crypto signal provider.

Crypto Inner Circle' Social Media

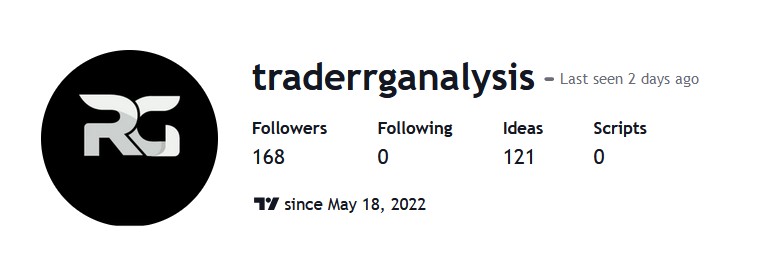

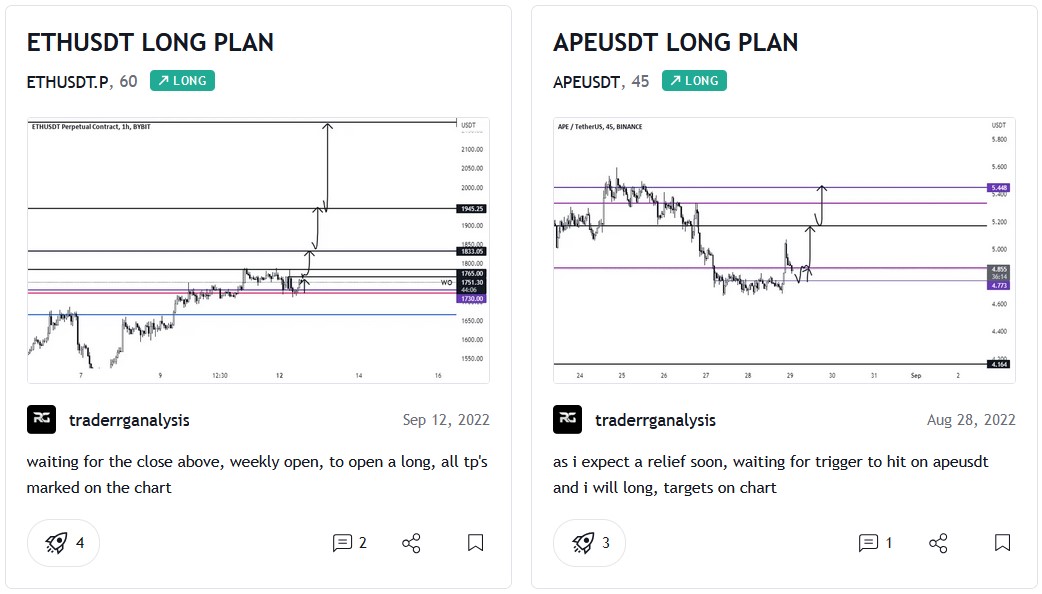

On the TradingView platform, the cryptocurrency signal provider Crypto Inner Circle operates under the username “traderrganalysis.” This provider was active on the platform from May 2022 until September 2022, consistently sharing forecasts and analyses during that period. However, since September 2022, there has been a noticeable absence of new forecasts or activity from this account.

https://www.tradingview.com/u/traderrganalysis/

Currently, "traderrganalysis" has garnered a following of 168 subscribers, reflecting a modest but engaged community of individuals interested in crypto trading insights. The sudden halt in updates raises questions about the provider’s ongoing engagement and reliability, leaving subscribers to ponder the future of the insights they had come to expect.

Aside from its presence on TradingView, the provider does not maintain any other notable social media channels. Instead, all attention and communication are centralized through a dedicated Telegram channel. This singular focus on Telegram suggests an intention to foster a more intimate community of subscribers, allowing for direct and immediate interaction. However, the lack of a broader online presence may limit accessibility for potential new subscribers seeking insights and updates from the provider.

Telegram

The primary and exclusive source of trading signals for the provider is its Telegram channel, which currently boasts over 164 subscribers. Despite being one of the larger crypto signal providers in its niche, the engagement rate on the channel is relatively low, measuring at approximately 7.3%. This suggests that while the subscriber base is significant, active participation, interaction, and responsiveness to the signals being shared may be lacking. Low engagement can indicate several possibilities, such as subscribers being less actively involved in not fully utilizing the provided signals, or the content not resonating as strongly with the audience as anticipated.

Analyzing the subscriber growth graph reveals a concerning pattern characterized by sharp spikes and declines. This erratic behavior strongly suggests that the provider might be artificially inflating the number of subscribers rather than organically growing the community. Healthy subscriber growth typically shows a more stable and gradual increase, rather than dramatic fluctuations. Such unnatural growth can undermine the credibility of the provider, raising questions about the authenticity of the subscriber base and the overall reliability of the signals being offered. If potential subscribers notice these tendencies, it may lead to skepticism regarding the value and legitimacy of the service.

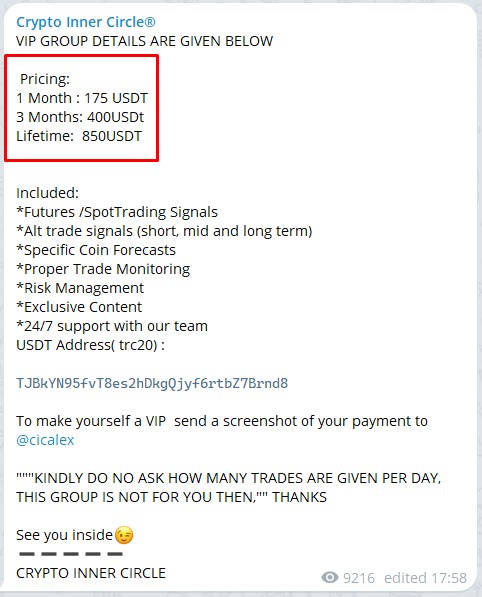

The provider's pricing structure for access to their VIP group includes the following tiers:

- 175 USDT for one month

- 400 USDT for three months

- 850 USDT for a lifetime subscription

It's notable that all payments are required in cryptocurrency, which might be a red flag for some potential subscribers. Such a payment method can raise concerns about transparency, security, and the provider's intention, especially for those who prefer traditional payment methods that offer more consumer protections.

In exchange for these fees, subscribers receive a variety of services, including:

- Futures/Spot Trading Signals: Guidance on when to enter and exit trades in both futures and spot markets.

- Alt Trade Signals: Recommendations for trading altcoins with various time horizons (short, mid, and long term).

- Specific Coin Forecasts: Insights and predictions regarding particular cryptocurrencies, which could help in making informed trading decisions.

- Proper Trade Monitoring: Support in tracking trades to ensure they align with strategy and risk management practices.

- Risk Management: Guidance on managing exposure to volatile markets to protect capital.

- Exclusive Content: Access to materials or insights not available to non-subscribers, possibly enhancing their trading strategy and knowledge.

While these offerings may appear valuable, potential subscribers should carefully consider the cost versus the perceived benefits, as well as the credibility and track record of the provider before committing to a subscription. The combination of high fees and the exclusive cryptocurrency payment method could deter some users, especially if they have concerns about the provider's legitimacy or the quality of the signals provided.

The admin of the Telegram channel operates under the pseudonym "Alex," maintaining a veil of anonymity that is a prevalent theme within this space. As you may have already observed, anonymity is a significant characteristic of Crypto Inner Circle.

The channel itself lacks detailed news updates or specific trading signals with precise entry and exit points, which can be a limitation for some users seeking clear guidance. A considerable portion of the content consists of forwarded posts from a VIP group, which may leave subscribers wanting for original insights. Nevertheless, the provider occasionally offers personal reflections on the cryptocurrency market, providing some value in the way of market commentary, though it may not always be sufficient for those looking for actionable trading signals.

Crypto Inner Circle Signals

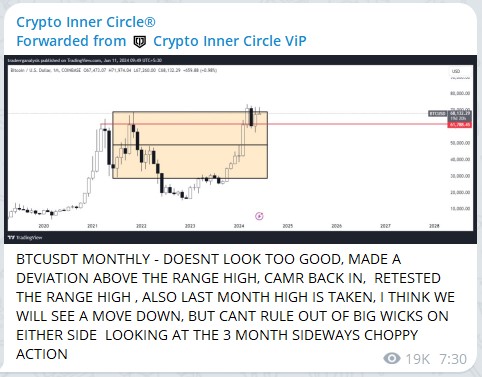

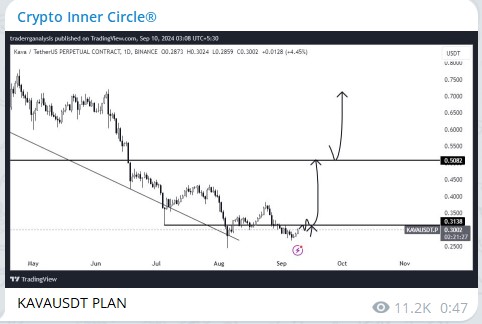

As mentioned earlier, the channel does not provide specific trading signals. Instead, it focuses on general technical analysis to guide its followers. One notable analysis shared by the provider highlighted the cryptocurrency asset KAVAUSDT, predicting that it would rise above the $0.300 mark.

Looking at the accompanying chart, it’s evident that the price indeed increased, ultimately reaching the designated level. However, it’s important to note that the provider anticipated an immediate upward movement. Contrary to this expectation, the price experienced a prolonged period of sideways movement that lasted more than two months following the publication of the post. This underscores the inherent challenges of market timing and serves as a reminder that even well-informed analyses can lead to unexpected price behavior in the volatile world of cryptocurrency.

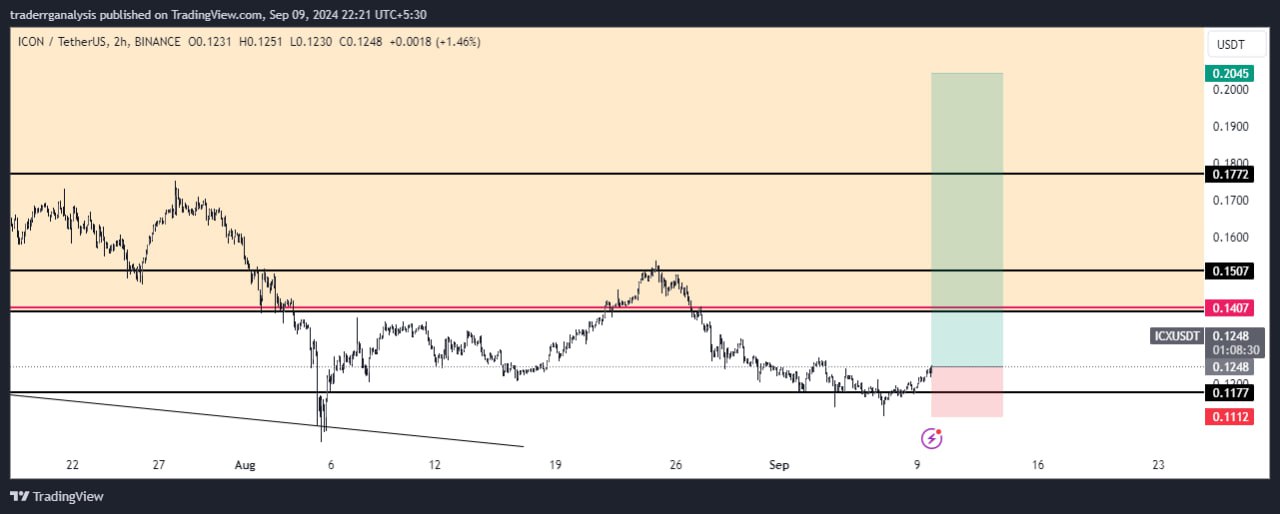

In the subsequent post labeled "ICXUSDT SWING LONG," the provider suggested that the price of ICXUSDT was likely to increase from its current levels. Observing the chart, it's clear that the price did indeed rise, ultimately reaching the anticipated upside target. However, it took a significant amount of time—76 days—for this move to materialize.

This example highlights another important aspect of trading and technical analysis: while predictions may eventually prove accurate, they can often take considerable time to come to fruition. This delay emphasizes the importance of patience in trading strategies, particularly in the highly volatile cryptocurrency market, where price movements can be influenced by numerous factors, including market sentiment and external events. It also serves as a reminder for traders to manage their expectations regarding the timing of potential gains.

In the analysis of the asset IOSTUSDT, the provider indicated a potential entry and exit strategy, suggesting that the trade could yield a risk-reward (R/R) ratio of more than 5. The provider anticipated that the price would increase, similar to the previous analyses. As the trade played out, the price did initially rise, allowing traders to realize a gain of approximately 2R before retracing. Unfortunately, this subsequent movement reached the stop-loss level, resulting in a loss that would have taken the position out of the trade.

This scenario illustrates the importance of managing risk and having a clear exit strategy, even in trades that initially appear promising. While a high R/R ratio can indicate attractive potential profits, the volatility of the market can lead to unexpected price reversals. It reinforces the principle that traders should be prepared for both favorable and unfavorable outcomes, and always consider stop-loss levels to protect their capital. Moreover, taking profits along the way can also be a prudent strategy in volatile markets.

Feedbacks

The absence of reviews for the Crypto Inner Circle provider on major platforms like Trustpilot, despite its substantial subscriber base of over 164,000, may raise some questions about the transparency and reliability of the service. While a large following can indicate a level of popularity or trust among users, the lack of documented feedback on well-known review sites might suggest that users either haven't felt compelled to share their experiences or that the provider has focused on less conventional platforms for gathering reviews.

However, finding reviews on other review sites on the internet can provide valuable insights, even if they are less prominent or verified. It's crucial for potential subscribers to examine these reviews carefully, looking for patterns in feedback regarding performance, customer support, and overall satisfaction.

When considering subscription-based trading signal services, potential users should evaluate both direct and indirect reviews, engage with community discussions where applicable, and approach the service with a healthy degree of skepticism. Researching the experiences of others can provide a clearer picture of what to expect and help you make informed decisions.

Conclusion

Crypto Inner Circle, a crypto signal provider, operates with complete anonymity, which raises some concerns about its overall credibility in the space. While the platform demonstrates analytical capabilities, it lacks a verified track record, making it difficult for potential users to assess its reliability fully. Additionally, the suspiciously rapid growth of its subscriber base further complicates the situation, leading to questions about the authenticity of its appeal and effectiveness. As such, potential subscribers should approach the provider with caution, carefully weighing the benefits against the potential risks associated with using an anonymous service lacking a proven history.